Bitcoin (BTC) has retreated towards the lows observed last week, relinquishing almost all of its recent advancements above the $70,000 mark and continuing its downward trend in tandem with a broader decline in the technology sector. Currently, Bitcoin is trading around $65,000.

In the past 24 hours, Bitcoin experienced a 2% decrease. This downturn was mirrored by similar losses in ether (ETH), which is priced at $1,916.07, and solana (SOL), currently valued at $76.98.

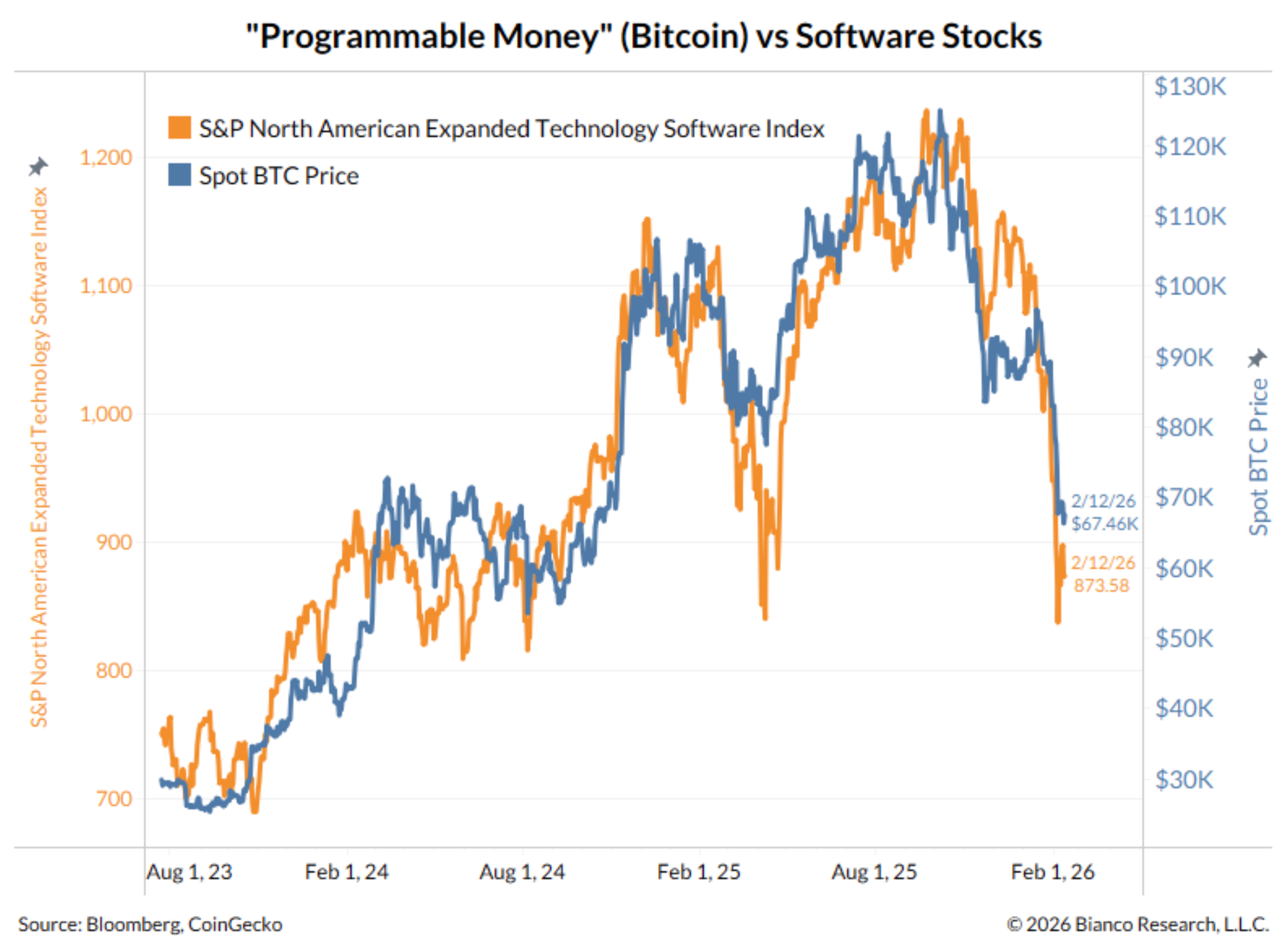

This drop reflects overall market trends seen in the Nasdaq index, which also fell by 2% on Wednesday. The software sector was particularly hard hit; for instance, the iShares Expanded Tech-Software Sector ETF (IGV) plummeted by 3%. Year-to-date performance shows that IGV has declined by 21%, as investors express concerns over high valuations amidst rapidly advancing artificial intelligence capabilities.

Macro strategist Jim Bianco commented on this situation: “Software stocks are facing challenges once again today,” he noted. “The IGV index is essentially back to panic levels we saw last week.”

Bianco further emphasized an important point: “Let’s not overlook another category of software—’programmable money,’ or cryptocurrency,” he remarked. “They share fundamental similarities.”

(Source: X/@biancoresearch)

Precious metals not immune

Gold and silver initially enjoyed modest gains throughout most of the day but faced abrupt declines during mid-afternoon trading sessions. By late afternoon, silver had dropped significantly by 10.3%, settling at $75.08 per ounce while gold decreased by 3.1%, bringing its price down to $4,938.