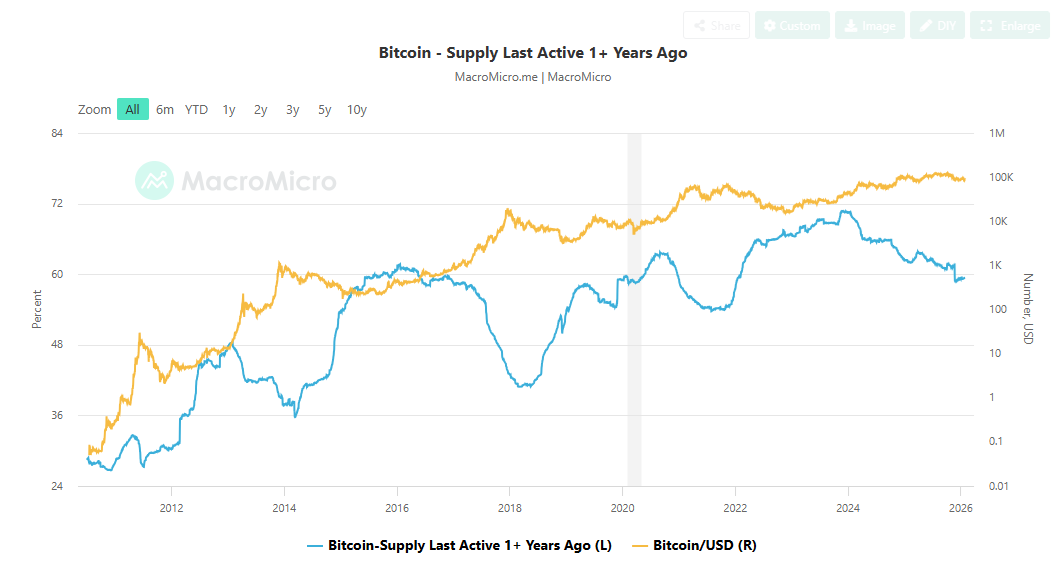

The proportion of lost $BTC might be lower than earlier estimates suggested. Reactivation of older wallets has prompted a reassessment of the quantity of coins once thought to be permanently inaccessible.

Bitcoin previously deemed lost has resurfaced after extended periods, with 2025 marking a significant year for shifts originating from aged wallets. Various factors contribute to this phenomenon, including liquidation events and wallet reorganizations. A notable catalyst was Bitcoin surpassing the $100,000 threshold, motivating even casual investors to retain potentially life-altering sums.

The surge in $BTC prices reaching new record highs triggered activity from diverse sources such as legacy miner wallets and Casascius physical coins. Analysis based on HODL waves indicates that coins transitioned primarily from wallets aged between three and five years into those held for seven to ten years.

Recovery of Previously Lost Bitcoins by Veteran Holders

As tracking methods improved and more wallets were identified, indications of irretrievably lost bitcoins diminished. Several cold storage addresses relocated their holdings due to custody changes or consolidation efforts into newer address formats.

Additional supplies emerged from forgotten or abandoned multisignature wallets, custodial accounts, estates resulting from inheritance processes, early miners’ reserves, original whales (large holders), former exchange founders, and other pioneers in the ecosystem.

A security-related factor prompting coin movements involved dust attacks accompanied by messages challenging proof-of-ownership claims. Although these attacks cannot seize funds directly from dormant addresses, some owners transferred assets to fresh addresses offering enhanced privacy protections against both cyber threats and physical risks associated with transparent public keys.

This reactivation excludes still-frozen assets like those linked to Mount Gox victims whose bitcoins remain under liquidator control awaiting resolution.

An Increasing Share Moves Into Older Holding Categories

A landmark year saw distribution activities involving over 3.4 million $BTC, which had been idle for more than ten years — encompassing early mining rewards including blocks mined by Satoshi Nakamoto himself that remain untouched today.

Total dormant supply since 2020 stands at approximately 6.2 million bitcoins representing relatively recent buyers who continue holding their positions long-term. Older cohorts occasionally show movement patterns tracked across various wallet clusters; however newer participants tend toward active trading strategies rather than prolonged holding through market downturns.

The resurgence in coin activity is not attributed directly to ETF demand—which primarily utilizes OTC desks and specialized exchanges—according to analyst Joao Wedson at Alphractal Research.

Throughout recent market cycles veteran whales have quietly redistributed holdings without showing signs typical of capitulation events; some older reserves may have contributed towards institutional treasury formations within crypto entities.

This trend highlights considerations about Bitcoin’s price resilience over time: while some holders faced losses after peaks were surpassed by subsequent declines, long-term owners—especially those reclaiming previously presumed lost coins—likely experienced reduced overall downside impact relative to short-term traders.