The Bitcoin price has been fluctuating within a consolidation phase, revealing the emergence of a bearish continuation pattern known as an inverted pennant.

Binance has experienced a significant surge in whale inflows, indicating an increased supply of coins available for trading on the platform.

The Crypto Fear and Greed Index stands at 10%, reflecting a deeply pessimistic sentiment among market participants.

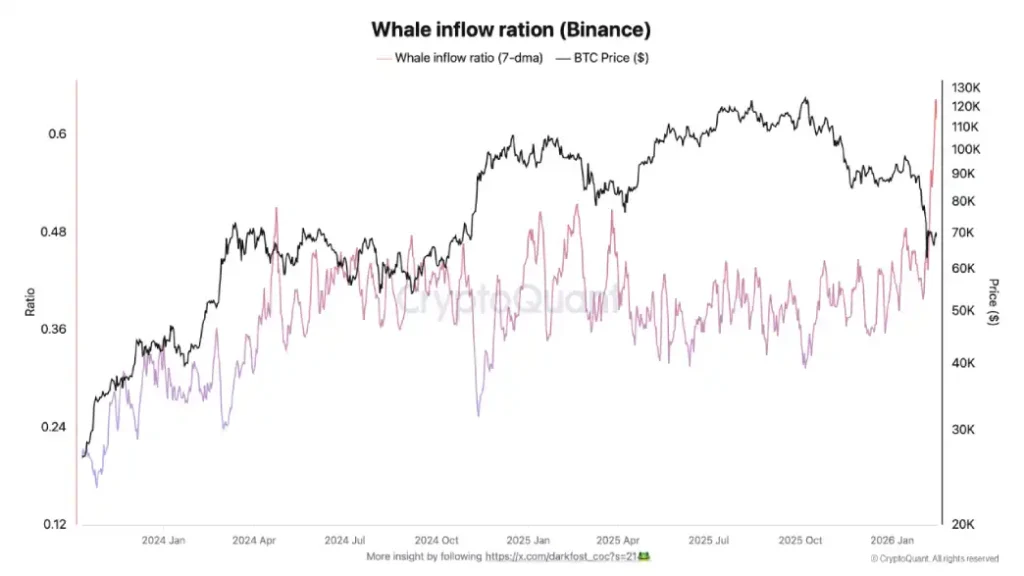

During Tuesday’s U.S. trading session, Bitcoin’s value declined by approximately 2%, settling around $67,521. This downward movement mirrored drops in technology stocks and gold prices amid escalating geopolitical tensions, suggesting that broader macroeconomic factors are influencing these markets simultaneously. The selling pressure has kept $BTC confined to a tight range near $70,000, signaling indecision from both buyers and sellers. Furthermore, on-chain data reveals a sharp increase in the Whale Inflow Ratio — pointing to heightened activity from large holders and raising concerns about an extended correction period ahead.

Whale Transfers to Exchanges Indicate Possible Upcoming Volatility for $BTC

Data from CryptoQuant highlights notable spikes in large-holder transactions on Binance during Bitcoin’s recent downturn. The whale inflow ratio—a metric calculating the proportion of Bitcoin deposits made by the ten largest transactions relative to total exchange inflows averaged over seven days—rose dramatically from roughly 0.40 to 0.62 between February 2nd and February 15th.

This increase suggests that major wallets have transferred significantly more BTC onto exchanges than seen in over two years. Such behavior typically correlates with greater coin availability for trading as prominent investors move assets from private storage into exchange accounts.

Experts link this surge partly to transfers made by Garrett Jin’s wallet—known as “19D5” or “Hyperunit whale”—which moved nearly 10,000 BTC onto Binance recently. Beyond this individual case, multiple substantial transfers have been recorded flowing into Binance due to its high liquidity during volatile market conditions.

This influx coincides with Bitcoin retreating from previous peaks—hovering between $67,000 and $68,000 mid-February after testing lower levels—as investors across all segments adjust their positions amid uncertainty resulting in elevated deposits by whales on exchanges.

Historically speaking, $BTC whales transferring coins onto exchanges often precedes significant market corrections accompanied by intensified selling pressure.

Technical Analysis Highlights Critical Bearish Continuation Pattern for Bitcoin Price

The price of Bitcoin has hovered close to $70K over the last fortnight without establishing any decisive breakout above or below this level—indicating hesitation among traders on both sides of the market fence.

A closer look at four-hour candlestick charts uncovers price movements confined within two converging trendlines forming an inverted pennant pattern—a classic bearish continuation signal characterized by descending resistance lines combined with triangular consolidation following prior downtrends.

$BTC/USDT – Daily Chart

This formation typically represents sellers pausing momentarily before resuming downward momentum.

If this technical setup plays out accordingly, $BTC candidates breaking below support near $67,200 could trigger further declines potentially driving prices down another ~18% toward approximately $55K post-breakdown.””>”>”>”>