Bitcoin is currently under increased pressure from macroeconomic factors following the recent US employment report, which revealed a stronger labor market than anticipated. This development has driven Treasury yields upward and diminished the chances of imminent Federal Reserve interest rate reductions.

In January, the US economy added 130,000 jobs—almost twice what analysts had predicted. Meanwhile, the unemployment rate dropped to 4.3%, highlighting ongoing robustness in the job market.

Although robust employment figures generally bode well for economic health, they complicate prospects for riskier assets such as Bitcoin.

US job growth unexpectedly accelerated in January and the unemployment rate fell to 4.3%, signs of labor-market stability that could give the Fed room to keep interest rates unchanged for some time while policymakers monitor inflation https://t.co/kFkiSxgylK pic.twitter.com/dHZX5mWOvr

— Reuters (@Reuters) February 11, 2026

Strong Employment Data Pushes Back Rate Cut Expectations

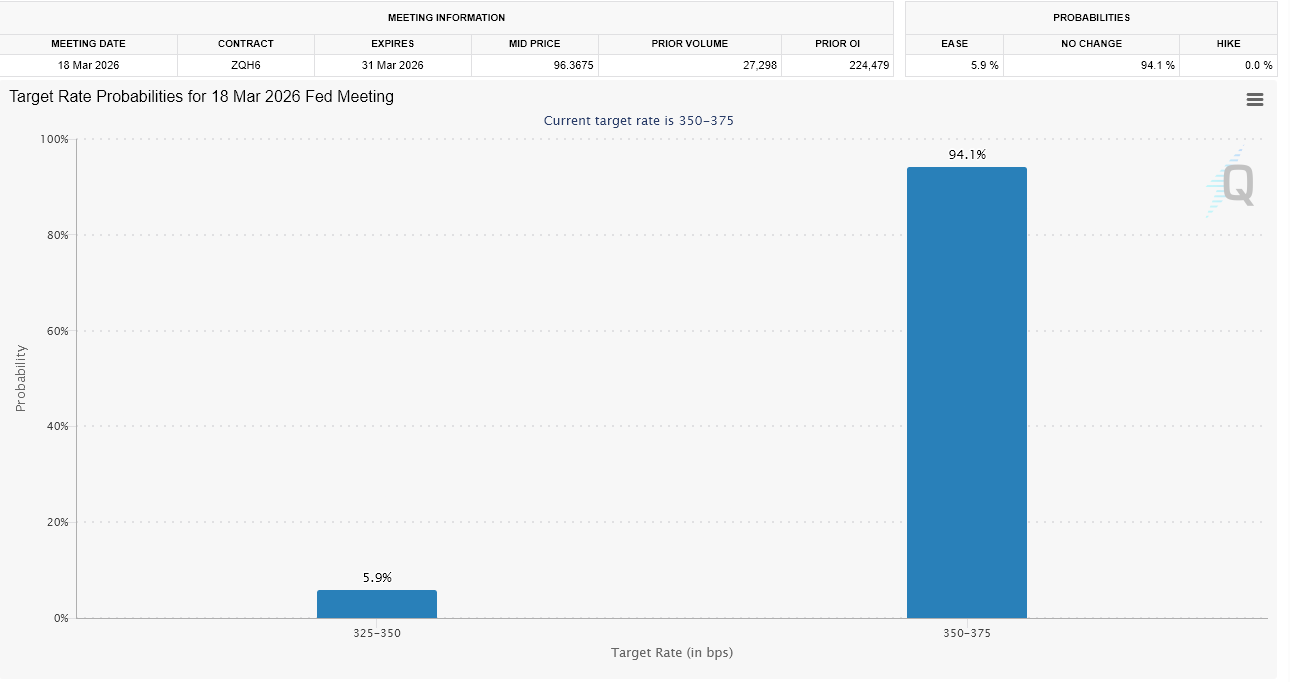

The markets had been pricing in possible interest rate cuts over upcoming months due to concerns about slowing economic growth. However, a resilient labor market reduces immediate pressure on monetary easing measures.

This shift prompted investors to adjust their expectations regarding Federal Reserve policies accordingly.

The bond market responded swiftly: yields on US 10-year Treasury notes surged toward 4.2%, climbing several basis points post-report release. Similarly, two-year Treasury yields rose as traders scaled back bets on near-term policy easing.

Ten year treasury yields jumped 8 bps to 4.20% (which has been a magnet for the market) on the jobs report. Given the mix of huge downward revisions and higher than expected Jan hiring – the direction is likely sideways until CPI report on Friday. pic.twitter.com/GOM1uNl19B

— Kathy Jones (@KathyJones) February 11, 2026

An increase in yields tightens financial conditions by raising borrowing costs throughout various sectors and elevating discount rates used when valuing risk assets like cryptocurrencies.

The Impact of Rising Yields on Bitcoin

Bitcoin’s price is highly sensitive to changes in liquidity environments. When Treasury yields climb higher, capital often shifts toward safer investments that generate steady returns—such as government bonds—drawing funds away from speculative assets like Bitcoin.

Additionally, rising bond yields tend to strengthen the US dollar simultaneously—a factor that further restricts global liquidity and diminishes appeal for high-risk investments worldwide.

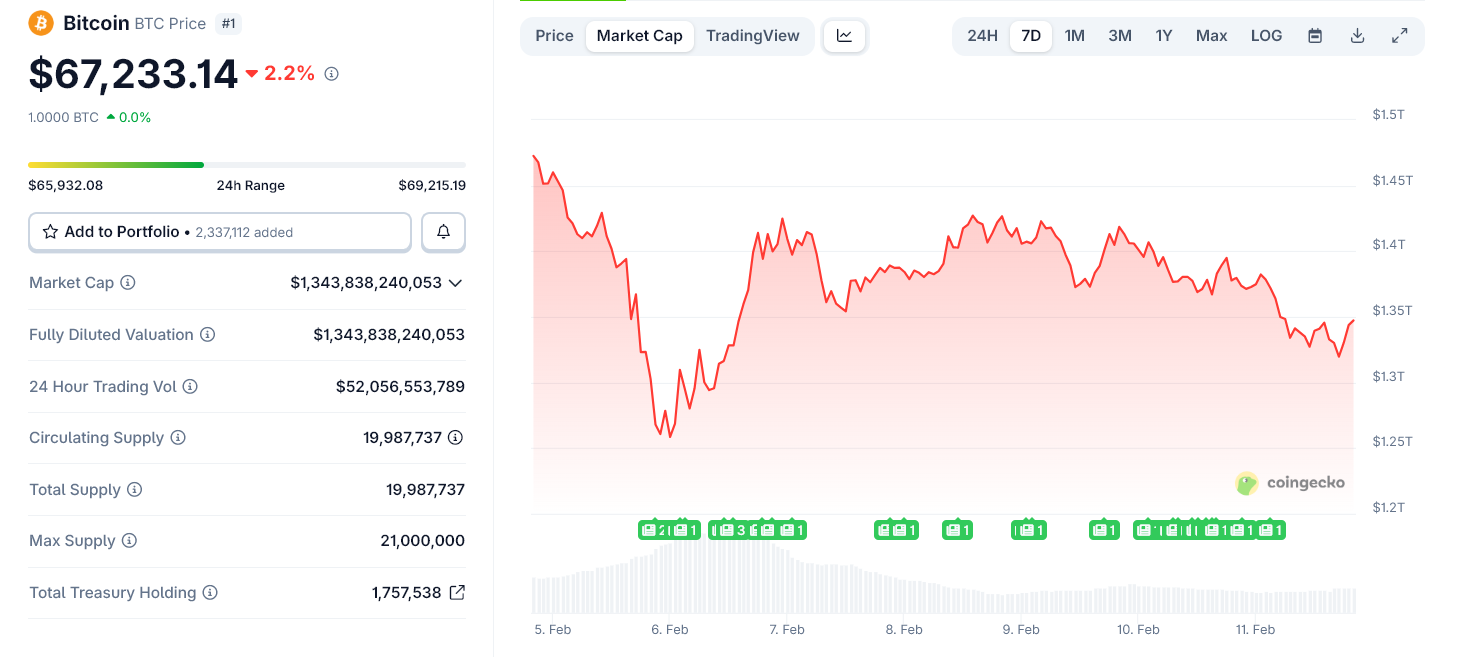

Bitcoin Price Over The Past Week (Source: CoinGecko)

This dynamic creates significant headwinds against cryptocurrency markets overall.

Despite briefly stabilizing around $70,000 earlier this week, Bitcoin now faces increased volatility risks due primarily to these strong employment figures. No clear indication exists yet suggesting imminent Fed policy easing, keeping liquidity constrained.

“For Bitcoin, This report represents short-term resistance. This magnitude dampens chances ''a March cut'', reinforcing Fed's pause at levels between $3&period50%-3&period75%. The catalyst needed by risky assets…’s cheap money just got delayed further out.Expect strengthening dollar with repricing upwards yield both pressuring BTC into narrow ranges soon,”

David Hernandez,

Crypto Investment Specialist at

21shares told BeInCrypto.

A Market Structure That Amplifies Macro Risks

The recent sharp downturn illustrated how susceptible bitcoin prices have become amid macroeconomic fluctuations.

Large ETF flows combined with institutional hedging strategies along with leveraged positions can accelerate price moves during tightening financial conditions.A strong labor environment doesn’t necessarily guarantee declines but it removes one major bullish driver — anticipation of easier monetary policy.

“In short term bitcoin looks defensive keeping eyes fixed around $65k level however if this strength proves temporary rather than sustained economic heating up then fed might still reduce rates later this year making bitcoin’s limited supply relevant again.Strong data today delays rally but does not negate long term bullish outlook.”

Fed Rate Cut Probability For March 2026 (Source: CME FedWatch)The Conclusion

The newest US jobs statistics support an extended period where interest rates remain elevated.

This scenario isn’t immediately disastrous for bitcoin but makes sustained upward momentum more challenging.

If neither liquidity improves nor bond yields fall back significantly,the broader macroeconomic context remains cautious rather than favorable towards cryptocurrencies.

The post Why The Us Jobs Data Makes A Worrying Case For Bitcoin appeared first On BeInCrypto.