Peter Schiff, a well-known economist and persistent Bitcoin skeptic, has issued a stark warning that Bitcoin might plummet to $20,000 if it fails to hold the crucial support level around $50,000.

This cautionary statement comes amid rising geopolitical tensions triggered by reports of potential US military strikes against Iran.

If Bitcoin falls below $50K—which seems probable—it is very likely to test the $20K mark. That would represent an 84% decline from its all-time high. Although Bitcoin has experienced such drops before, never has it faced this level of hype, leverage, institutional involvement, and market capitalization at risk. It’s time to sell Bitcoin now!

— Peter Schiff (@PeterSchiff) February 19, 2026

Peter Schiff’s Opposition to Bitcoin Intensifies

Schiff believes that breaching the $50,000 threshold is imminent and could trigger a far more severe downturn. He predicts that despite growing institutional adoption and mainstream interest in cryptocurrencies, Bitcoin may repeat historical crash patterns seen in previous cycles.

This warning emerges as Bitcoin trades near $66,000—a significant drop from recent peak levels.

For over ten years now, Schiff has been one of the most vocal critics of Bitcoin. He consistently labels it as a speculative bubble devoid of intrinsic value.

During past bull runs he forecasted major crashes while advocating gold as a more reliable store of wealth.

Nonetheless, history shows that despite sharp corrections along the way, Bitcoin often rebounds strongly and achieves new record highs over time.

The timing of his latest alert coincides with fragile conditions across cryptocurrency markets worldwide. Investor sentiment has soured due to fears surrounding possible US military interventions targeting Iran.

Historically speaking, <span style="font-weight: bold;">Bitcoin tends to decline during early stages of geopolitical crises because investors shy away from volatile assets.

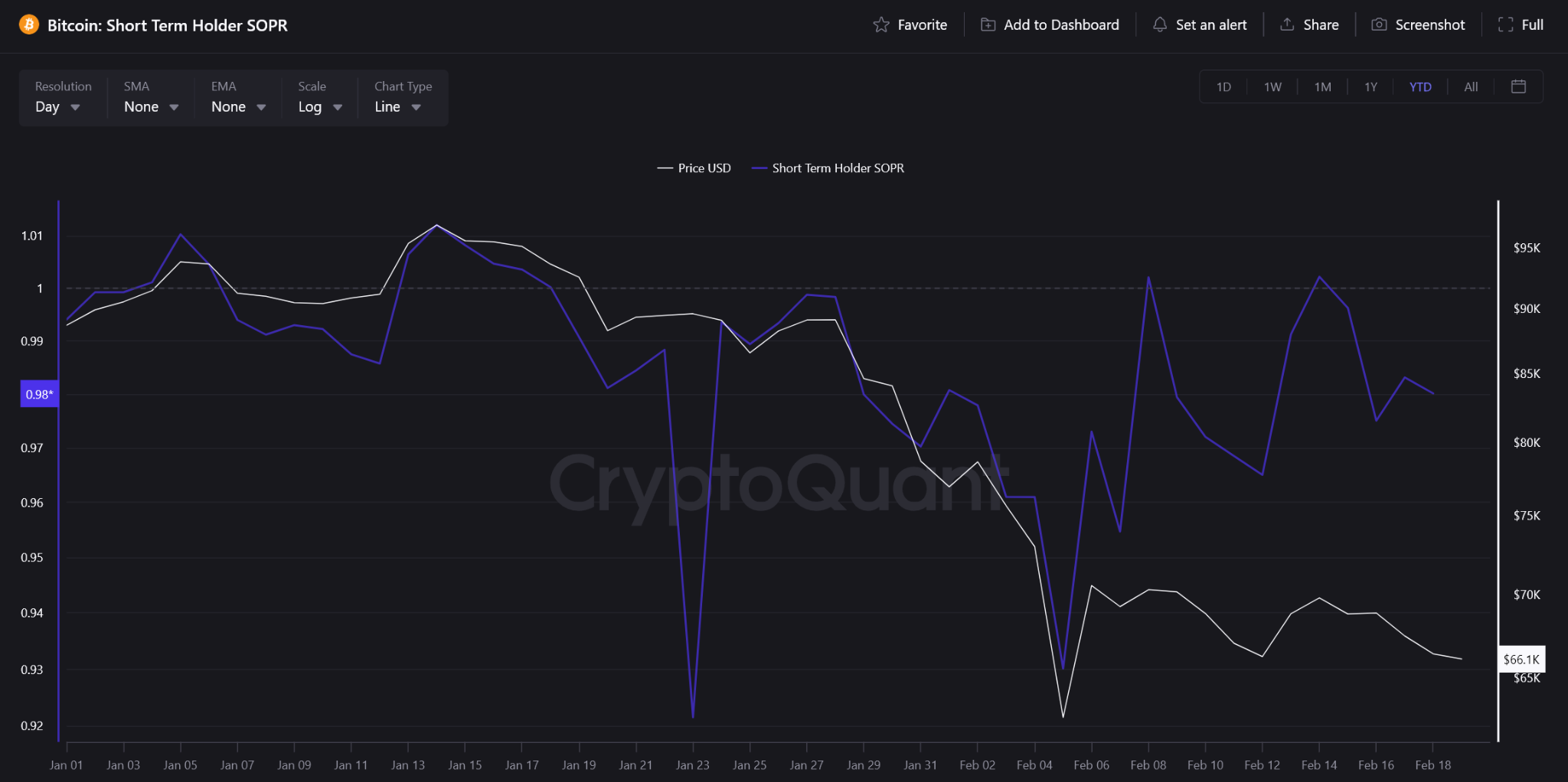

On-chain analytics reinforce this cautious stance: The Short-Term Holder SOPR (Spent Output Profit Ratio) currently sits below 1—indicating recent purchasers are offloading their holdings at losses.

This metric reflects prevailing fear among less committed investors who are capitulating under pressure.

Conversely, a different key indicator paints an alternative picture: The short-term Sharpe ratio for Bitcoin has plunged into deeply negative territory.

This suggests returns have been unusually poor relative to volatility — historically such extremes have often marked local bottoms rather than signaling prolonged collapses.

Bitcoin’s Short-Term Sharpe Ratio Has Reached Levels Typically Seen At Generational Buying Opportunities.

“The arrows on this chart clearly show how each prior extreme negative reading was followed by strong rallies reaching new highs.” – @MorenoDV_ pic.twitter.com/nxFBUgHxi9

This leads us toward an ambiguous outlook:

While ongoing geopolitical instability combined with weak market sentiment could drive prices lower in the near term, much speculative froth appears already eliminated.

Schiff’s forecast underscores increasing uncertainty—but blockchain data implies we might be closer to market stabilization or reset phases rather than enduring collapse.

The original article titled “Peter Schiff Warns bitcoin Could Crash To &dollar20&comma000 – Is It Possible?”, was first published on BeInCrypto.

</html