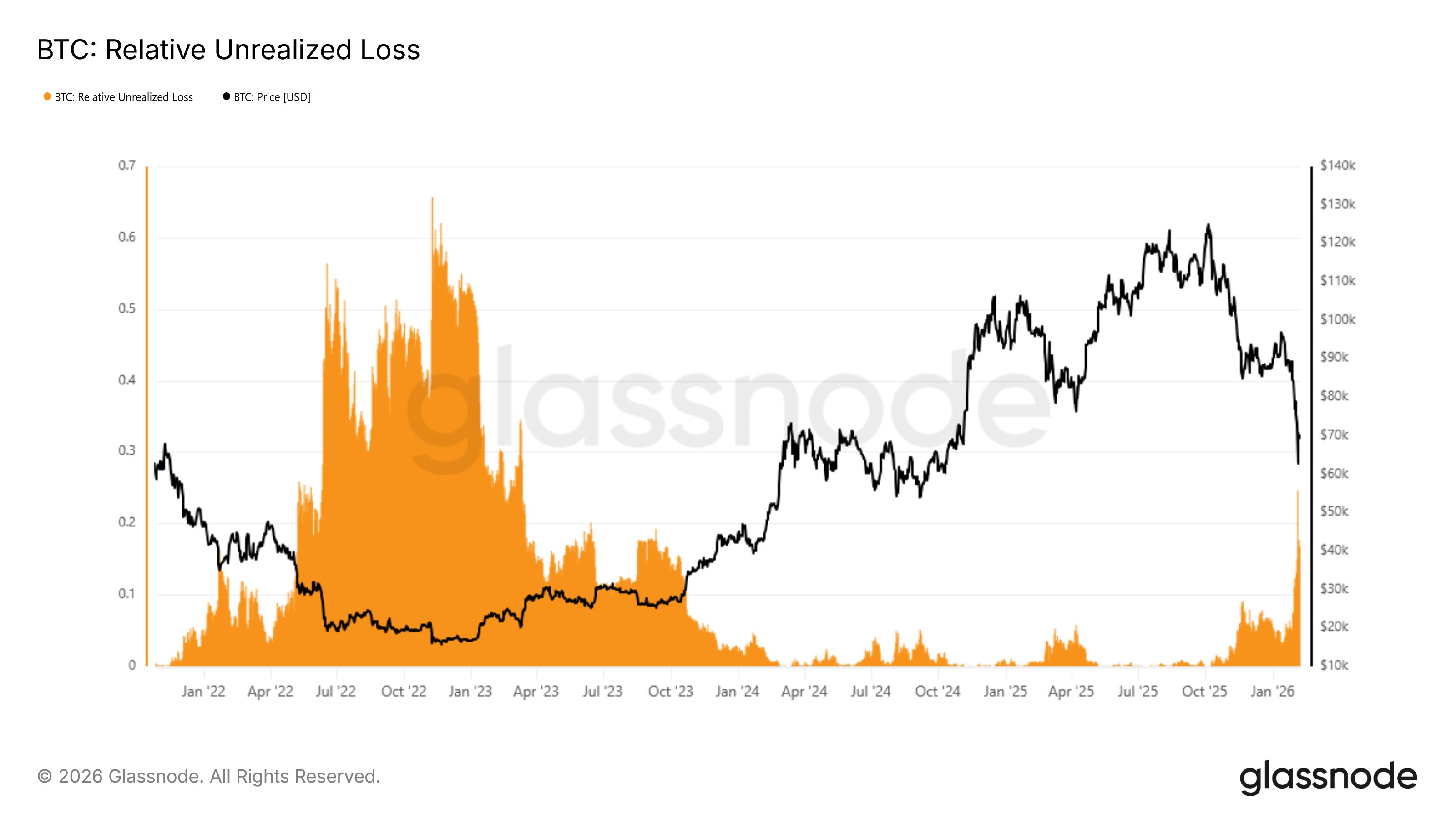

The recent downturn in Bitcoin’s value has resulted in unrealized losses reaching levels comparable to those observed during significant bear markets.

This information is crucial for market watchers, particularly bullish investors, as it illustrates the current phase of the market cycle. Specifically, unrealized losses have climbed to 16% of the total cryptocurrency market capitalization, indicating that a substantial number of Bitcoin holders are currently at a loss.

Essential Insights

The recent downturn in Bitcoin’s value has resulted in unrealized losses reaching levels comparable to those observed during significant bear markets.

<pSpecifically, unrealized losses have climbed to 16% of the total cryptocurrency market capitalization, indicating that a substantial number of Bitcoin holders are currently at a loss.

The latest increase indicates growing stress within the market.

This situation mirrors conditions from early May 2022 when heavy selling and negative sentiment were prevalent.

Bitcoin Unrealized Losses Reach 16%

On-chain data provided by Glassnode has been monitoring how much capital within the market is experiencing paper losses.

A chart shared by them reveals that when Bitcoin was valued at $70,000, unrealized losses represented approximately 16% of its overall market cap. This suggests that around one-sixth of Bitcoin’s worth is presently held at a loss.

Bitcoin Relative Unrealized Loss/Glassnode

The rise in unrealized losses followed a significant price correction for Bitcoin. The leading cryptocurrency saw declines of 11% and 23% over seven and thirty days respectively due to whale sell-offs and increased uncertainty within the marketplace. This situation has led to billions being wiped off from crypto valuations affecting many holders adversely.

Interestingly enough, this figure represents a stark contrast compared to just months prior when unrealized losses were significantly lower. A tweet from Glassnode referenced an October post noting that back then these losses accounted for only 1.3% of BTC’s overall valuation on the market cap scale.

An analyst known as “CryptoVizArt” remarked during this time that no severe pain typical for genuine bear phases had yet been felt by investors. Historically speaking mild corrections tend to push these figures above 5%, while more severe downturns can escalate them beyond even 50%. With current figures hitting around sixteen percent; it appears we may be edging closer towards bearish territory now than before!

Implications for Bitcoin

The relative measure regarding unrealised loss assesses what portion out there among bitcoin supplies remains underwater based on present pricing trends seen today! When such metrics begin rising up high—this typically indicates more individuals trapped above their cost basis which raises pressure across markets increasing risks associated with capitulation events occurring soon thereafter too!

This latest spike signifies mounting pressures throughout various sectors involved here! Long-term stakeholders remain somewhat resilient but short-term participants feel strain amid falling prices recently trending downwards further still! A growing pool filled with unfulfilled potential often arises during transitional periods where bullish momentum fades away leaving fear dominating instead!

A Familiar Pattern From Last Year (2022)

According To glass node—current structures mirror those witnessed back around early May last year (2020)—another timeframe marked heavily characterized via excessive selling combined alongside deteriorating sentiments across boards alike too! At That point—in particular—we watched bitcoin peak near $40k before plummeting sharply downwards hitting lows near $29k just weeks later on afterwards following suit accordingly too!

This drop triggered noticeable increases concerning our previously mentioned metric surrounding unfulfilled potentials appearing similar towards what we’re seeing unfold today right now also here again presently still ongoing as well perhaps?! Notably though—the corrections didn’t instantly indicate closures toward any ending phase rather continued downward slides occurred further leading ultimately toward bottoms reached later come November ’22 eventually arriving there altogether finally closing out things nicely wrapped up then!!

While nothing guarantees additional declines moving forward—it does suggest bitcoin might already find itself entrenched firmly inside initial stages pertaining towards broader bearish climates ahead indeed historically speaking they usually take quite some time unfolding until clearer recoveries commence thereafter emerging fully once again hopefully returning us back upward trajectories eventually sooner or later sometime soon hopefully yet!!!