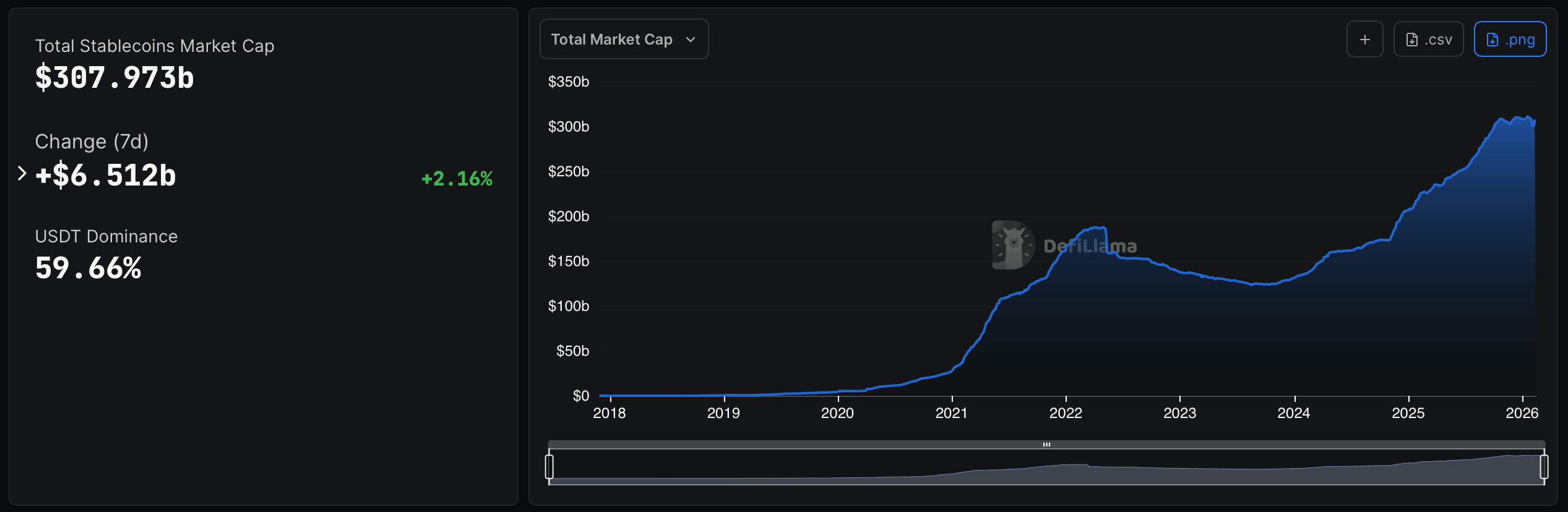

This year, the stablecoin economy notched a record peak of $311.837 billion roughly 27 days ago, only to cool to $300.722 billion by Feb. 1. Over the last two weeks, however, the sector added $7.251 billion back to its tab, with most of that expansion unfolding within the past seven days.

$307B and Climbing

Between Feb. 7 and Feb. 14, 2026, metrics from defillama.com’s stablecoin stats show the fiat-pegged token sector climbed 2.16% from the previous week, adding $6.512 billion to its total. That accounts for 89.81% of the $7.251 billion expansion recorded over the past two weeks, meaning nearly all of the recent lift occurred within this narrow window.

Stablecoin market cap stats via defillama.com on Feb. 14, 2026.

As of Saturday, Feb. 14, the stablecoin economy stands at $307.973 billion, with tether ( $USDT) commanding 59.66% of the total. Over the past week, $USDT’s market cap edged up 0.14%, adding $251.98 million to its balance sheet. The dominant stablecoin now carries a market valuation of $183.727 billion. Circle’s $USDC follows at $73.559 billion after a 1.39% gain, reflecting a $1.012 billion increase during the same stretch.

Sky dollar (USDS) saw strong expansion week-over-week, showing clear upward capital inflows with a 3.72% gain. USDS has a $6.622 billion market cap. The largest decline among the top ten group, was Ethena’s $USDe, indicating short-term contraction. $USDe shed 2.25% dropping to a market cap of $6.312 billion. World Liberty Financial’s USD1 grew by 1.63% to $5.302 billion by Saturday.

$DAI saw the sharpest weekly drop in the top ten, reflecting a significant reduction in circulating supply. $DAI’s 4.53% plunge led to a market cap of $4.387 billion. Paypal’s $PYUSD delivered one of the strongest weekly performances among major issuers, rising 5.07% over the seven-day stretch as its market capitalization reached $4.022 billion. That lift places $PYUSD squarely among the week’s more eye-catching gainers.

Blackrock’s BUIDL recorded the sharpest increase within the top-ten cohort, climbing 23.07% week over week to attain a $2.363 billion valuation. The move follows several weeks of outflows from BUIDL’s market, marking a decisive reversal. Its outsized jump far exceeds the broader stablecoin sector’s pace, pointing to renewed appetite for tokenized dollar products linked to traditional financial rails.

Falcon Finance’s $USDf, by contrast, ticked 0.67% lower during the same interval. The pullback proved relatively contained compared with other weekly contractions, leaving $USDf at a $1.637 billion market cap while retaining its place inside the top-ten ranks.

Closing out the list, Ripple’s RLUSD advanced 1.85% over the past week, lifting its market capitalization to $1.522 billion. The increase reflects measured expansion at the lower edge of the top tier, reinforcing a wider pattern of incremental growth among newer fiat-backed entrants even as the sector’s largest tokens continue to command the lion’s share of supply.

The latest figures illustrate a stablecoin market that is neither stagnant nor overheated, but recalibrating in real time as capital rotates among incumbents and emerging issuers. While tether ( $USDT) and $USDC continue to anchor the sector’s supply, smaller entrants are steadily carving out share through targeted growth spurts and niche positioning. With total valuation nearing prior highs once again, the fiat-backed token arena appears to be building momentum methodically.

FAQ ❓

What is the current stablecoin market size as of Feb. 14, 2026? The stablecoin economy stands at $307.973 billion.

How much did the stablecoin sector grow this week? The market added $6.512 billion between Feb. 7 and Feb. 14, a 2.16% weekly increase.

Which stablecoin holds the largest market share? Tether ( $USDT) dominates with 59.66% of the total market.

Which stablecoins saw the biggest weekly gains? Blackrock’s BUIDL rose 23.07%, while Paypal’s $PYUSD climbed 5.07% over the past seven days.