According to Fidelity’s global macro director, the recent decline of bitcoin to $60,000 may signify the lowest point in its current cycle, paving the way for a future bull market and a potential surge towards new record highs.

Fidelity Macro Chief Connects Bitcoin’s Growth to $118 Trillion Liquidity

On February 13, Jurrien Timmer, Fidelity’s Director of Global Macro, took to social media platform X to express that bitcoin’s recent drop to approximately $60,000 has reached a support level he had previously identified. This suggests it could be the bottom of its last phase and heralds the beginning of a new upward trend.

Timmer stated: “Bitcoin finally hit $60K last week—this aligns with the support zone I pointed out months ago when I suggested that another four-year bull cycle was likely coming to an end. A decrease down to ‘only’ $60K would be relatively mild for what is known as a bitcoin winter; however, as this commodity currency matures over time, we should expect less dramatic fluctuations.”

He further commented: “While it’s uncertain whether $60K is indeed the low point, my inclination is that it might be. After some months of adjustments and consolidations around this price range, we could see the onset of another cyclical bull market.” Additionally, Timmer shared:

“Drawing from historical cycles’ mathematical harmony—which are not necessarily indicative of future trends—I believe any forthcoming waves could eventually propel us toward unprecedented heights.”

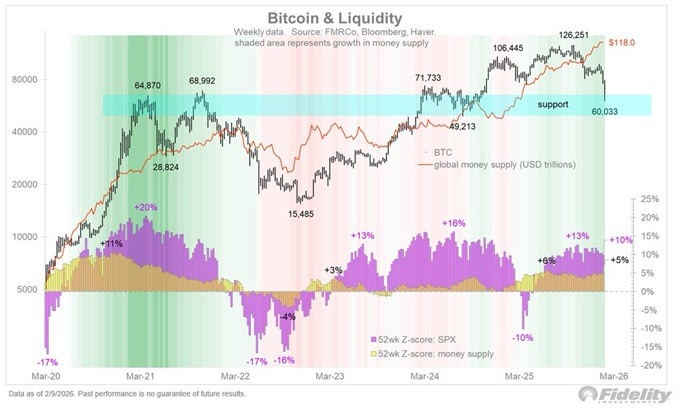

Timmer also provided two illustrative charts alongside his insights. The first chart titled “Bitcoin & Liquidity” juxtaposes bitcoin prices with global money supply growth rates. It highlights previous cycle peaks at approximately $64,870; $68,992; $71,733; and even up to $126251 while marking around $60k as technical support against a backdrop where global liquidity stands at about an impressive total of roughly 118 trillion dollars.

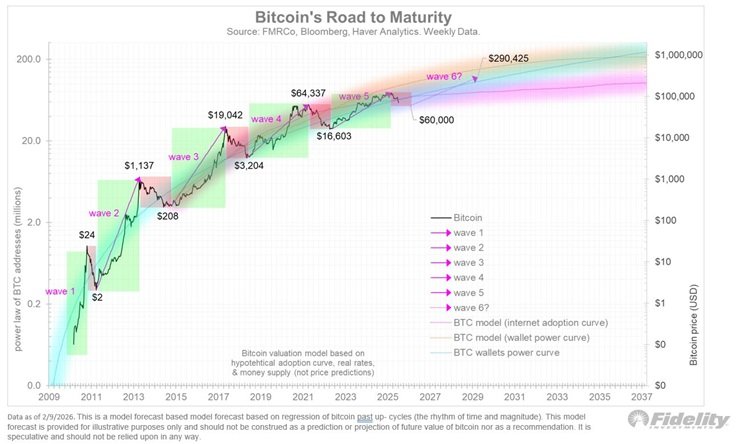

The second chart labeled “Bitcoin’s Path Toward Maturity” illustrates historical price movements from early values near just two dollars or twenty-four dollars all the way up past sixty-four thousand dollars—with projections indicating wave six approaching around two hundred ninety thousand four hundred twenty-five dollars. This model incorporates factors such as adoption rates and wallet growth along with macroeconomic variables providing an expansive long-term framework potentially extending towards one million dollars over time. While described more as illustrative rather than predictive in nature—the visual analysis implies if past cyclical behaviors coupled with ongoing adoption trends persist—bitcoin may continue on its structured maturation journey following current consolidation efforts centered around sixty thousand dollars.

Frequently Asked Questions 🧭

Why does Fidelity’s global macro director consider 60k crucial for Bitcoin?

He perceives this drop correlates with concluding its previous four-year bullish trend possibly marking cyclical lows while limiting downside risks compared against earlier crypto winters.

Could Bitcoin’s latest downturn indicate an impending bullish resurgence?

Timmer proposes after settling into stability near sixty thousand—a fresh upward trajectory consistent within historic four-year patterns might emerge.

How does Bitcoin maturation influence volatility expectations?

As it transitions into being recognized more broadly like established macro assets or ‘commodity currencies,’ Timmer anticipates reduced price swings which could draw increased institutional investment.

What underpins long-term investment perspectives regarding Bitcoin cycle evaluations?

Citing recurring mathematical structures along with sustained adoption increases—Timmer asserts if these historical models hold true then ultimately significant all-time highs remain achievable over extended periods.