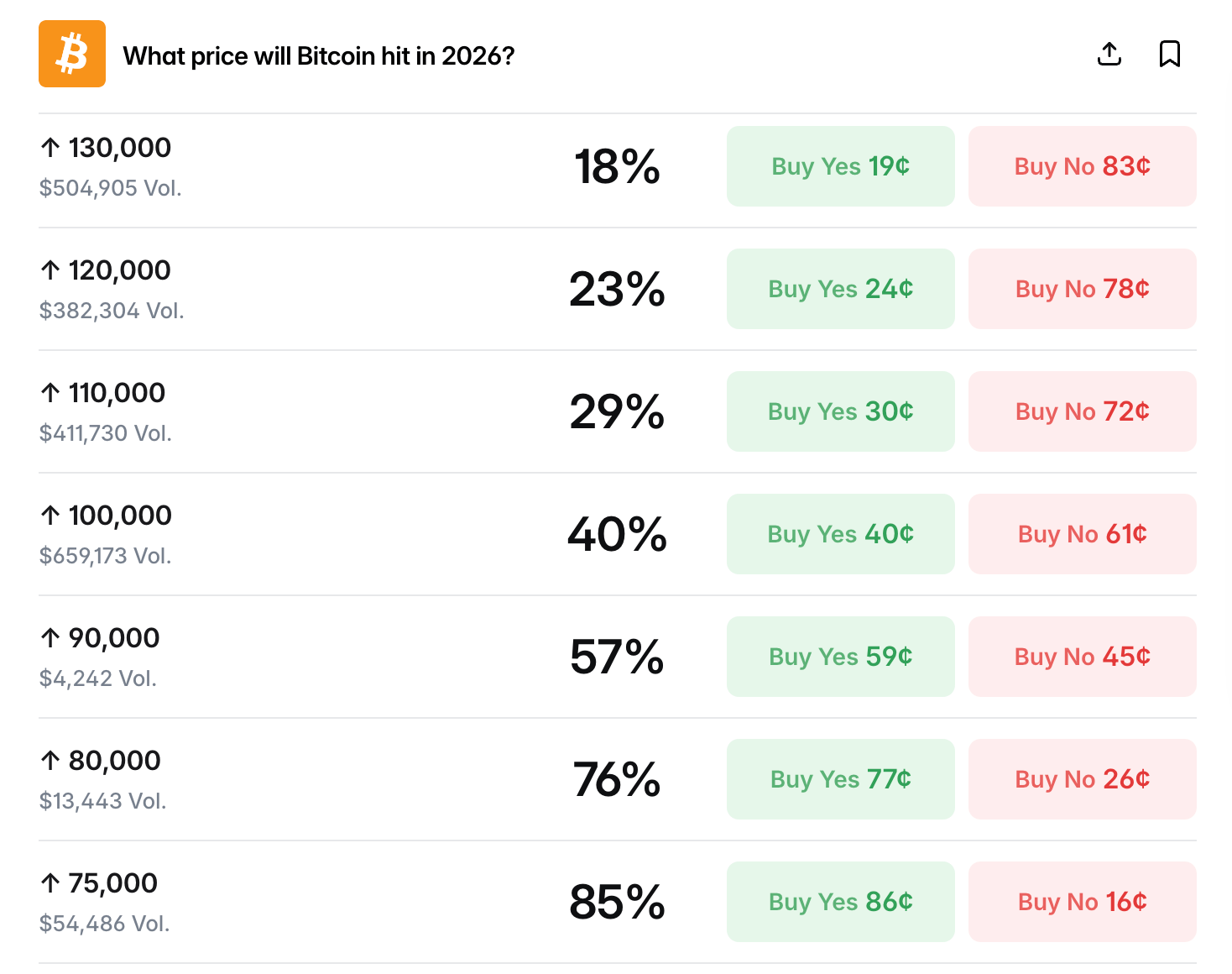

Investors on platforms like Polymarket, Myriad, and Kalshi are actively betting on the future price movements of Bitcoin for 2026. With seven ongoing contracts accumulating over $84 million in trading volume, the general sentiment reflects a cautious optimism among traders, who are also engaging in various hedging strategies.

Increasing Odds for Six-Figure Bitcoin as Time Progresses

One of the most popular contracts on Polymarket focuses on predicting Bitcoin’s price in February 2026. This multi-outcome market will resolve positively if any one-minute Binance BTC/USDT candle high meets or exceeds a specified level between February 1 and February 29, boasting a total volume close to $61 million.

The current market pricing suggests an implied probability of approximately 45% that Bitcoin will reach $75,000; meanwhile, an $80,000 target is estimated at around 17%. Confidence diminishes significantly beyond this point: there’s about a 6% chance for an $85,000 valuation and roughly a mere 2% likelihood for hitting $90,000. Targets above six figures are currently priced at around or below 1%.

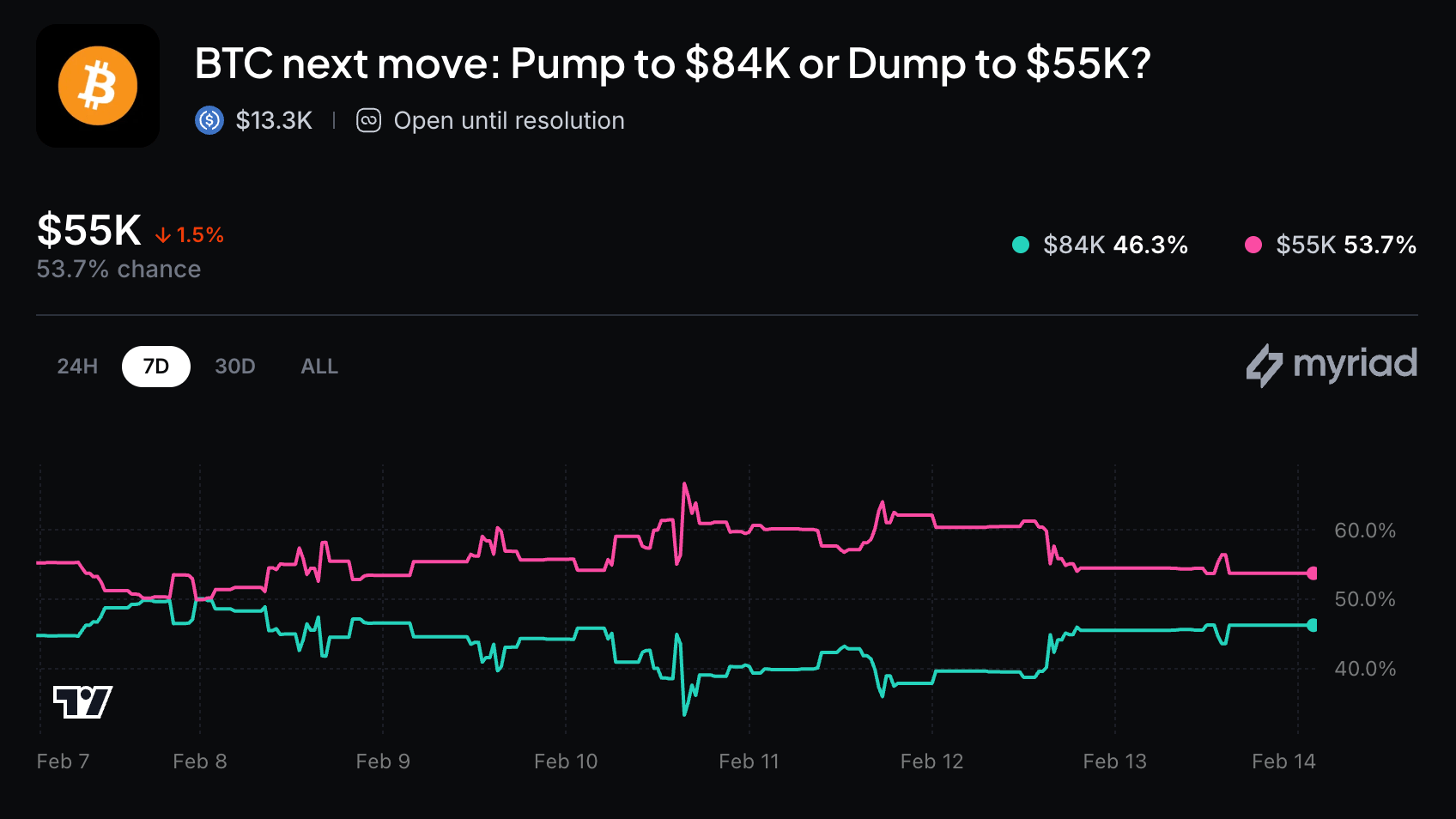

Trading activity tends to cluster around key psychological thresholds. The strike price of $85,000 leads among bullish targets while significant defensive positioning is evident at levels like $55,000 and $50,000 — indicating that traders are preparing for both upward extensions and potential pullbacks.

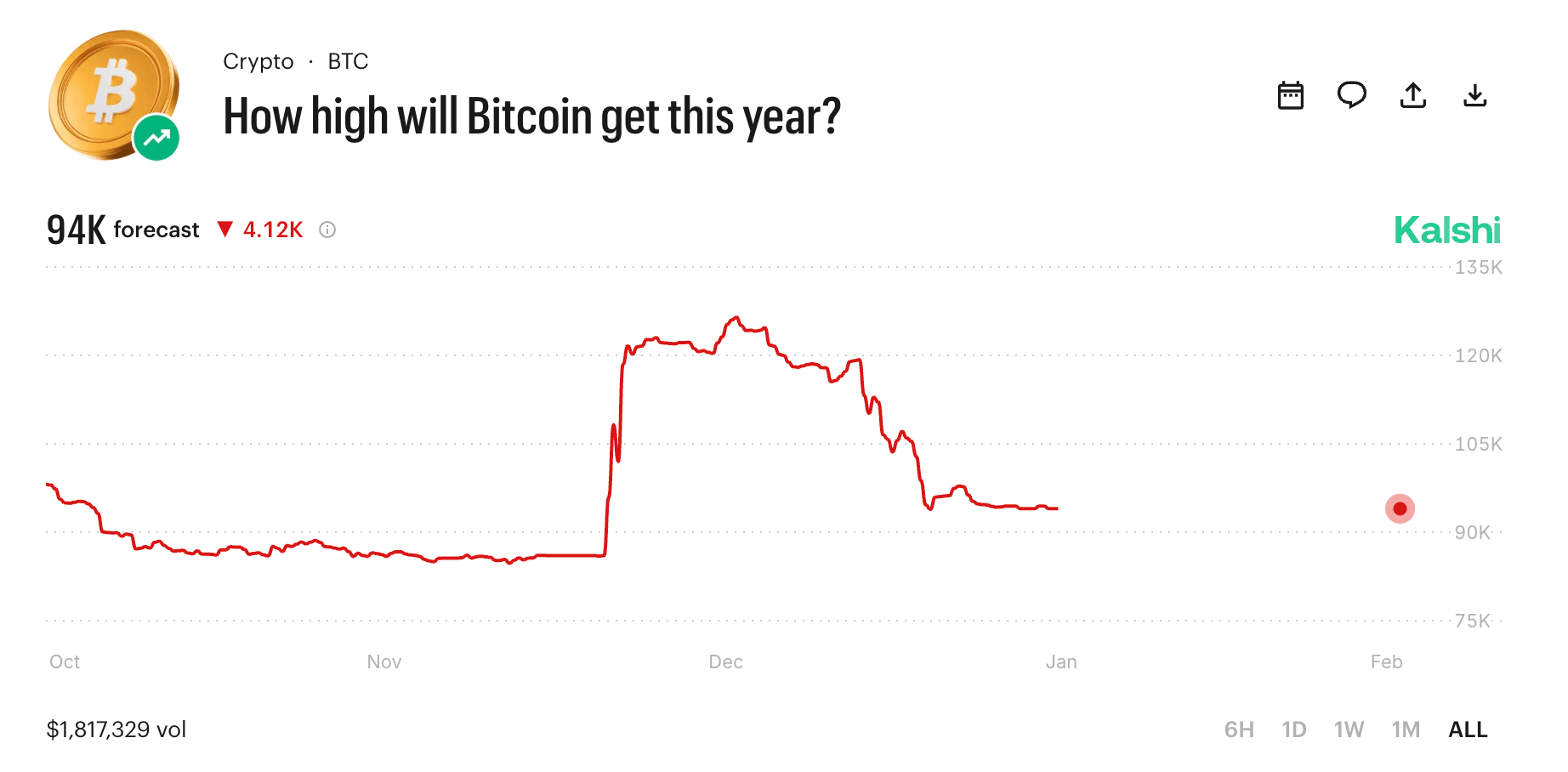

A broader contract on Polymarket seeks to predict what price Bitcoin might achieve before January 1st of next year. Here too the crowd assigns nearly a 40% chance that it could hit the coveted mark of $100K during this year; however probabilities gradually decrease for targets above this level with long-shot aspirations such as reaching up to $250K lingering near just about 5%.

Interestingly enough substantial trading volumes appear at both ends of the spectrum including notable activity surrounding prices like $15K — suggesting more hedging behavior rather than straightforward directional bets with traders looking to insure against extreme risks.

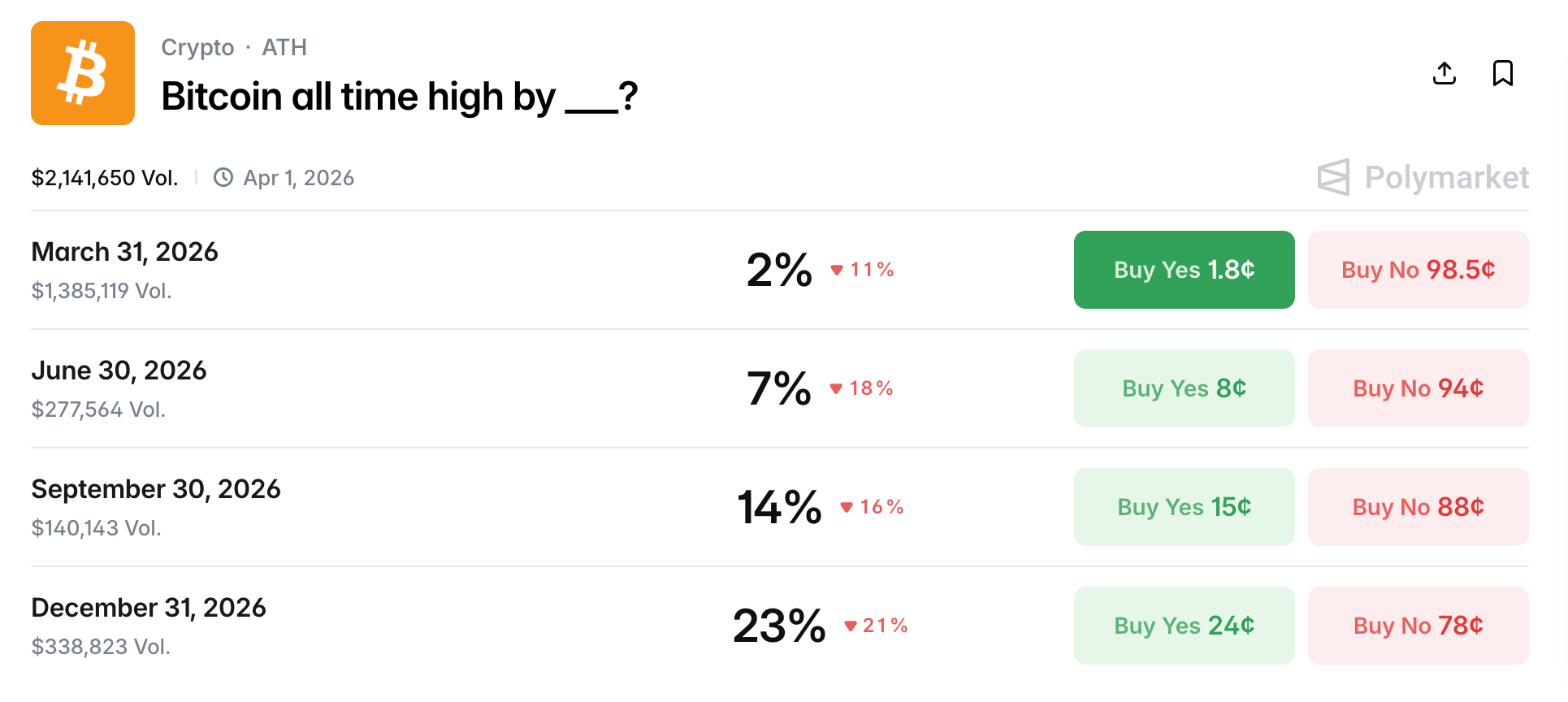

An additional timeline contract from Polymarket investigates whether Bitcoin can set new all-time highs by various deadlines throughout this year. Current odds remain low initially: approximately only about a mere two percent by March rising slightly to seven percent by June but climbing significantly higher towards December where implied probabilities rise up towards twenty-three percent.

This gradual increase in probabilities over time indicates that investors anticipate slow improvement rather than sudden surges. Liquidity appears concentrated around earlier deadlines reflecting active short-term positioning even while longer-term optimism builds slowly over time.

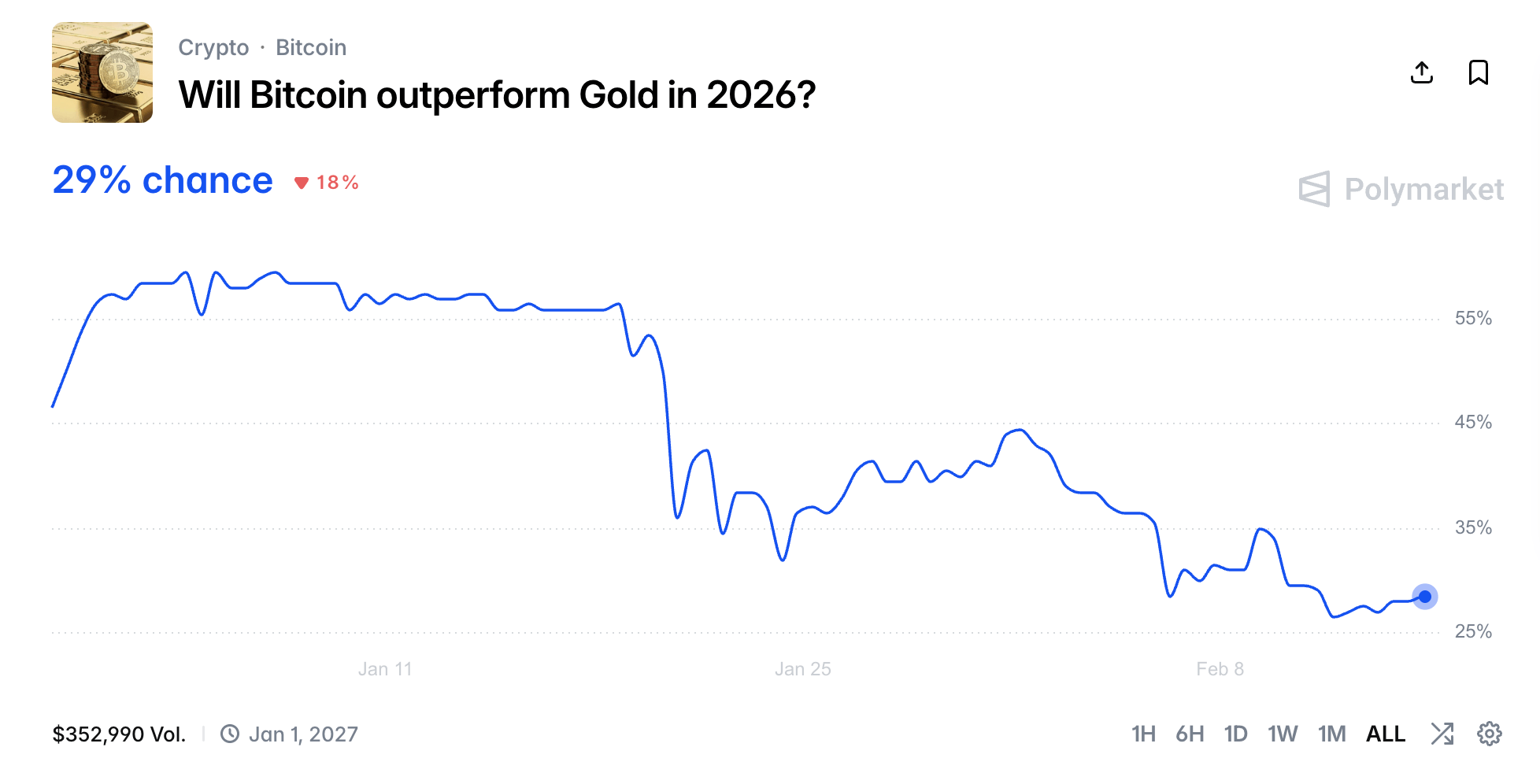

A macro-oriented contract hosted by Polymarket queries whether Bitcoin will outperform gold within this timeframe; presently assigning it only about twenty-nine percent chances against gold’s favored position which stands near seventy-two percent overall return expectations annually from precious metals perspective

This pricing reveals caution regarding volatility associated with bitcoin alongside prevailing macroeconomic conditions impacting risk appetite amongst investors weighing higher real yields along historical post-halving trends making gold seem steadier performance option moving forward into upcoming months ahead

.

FAQ ❓

What do Polymarket traders expect for bitcoin in February 202

The highest implied probability is near $75 , with sharply lower odds above $80 , .

What are the chances bitcoin hits $100 K in20126 ?

Kalshi markets currently imply roughly39 %chanceof crossing$100 ,thisyear.

Do traders expect anewall-timehighsoon?

Near-term oddsarelow ,withhigherprobabilitiesassignedto late20206 .

Isbitcoinfavoredtooutperformgoldin20206?

No ,marketscurrentlygivegoldaclearedgeoverbitcoinforannualperformance.