ALSO READJob losses, orders drying and production halts – How Trump’s tariff pain is hurting India

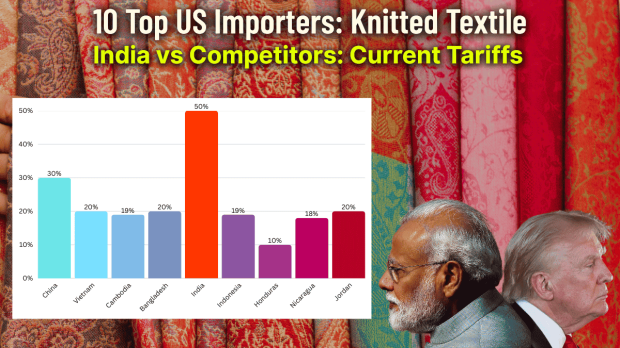

China, which holds the largest share of US textile imports, is facing a 30 per cent tariff. However, India, which became the fifth largest exporter by 2024, is facing almost double the tariffs — 59 per cent on textiles, 63.9 per cent on knitted apparel, and 60.3 per cent on non-knitted apparel — according to data released by SBI Research in its report. Indonesia, which ranks below India at sixth place, is facing only a 19 per cent tariff, giving it a better market opportunity than India.

Gems, jewellery and seafood face pressure; Competition from lower-tariff countries intensifies

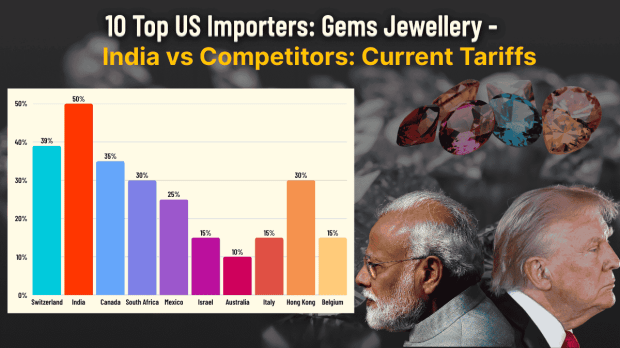

Gems and jewellery exporters, who send nearly a third of their $28.5 billion annual shipments to the US, are also bracing for disruption. The tariff on Indian jewellery has doubled from 25 per cent to 50 per cent, while countries like Switzerland which tops the US importer list for gems and jewellery is only facing a levy of 39 per cent. Canada stands at third on the list is also facing only 35 per cent tariff.

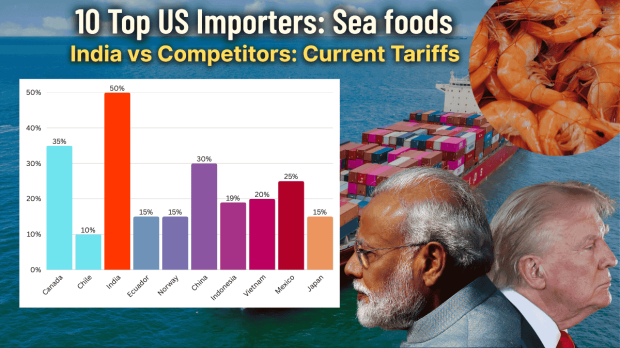

Shrimp exporters too fear steep losses, as more than half of India’s shrimp output goes to the US. With the new tariff, India will be significantly costlier compared to Ecuador, the fourth-largest exporter of seafood to the US, which faces only a 15 per cent duty. India ranks third after Canada and Chile, the top two seafood exporters to the US. Both countries, however, are subject to lower tariffs than India — 35 per cent for Canada and 10 per cent for Chile.

Trade surplus at risk

The report also highlighted that in the worst-case scenario, trade surplus that India enjoys with the US could vanish and slip into a deficit. “As $45 billion of exports will be impacted due to 50% tariffs, then at worst scenario India’s trade surplus will convert to trade deficit,” SBI Research said.

ALSO READ50% tariff an opportunity in disguise? 3 ways Modi is planning to beat tariff pain

SBI Research however, expressed confidence that “trade negotiations will restore confidence and improve export to US” if both governments work towards a settlement.

Pharma escapes but overall risk high

One silver lining is that Indian pharmaceutical exports, which make up nearly 40 per cent of US drug imports, remain exempt. Smartphones and steel are also relatively insulated.

Tariffs to shave off US GDP and create inflationary pressures

Analysts believe US consumers will also feel the pinch as prices of goods such as garments, jewellery and seafood rise. The report estimates that the tariffs could shave 40–50 basis points off US GDP while fuelling input cost inflation. “The US is beginning to show signs of renewed inflationary pressure, driven by the pass-through effects of recent tariffs and a weaker dollar—particularly in import-sensitive sectors such as electronics, autos and consumer durables,” SBI Research said.

“We believe that US tariffs are likely to affect US GDP by 40–50 bps and increase input cost inflation,” the report noted.