Mike McGlone, the lead commodities strategist at Bloomberg Intelligence, has presented a chart that could shift the Bitcoin narrative from hopeful gains to inevitable market forces. His analysis is straightforward: recent price trends may signal caution rather than encouragement to increase holdings.

Arguments for $28,000 Bitcoin and the Concept of a “Reverse Wealth Effect”

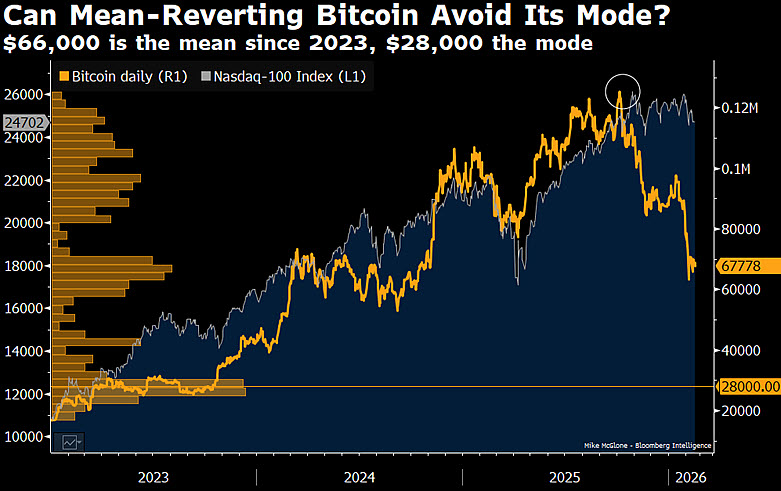

In his commentary accompanying the visual data, McGlone notes that since 2023, Bitcoin’s price has gravitated back toward its cycle average of $66,000. However, when examining frequency distribution, a different picture emerges. The mode—the most frequently occurring price—hovers near $28,000. This implies that Bitcoin has spent significantly more time trading well below current levels than above them.

The chart compares daily movements of Bitcoin with those of the Nasdaq-100 index. According to McGlone’s interpretation, this comparison exerts considerable pressure on stock markets to continue their upward trajectory. Should Nasdaq-100 fail to advance further, assets considered risky—which have thrived on increased liquidity and wealth—may once again face downward pressure.

McGlone introduces the idea of a “reverse wealth effect,” where declining equity valuations and tightening household finances reduce speculative appetite among investors. In this context, falling cryptocurrency prices are not isolated events but indicators pointing toward an overall economic contraction.

This perspective challenges the notion that Bitcoin acts as an uncorrelated hedge asset. Instead, data reveal strong correlations with technology stocks and show clustering around $28,000 rather than near recent peaks exceeding $60,000.

The key insight here isn’t about pinpointing exact price targets but understanding probabilities: if mean reversion occurred close to $66K while most trading activity since 2023 centers much lower at around $28K; future returns will heavily rely on sustained growth in equities markets. Without such expansion in stocks continuing unabated, downside volatility is likely to become common rather than exceptional.