As Bitcoin (BTC) continues to decline below the $70,000 mark, historical trends indicate that it may experience further drops before reaching a bottom.

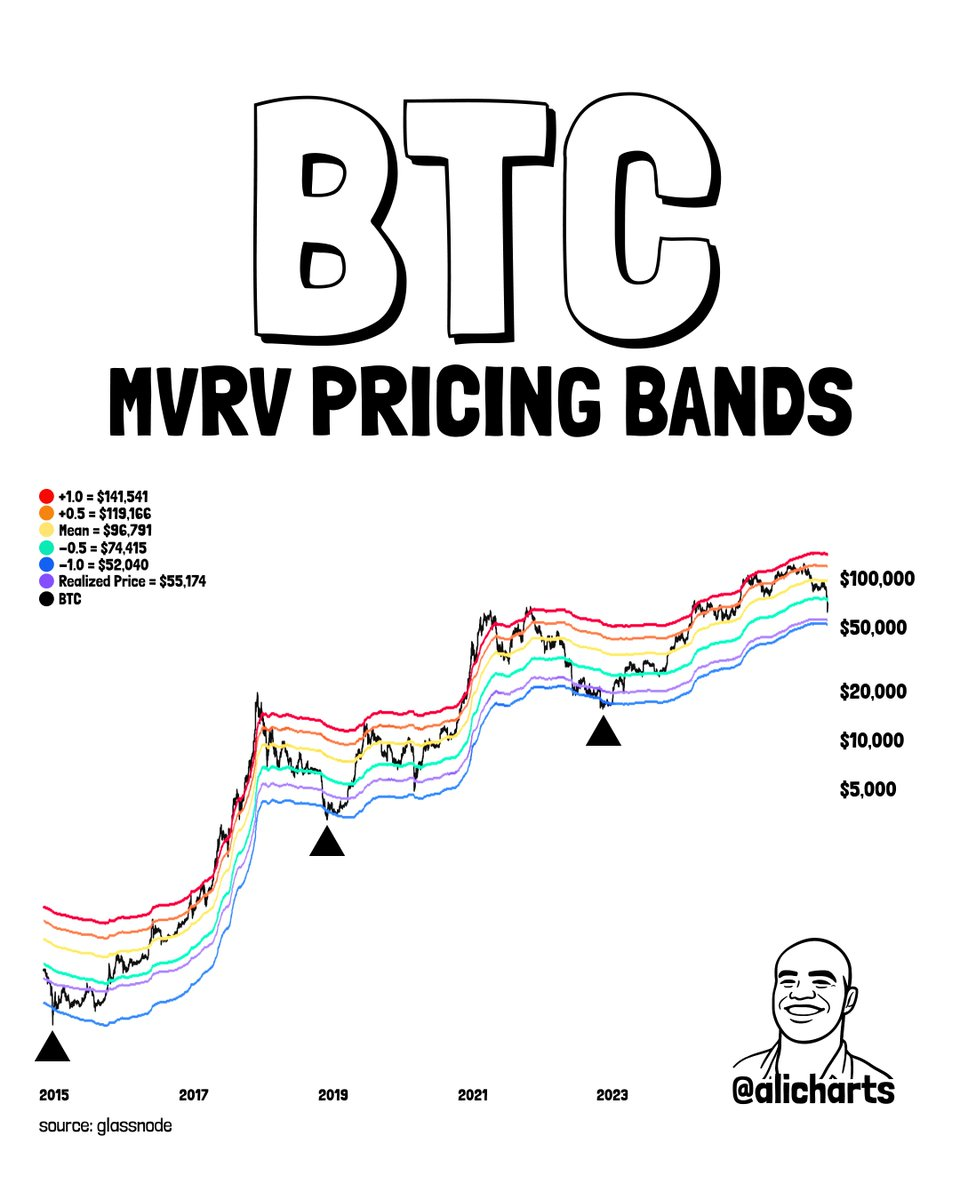

The Market Value to Realized Value (MVRV) Pricing Bands, a tool utilized for identifying periods of significant overvaluation and undervaluation, reveal that Bitcoin is trading at levels historically associated with major cycle bottoms.

According to cryptocurrency analyst Ali Martinez’s data shared in an X post on February 9, Bitcoin has consistently found stable lows when its price nears the −1.0 MVRV Pricing Band. This zone indicates substantial market undervaluation.

This trend was evident during the bear markets of 2015 and 2018 as well as in 2022; each instance preceded prolonged recoveries. Currently, the −1.0 band is positioned around $52,040, suggesting that Bitcoin is within a historically important accumulation range rather than merely undergoing a typical correction.

The MVRV indicator assesses Bitcoin’s market value against its realized value—the average cost basis on-chain. Significant declines below this long-term mean often signal widespread losses and can indicate capitulation events.

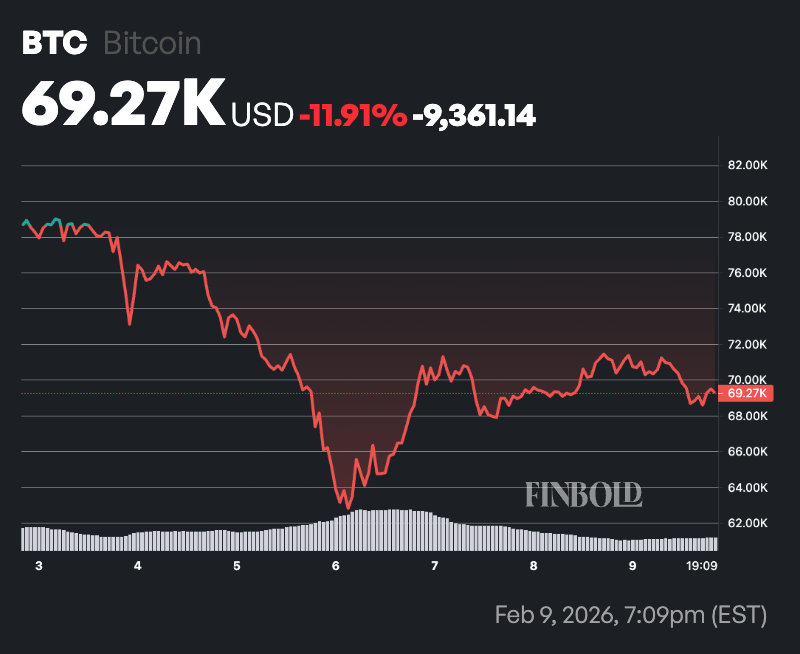

At this juncture, the pressing question remains whether the recent market pullback signifies capitulation or if it marks the beginning of a more profound downturn.

As of now, Bitcoin was trading at $69,279 after experiencing over a 2.6% correction in just 24 hours; additionally, it has dropped by 12% over the past week.

Bitcoin Fundamentals

Importantly, following a tumultuous period where Bitcoin briefly fell towards $60K–$61K—representing nearly a 50% drop from its all-time high near $126K—it has made some recovery since then by regaining levels above $70K during parts of last weekend due to institutional buying during dips.

However, data released on Monday revealed that institutional flows are still under pressure. According to Finbold’s report from February 6-9 period BlackRock-managed crypto products saw net outflows exceeding $3.6 billion predominantly focused on both Bitcoin and Ethereum assets.

This asset manager’s total crypto holdings have decreased to approximately $59.7 billion; however these changes mainly reflect ETF redemptions and custody movements rather than direct selling within markets themselves.

Meanwhile despite widespread predictions for crashes anticipated early into next year Bernstein has adopted an exceptionally bullish stance regarding bitcoin forecasting potential surges up towards new all-time highs reaching around$150k by year-end .

The firm argues current pullbacks illustrate investor behavior instead structural weaknesses citing increasing institutional adoption favorable regulatory conditions across U.S., along absence major scandals within industry as key supports underpinning positive price outlooks .

Main image via Shutterstock