The cryptocurrency landscape is currently navigating one of its most tumultuous phases since the downturn in 2022. After reaching a significant peak in late 2025, Bitcoin has begun a steep decline, recently falling below the $73,000 threshold. This recent price movement has reignited an age-old discussion: Is it possible for Bitcoin to plummet to zero? Notable investor Michael Burry, famed for his foresight during the “Big Short,” has intensified this debate by cautioning that the existing market structure could lead to a disastrous “death spiral.”

Analyzing Bitcoin’s Decline: A Technical Perspective

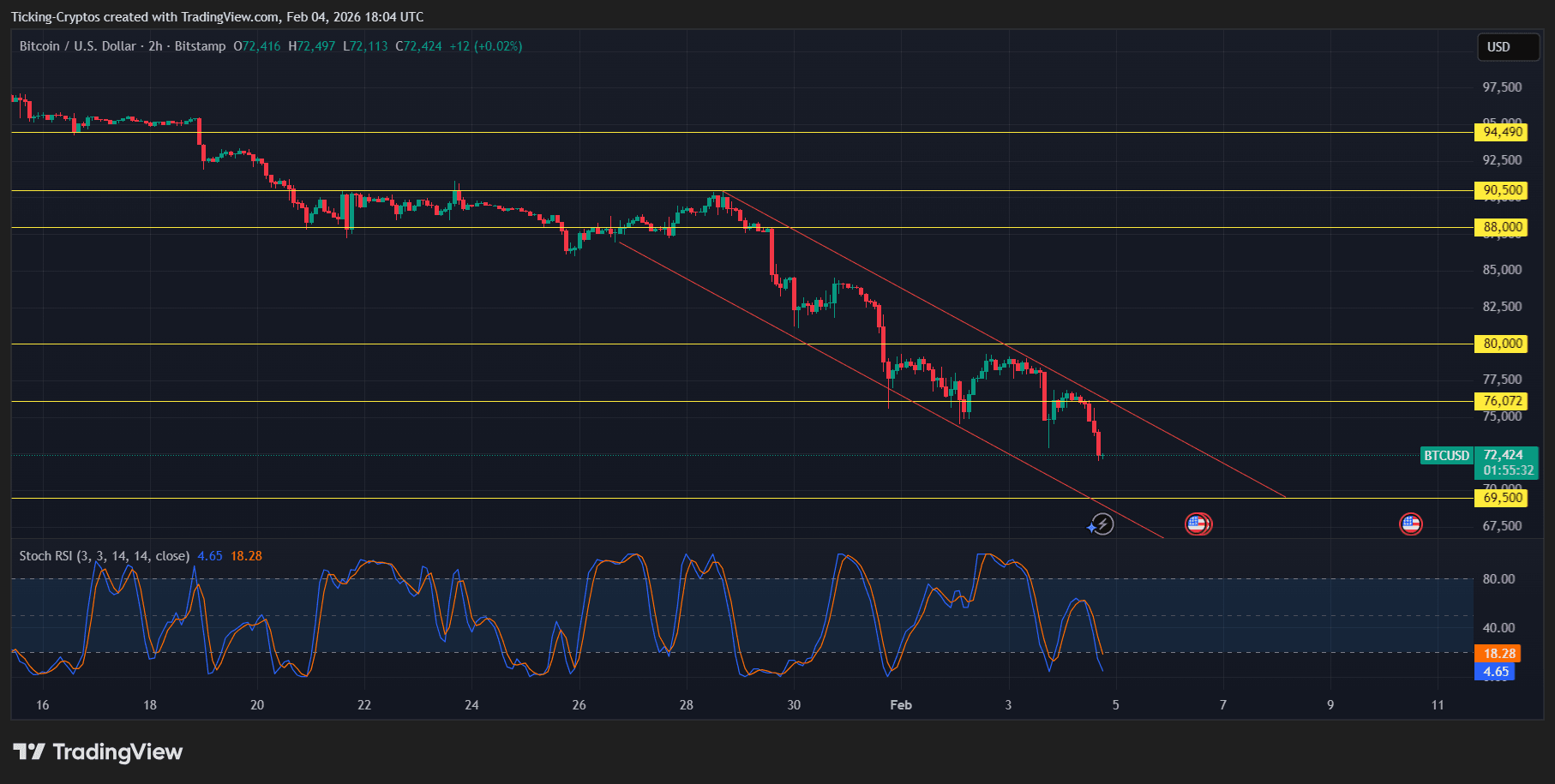

Examining the latest price trends of $BTC-USD reveals an increasingly bleak technical outlook. Following its all-time high of $126,000 in October 2025, Bitcoin has seen nearly a 40% depreciation.

Key Support Breach: Recently, Bitcoin breached its crucial 100-week Exponential Moving Average (EMA). Historically speaking, when this level is lost, it often leads to testing the lower support at around $68,400 marked by the 200-week EMA.

The Risk of a “Death Spiral”: The chart indicates potential formation of a “Head and Shoulders” pattern on longer timeframes. Analysts from reputable platforms like Bloomberg warn that if support at $68,000 fails to hold firm, there could be further declines toward levels as low as $40,000 or even $30,000.

Institutional Pressures: Major corporate stakeholders such as MicroStrategy are now facing losses below their acquisition cost (approximately $76,000). Burry suggests that forced sell-offs from these large entities may trigger an uncontrollable cycle of selling pressure within the market.

$BTC/USD Analysis – TradingView

Burry’s Insights on Potential Collapse

Michael Burry—who accurately forecasted the housing crisis in 2008—has taken to his Substack platform recently to question Bitcoin’s intrinsic value. He posits that Bitcoin is failing as both a hedge against currency debasement and as “digital gold,” pointing out how its correlation with precious metals is leading investors to liquidate gold and silver holdings just to cover crypto-related losses.

Burry’s primary argument for predicting a potential crash down to zero centers around what he sees as an absence of genuine use cases for Bitcoin. He warns that if institutional investments through ETFs continue their withdrawal trend—which saw over $500 million exit in late January 2026—the speculative bubble surrounding cryptocurrencies may completely burst.

Skepticism Beyond Burry

Burry isn’t alone in his skepticism regarding Bitcoin’s worth; Nassim Nicholas Taleb—the author behind The Black Swan—has consistently argued thatBitcoin’s value approaches zero. His reasoning hinges on what he terms “absorbing barrier” theory; he asserts that if there exists any likelihood—even minuscule—that an asset without dividend yield can drop down to nothingness then its current valuation should also reflect zero today.

Skeptics also highlight additional concerns:

- Regulatory Challenges: Governments might create barriers making it exceedingly difficult for individuals or businesses wishingto convert $BTC back into fiat currencies.

- Pace of Technological Change:If blockchain technology failsto scale effectively or if superior alternatives emerge onto themarketplace;

- Miner Struggles:If prices dip beneath production costs (estimatedaround$50kfor many minersin2026),the securityofthenetworkcouldbe compromised significantly;

Crisis or Resilience? Debating Zero Valuation Claims

A loud chorus advocates against considering any possibilityof crashingdown towardszero due largelyto decentralized network dynamics which ensure continued demand even amid institutional exits thanks tothe steadfast commitmentof core “HODLers”and users across emerging markets worldwide.

Additionally,the riseofthe hardware wallet sectorand self-custody movements serveas safeguards ensuringthat supply remains distributed rather than concentratedin centralized hands vulnerabletodeath spirals.As long asthereare individuals willingtopart withtheir$BTC for basic necessities like breador other forms currency,value will persist abovezero!

A Closing Thought: Are We Approaching Bottom?

Thecurrent sentiment within themarket reflects“extreme fear,”withthe Fear & Greed index hoveringaround15.DespiteBurrys’concernsregardinginstitutionalliquidations posing significant risks,Bitcoin hasweathered80%+drawdowns multiple times throughoutits history.Investors oughtto monitorcloselythe$68ksupportlevel whileconsidering utilizingtop-tiercrypto exchangesfor effective risk management strategies.