According to Deribit, a derivatives exchange, the substantial volumes of Bitcoin options suggest that there remains considerable interest and investment in the crypto derivatives sector. However, it appears that traders are now exercising caution in managing their risks, which may clarify the recent fluctuations in Bitcoin’s price.

The current trading scenario for Bitcoin hovering around $90,000 becomes much clearer when analyzed through market positioning rather than merely focusing on price movements. This insight was shared by the Coinbase-affiliated derivatives platform on Wednesday.

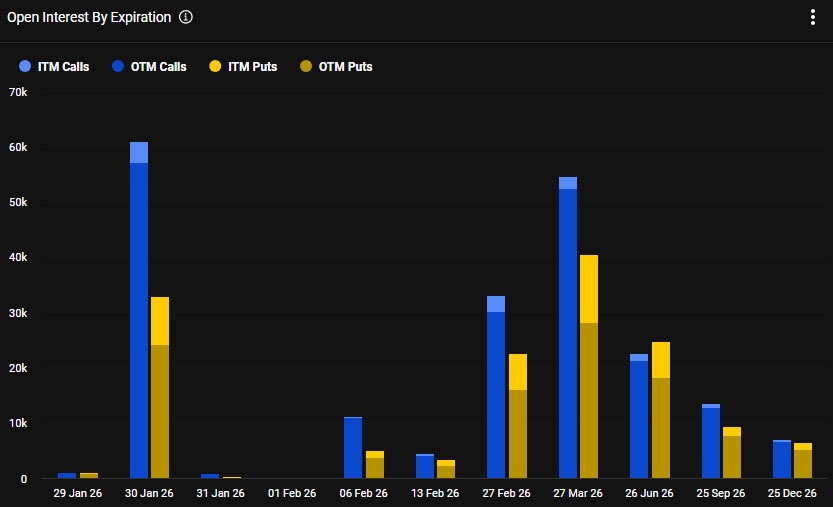

Bitcoin (BTC) seems to be experiencing stagnation due to a high concentration of open interest (OI) surrounding specific strike prices ahead of the significant expiry date on January 30th.

This indicates that a large portion of market exposure is being managed through options instead of outright leveraged futures contracts.

“Traders are active but are employing hedges and structured trades rather than relying solely on directional leverage.”

Since mid-November, Bitcoin has been fluctuating within a defined range between approximately $85,000 as support and $95,000 as resistance.

Capital is available; however, risk management prevails

Deribit noted that elevated options volume for imminent expirations—especially puts—implies that traders are taking steps to manage their risks effectively. As such, price changes have become more responsive to hedging activities than external events or news releases.

“Price rallies might encounter selling pressure from those reducing risk exposure while declines could attract buyers adjusting their positions,” they remarked. “Consequently, momentum must exert greater effort to gain traction.”

“The key takeaway here isn’t an absence of interest; capital is indeed present. Instead, risk is being managed with increased precision and short-term pricing dynamics are influenced significantly by positioning strategies alongside new developments.”

The total open interest for Bitcoin options currently stands at approximately $38.7 billion and has been steadily increasing throughout this month according to CoinGlass data.

A significant month-end expiry for Bitcoin options approaches

This upcoming Friday will witness an end-of-month expiry for Bitcoin options valued at around $8.4 billion based on notional value estimates provided by Deribit.

The put/call ratio sits at 0.54 indicating nearly double the number of long contracts compared to shorts set to expire soon. The max pain point—the level where most contracts will conclude with losses—is currently pegged at $90,000 while open interest remains heavily focused around the $100K strike price.

Bitcoin options OI by expiration source: Deribit