The recent decline in Bitcoin’s $BTC$77,317.26 price has altered the sentiment within the market, with speculation about further drops now as prevalent as bets on it surpassing $100,000.

This leading cryptocurrency has experienced a nearly 10% drop this week, hitting nine-month lows below $78,000 according to CoinDesk data. This price downturn has prompted traders to seek out put options—derivative contracts that provide protection against potential declines in Bitcoin prices—similar to how health insurance protects you when you’re unwell.

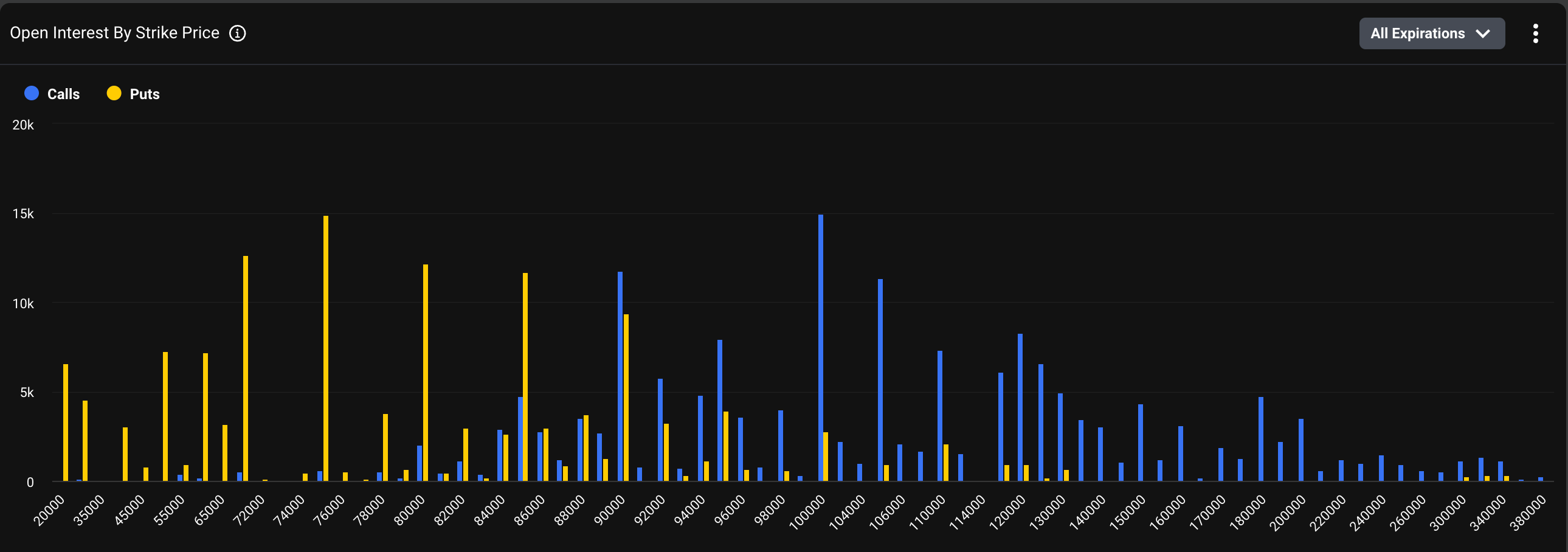

As a result of this trend, the dollar value of active Bitcoin put options contracts at the $75,000 level listed on Deribit is currently at $1.159 billion. This figure is almost equivalent to the notional open interest of $1.168 billion tied up in the $100,000 call option. Deribit holds its position as the largest crypto options exchange globally by both volume and open interest; one contract corresponds to 1 $BTC.

In essence, the popularity of the $75,000 put option—which bets that Bitcoin’s spot price will dip below this threshold—is now comparable to that of the previously favored $100,000 call option which anticipates a surge into six figures.

“There has been an enormous increase in put buying over the last 48 hours (sensitivity peaked), coinciding with $BTC‘s plunge from 88k down to 75k,” remarked an anonymous observer known as GravitySucks in a post on X.

Puts are seeing more activity than calls. (Deribit)

While interest remains high for puts at around $75K—the most sought-after bearish bet—there is also notable open interest for puts at strike prices of $70K, $80K and even up to $85K; however higher-strike calls (with exception for those at or above$100K) show less engagement.

This shift contrasts sharply with trends observed since Donald Trump’s election victory when higher-strike calls consistently attracted more attention than lower-strike puts. The previous bullish outlook likely stemmed from optimism regarding potential surges due to Trump’s campaign promises surrounding pro-crypto regulations.

Despite some fulfillment of these promises during Trump’s administration,

$BTC‘s rally ultimately fizzled out above $120k in early October and has been declining ever since.

In addition to macroeconomic pressures,

delays concerning legislation related to crypto market structure have likely added frustration among investors.