Bitcoin’s recent sharp decline earlier this month might signal the onset of a late-stage bear market phase, but according to Vetle Lunde, head of research at K33, investors should not anticipate a swift rebound.

“The current market environment closely mirrors conditions seen in late September and mid-November 2022,” Lunde explained. “These periods were near the bottom of the bear market and were followed by extended phases of consolidation.”

Back then, Bitcoin traded between $15,000 and $20,000—approximately 70% below its peak in 2021.

At present, Bitcoin has stabilized within a narrower range from $65,000 to $70,000. The regime model developed by K33 Research—which integrates derivatives data, ETF flows, technical indicators, and macroeconomic signals—indicates that the market is approaching a cyclical low point.

The Calm Before The Storm

A key characteristic of this consolidation phase is significantly reduced trading activity as speculative frenzy subsides.

The K33 report highlights that spot trading volumes have dropped by 59% week-over-week. Additionally, open interest in perpetual futures contracts has fallen to its lowest level in four months while funding rates remain negative across all platforms.

Lunde notes that such cooling-off periods are typical following intense liquidation events when traders absorb losses and adjust their positions accordingly.

Meanwhile in U.S.-listed Bitcoin ETFs there has been an unprecedented drop in exposure amounting to over 103 thousand BTC since early October. Despite this reduction—and with Bitcoin having retraced nearly half its value—more than 90% of peak exposure measured in BTC terms still remains intact according to Lunde’s analysis.

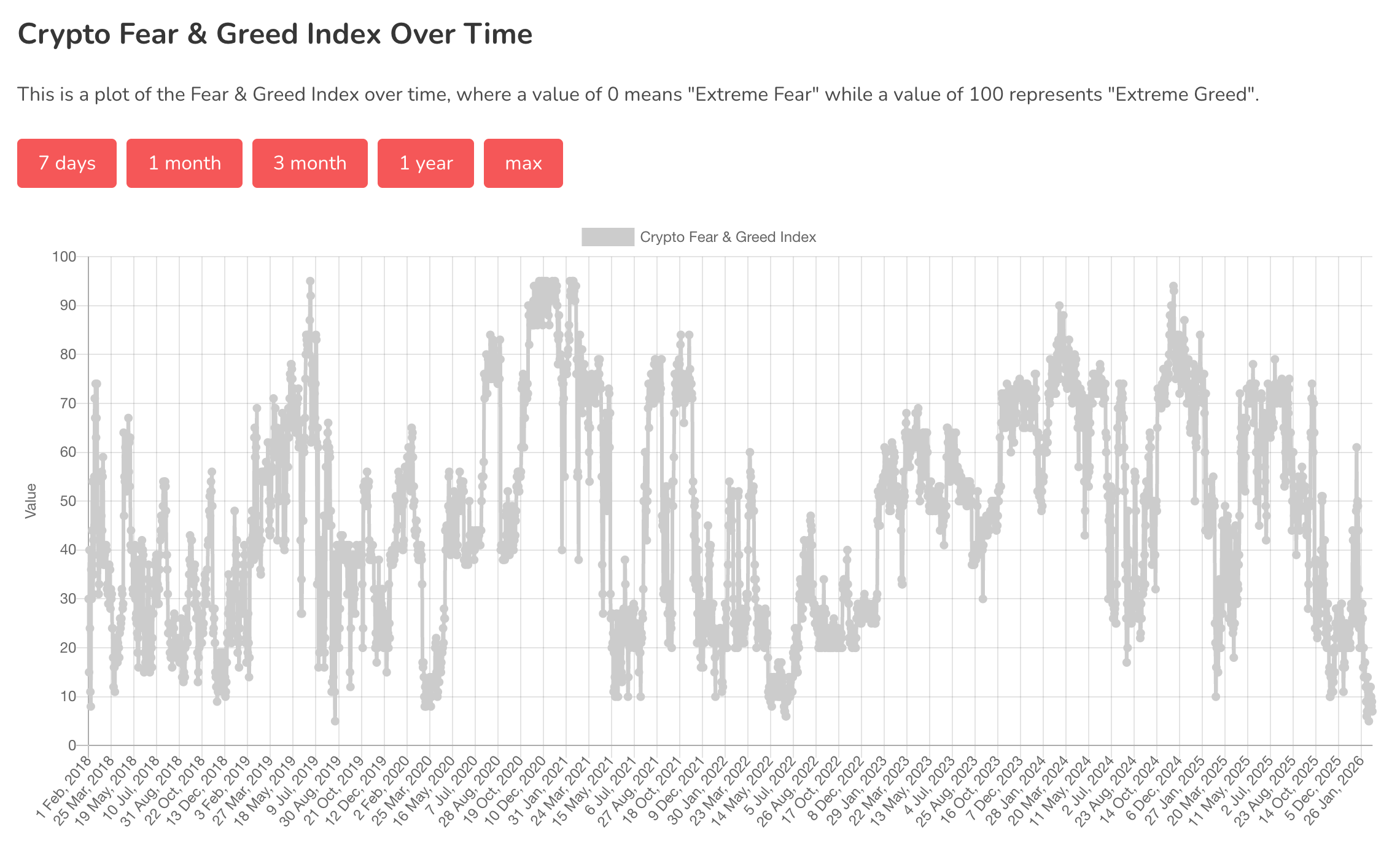

Market sentiment also reflects caution: the “Crypto Fear and Greed” Index plummeted last week to an all-time low score of just five and hovered below ten for most days thereafter.

A Zone For Long-Term Investors

So what does this mean for participants? According to Lunde, 'Bitcoin is probably close or at a global bottom but poised for prolonged sideways movement between $60K-$75K.'

This pattern historically yields modest returns during similar regimes but offers attractive accumulation opportunities for those with patience on their side.

James Check—a co-founder at Checkonchain specializing in on-chain analytics—noted that these lateral phases provide strategic moments for positioning rather than rapid gains.

“Most often Bitcoin remains stagnant before suddenly surging sharply during brief windows,” says Check. “These explosive moves usually occur within just several trading days early or late into bull cycles.”

“if you miss those quarters where it jumps up over 100%, you essentially miss out on significant portions of gains,” he warns against attempting perfect timing around tops or bottoms as it often results in missing initial rallies.”

In essence: while extended consolidation can be frustrating emotionally—it historically rewards steady hands more than precise timing strategies.”