Bitcoin experienced a decline below the $73,000 mark for the second day in a row, marking another turbulent week during which it shed nearly 18% of its value. This drop has resulted in a staggering loss of around $500 billion from its market capitalization since mid-January.

Bitcoin’s Gains Wiped Out Amid Rising Liquidations

For two consecutive days, bitcoin’s price fell beneath the $73,000 level, extending an already volatile period that saw the cryptocurrency lose close to 18% of its worth. Similar to the previous trading session, bitcoin tumbled from an intraday peak of $76,300 down to approximately $72,000 by early afternoon EST—a decline amounting to roughly 3%. This downward trend mirrored movements in technology-heavy indices like Nasdaq, which was down by about 2.36% at that time.

This recent slide reduced bitcoin’s total market cap to about $1.45 trillion. Since reaching a year-to-date high near $97,500 on January 15th, it has wiped out nearly half a trillion dollars in value. The crash on February 4th triggered significant liquidations—eliminating around $125 million worth of long positions within just four hours alone. Over the past day and night span (24 hours), leveraged liquidations surpassed an astonishing $830 million with bullish traders suffering most losses.

The price drop coincided with substantial withdrawals totaling approximately $272 million from spot bitcoin exchange-traded funds (ETFs). Market sentiment remained pessimistic despite news that U.S lawmakers intend to debate the CLARITY Act—legislation aimed at creating clear regulatory guidelines for cryptocurrencies—and even after Congress voted successfully late on February 3rd to end part of the government shutdown; these developments failed to spark any meaningful risk appetite among investors.

$BTC/USD one-hour chart via Bitstamp as seen on February 4th shows Bitcoin hitting an intraday low near $72K at around midday EST.

Tech Sector Slump Driven by AI Stocks Pulls Markets Lower

The broader market downturn was largely attributed to setbacks within artificial intelligence-related stocks and semiconductor companies. Advanced Micro Devices (AMD) led this sell-off with shares plunging over sixteen percent following cautious future earnings guidance announcements. Other major tech players such as Nvidia (-4%), Broadcom (-7%), and Intel (-3.5%) also suffered sharp declines contributing heavily toward Nasdaq’s negative performance while S&P 500 and Dow Jones Industrial Average slipped less than one percent each.

Meanwhile bitcoin continues showing strong correlation with Nasdaq movements but increasingly diverges from traditional safe-haven assets like gold—challenging its reputation as “digital gold.” This separation suggests BTC currently behaves more like high-risk tech equity rather than a stable store-of-value asset class.

Additionally,the crypto community is questioning Strategy’s diminishing influence after shifting their approach towards financing new bitcoin purchases—their once frequent acquisitions no longer seem capable of igniting sustained rallies.

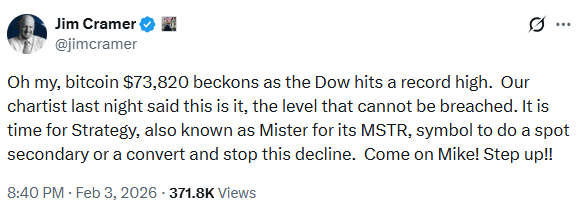

This waning impact prompted notable figures including TV host and investor Jim Cramer urging Strategy Chairman Michael Saylor via social media platform X (formerly Twitter) for reconsideration:

“Memo for Michael Saylor: we believe that maintaining support above $73,₀₈₀₊'s crucial,”

“It's time for another zero-coupon convertible bond issuance before further declines occur.

Your company's earnings depend heavily upon this move — what will you report come Thursday? Let's make it happen!”

Read more: XRP derivatives indicate caution amid stalled prices below $1.65

Although current trading levels remain under Strategy’s average acquisition cost basis across their holding portfolio exceeding seven hundred thousand bitcoins ($BTC) , opinions differ regarding their financial resilience.

Most analysts agree even prolonged bearish trends are unlikely threaten immediate solvency due primarily due large cash reserves shielding balance sheets against extreme volatility episodes common within crypto markets today.

Frequently Asked Questions ❓

- Why did Bitcoin dip below $73K again?

Its movement closely followed Nasdaq’s tech sector sell-off combined with overall weaker market conditions. - How much value has Bitcoin lost so far this year?

Since peaking near $97, 500 back on January fifteenth , BTC erased roughly five hundred billion dollars in valuation . - What caused recent liquidation spikes?

Over eight hundred thirty million dollars worth leveraged bets were liquidated during last twenty-four hours . - Certainly is Strategy vulnerable amidst downturn?

Analysts generally agree firm possesses ample cash buffers mitigating short-term risks posed by ongoing volatility .