Bitcoin’s reputation as “digital gold” is facing challenges, with its recent price trends resembling those of a volatile growth asset rather than a reliable safe haven, according to fresh insights from Grayscale.

Zach Pandl, the report's author, noted on Tuesday that although Grayscale continues to regard Bitcoin ($BTC) as a long-term store of value due to its capped supply and independence from central banks, current market dynamics tell a different story.

“In the short term, Bitcoin's price fluctuations have not shown strong correlation with gold or other precious metals,” Pandl explained, highlighting record-breaking surges in bullion and silver prices.

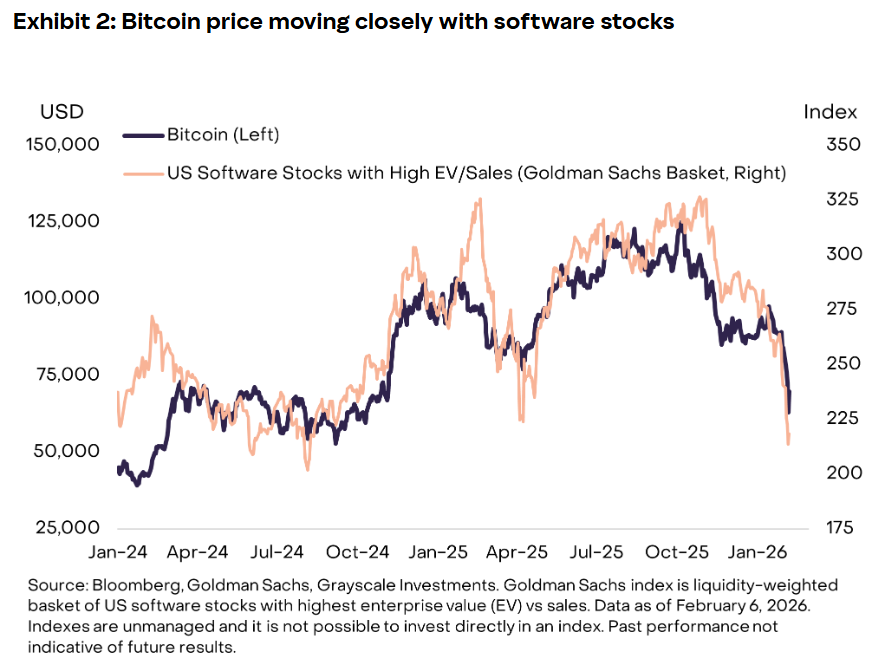

Instead, their analysis revealed that Bitcoin has formed a notable correlation with software stocks since early 2024. This sector has recently faced significant selling pressure amid fears that artificial intelligence might disrupt or obsolete many software services.

Bitcoin’s recent downturn parallels the decline in software equities since early 2026. Source: Grayscale

The study suggests that Bitcoin’s increasing sensitivity to equities and growth-oriented assets reflects its deeper integration into conventional financial markets. This trend is partly driven by institutional investors’ involvement, exchange-traded fund activities, and evolving macroeconomic risk perceptions.

This transition coincides with Bitcoin experiencing approximately a 50% drop from its October peak above $126,000. The decline occurred in multiple phases: starting with an unprecedented liquidation event in October 2025 followed by renewed sell-offs in late November and again at the end of January 2026. Additionally, Grayscale pointed out “motivated US sellers”, noting persistent price discounts on Coinbase over recent weeks.

Related: The crypto investment strategy for 2026 includes Bitcoin alongside stablecoin infrastructure and tokenized assets

An ongoing transformation for Bitcoin

Grayscale emphasizes that Bitcoin’s inability lately to uphold its safe-haven status should be seen not as failure but as part of its natural evolution as an asset class.

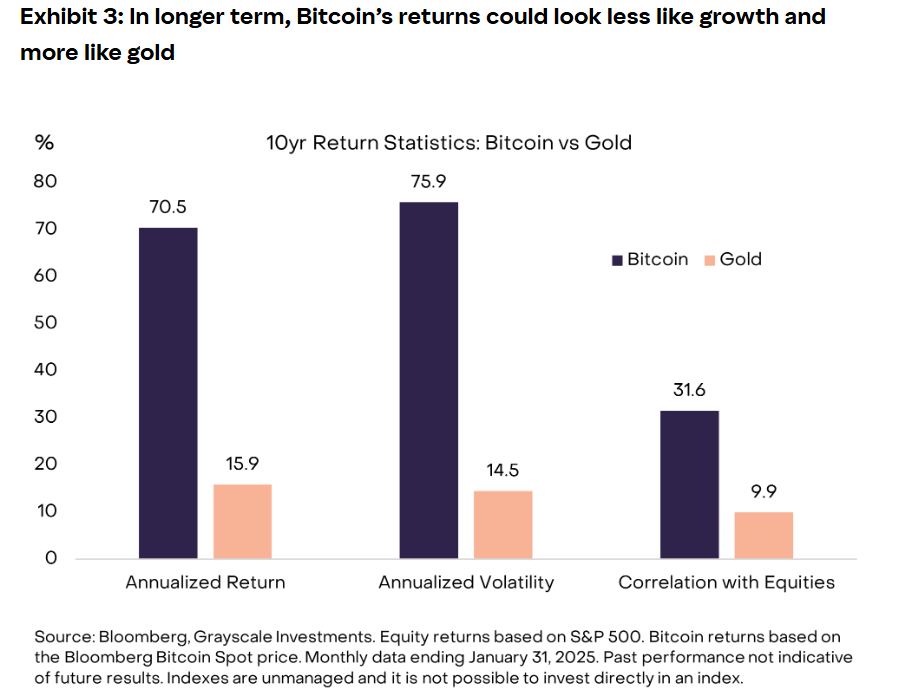

Pandl remarked it was unrealistic to expect Bitcoin would replace gold as monetary standard within such a brief timeframe.

“Gold has served monetary purposes for millennia and was foundational to the global monetary system until the early 1970s,” he wrote.

While failing so far to achieve comparable monetary prominence remains “a core aspect of our investment thesis,”, Pandl believes this could change over time given accelerating digitization driven by AI technologies, autonomous agents,and tokenized financial markets worldwide.

Despite recent setbacks,BTC’s annual returns have considerably surpassed those of gold over ten years.Source:Grayscale

In the short run,BTC’s rebound may hinge upon new capital inflows,either via revived ETF investments or renewed retail interest.Market maker Wintermute observed retail buyers currently favor AI-related stocks along growth themes,reducing immediate demand for cryptocurrencies.

Related:The Wall Street consensus favors crypto now,banks embracing $BTC stablecoins,and tokenized cash systems