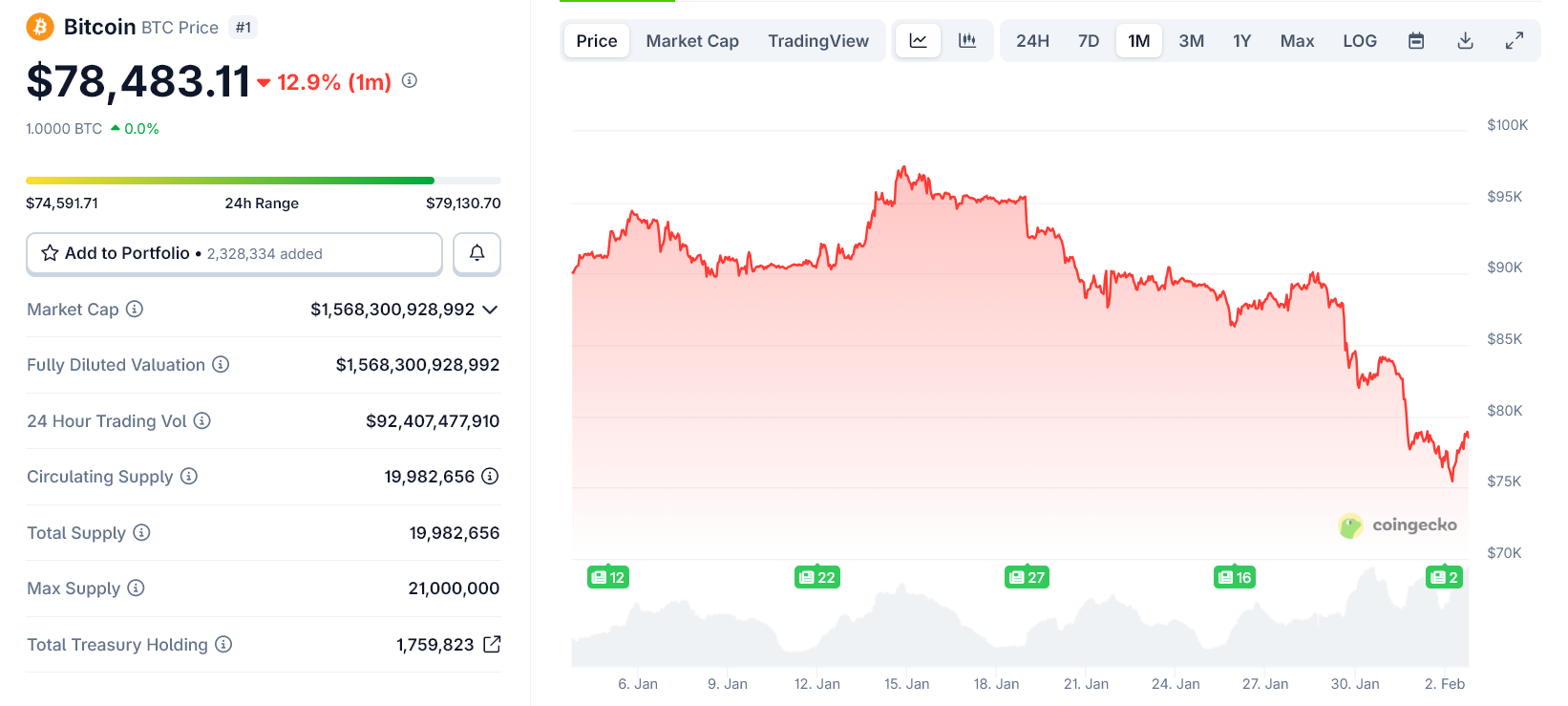

The recent decline in Bitcoin’s price goes beyond a mere technical pullback. It is nearing a critical threshold that directly impacts mining economics, thereby altering the overall market risk dynamics.

When Bitcoin approaches approximately $70,000, the market transitions from being dominated solely by traders to one where network fundamentals, miner actions, and forced liquidation risks become significant factors. This price point holds more importance than any conventional trendline or moving average at this moment.

Bitcoin Approaches a Critical Mining Pressure Zone

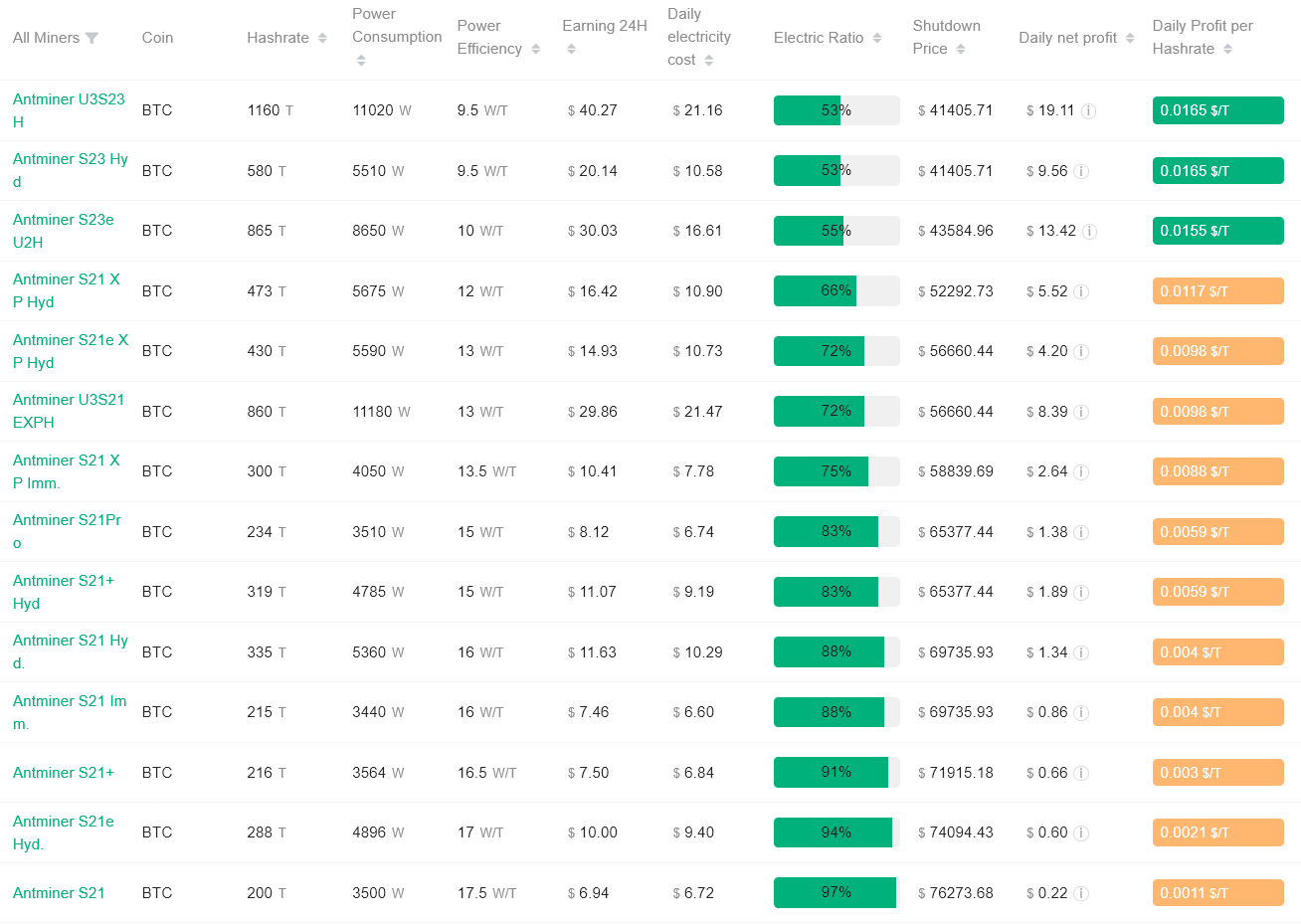

Given the current network difficulty and electricity costs averaging around $0.08 per kilowatt-hour, recent mining data reveals a distinct pressure range.

The shutdown prices for most Antminer S21-series devices—which account for a substantial portion of today’s global hash rate—cluster between $69,000 and $74,000 per Bitcoin.

Simply put, when prices fall below this band, many miners cease to generate operational profits.

The majority of Bitcoin miners have shutdown thresholds under $70K. Source: Antpool

Bitcoin frequently experiences price swings spanning thousands of dollars in either direction. What distinguishes this scenario is not the velocity of change but rather which participants face financial strain.

If prices remain above $70K, mining generally stays profitable across the board; however, dipping below forces only highly efficient miners to sustain operations while mid-tier players incur losses.

This dynamic exerts pressure not just on pricing but also on cash flow management and corporate balance sheets — ultimately influencing miner behavior significantly.

A Shutdown Price Does Not Guarantee Market Support

It is crucial to clarify that a shutdown price should not be mistaken as an assured support level for Bitcoin’s value. Miners lack control over market pricing; hence it is possible for prices to trade beneath breakeven points over extended durations without immediate mine closures triggering rebounds.

Nonetheless, these shutdown zones signify behavioral shifts among miners—and such changes often drive market movements during periods of stress or uncertainty.

Bitcoin Price Trends Over The Last Month. Source: CoinGecko

The Consequences If Bitcoin Drops Below $70K

A brief dip under $70K followed by rapid recovery would likely cause minimal disruption; however sustained trading beneath this mark triggers cascading effects:

- Lesser-capitalized miners may liquidate BTC holdings just to cover operational expenses like electricity bills and hosting fees;

- Certain operators might power down rigs altogether leading to reduced hash rates;

- Pessimism could intensify as media narratives shift focus from mere volatility toward “mining distress.”

No single factor alone spells disaster—but combined they can exacerbate downward momentum considerably.

Mining-related stress becomes particularly perilous when coupled with liquidity shortages.

Currently,

- Tightened global liquidity conditions;

- Diminished risk appetite;

- Sizable ETF outflows alongside derivatives liquidations.

Should forced selling triggered by mining pressures coincide with these elements simultaneously,the resulting sell-off could outpace what fundamental analysis would predict.

Such sharp & disorderly declines don’t indicate failure within Bitcoin itself,but rather reflect convergence among multiple adverse factors at once.

This article originally appeared on BeInCrypto titled “Major Bitcoin Miners Face Shutdown Risk If $BTC Falls Below $70,000″.

</P