Bitcoin’s recent recovery has shown signs of weakness. After dropping to around $85,970, the cryptocurrency managed only a modest 4% increase before hitting resistance near $89,380. This price movement occurred despite new developments in ETF news and indications of technical improvement.

The main challenge lies in timing. Optimism for interest rate cuts is nearly nonexistent ahead of the Federal Reserve’s upcoming announcement, with broader economic caution overshadowing short-term bullish indicators. Bitcoin remains mostly flat across various timeframes as traders await a definitive catalyst.

Momentum Fizzles Despite Divergence as Rate-Cut Sentiment Damps ETF Excitement

Examining the daily chart reveals that Bitcoin exhibited a hidden bullish divergence between December 18 and January 25: while prices formed higher lows, the Relative Strength Index (RSI) registered lower lows.

The RSI gauges momentum strength; when it declines but prices hold steady or rise, it often signals an impending rebound. Although this indicator did trigger a bounce for Bitcoin, gains were limited to roughly 4%, stalling near $89,380 before sellers regained control.

If you want more insights like these from crypto experts such as Editor Harsh Notariya’s Daily Crypto Newsletter, consider subscribing.

This subdued response is significant because during January 25–26 ETF enthusiasm increased following BlackRock’s submission for a Bitcoin premium-income ETF—news that typically fuels extended rallies but failed to do so this time around.

BlackRock just dropped the official S-1 for its upcoming iShares Bitcoin Premium Income ETF… no fee or ticker yet. The strategy aims to “track performance of bitcoin price while generating premium income through actively managed call option writing…” pic.twitter.com/CZDahm4mNj

— Eric Balchunas (@EricBalchunas) January 26, 2026

The missing factor here is macroeconomic backing. Polymarket currently indicates a 99% chance that rates will remain unchanged at the next Federal Open Market Committee meeting. Without expectations of rate cuts boosting liquidity conditions are tight; thus even positive technical signals struggle to gain traction.

In essence: although RSI suggested room for upward movement in $BTC, prevailing skepticism about rate reductions shut down further advances quickly.

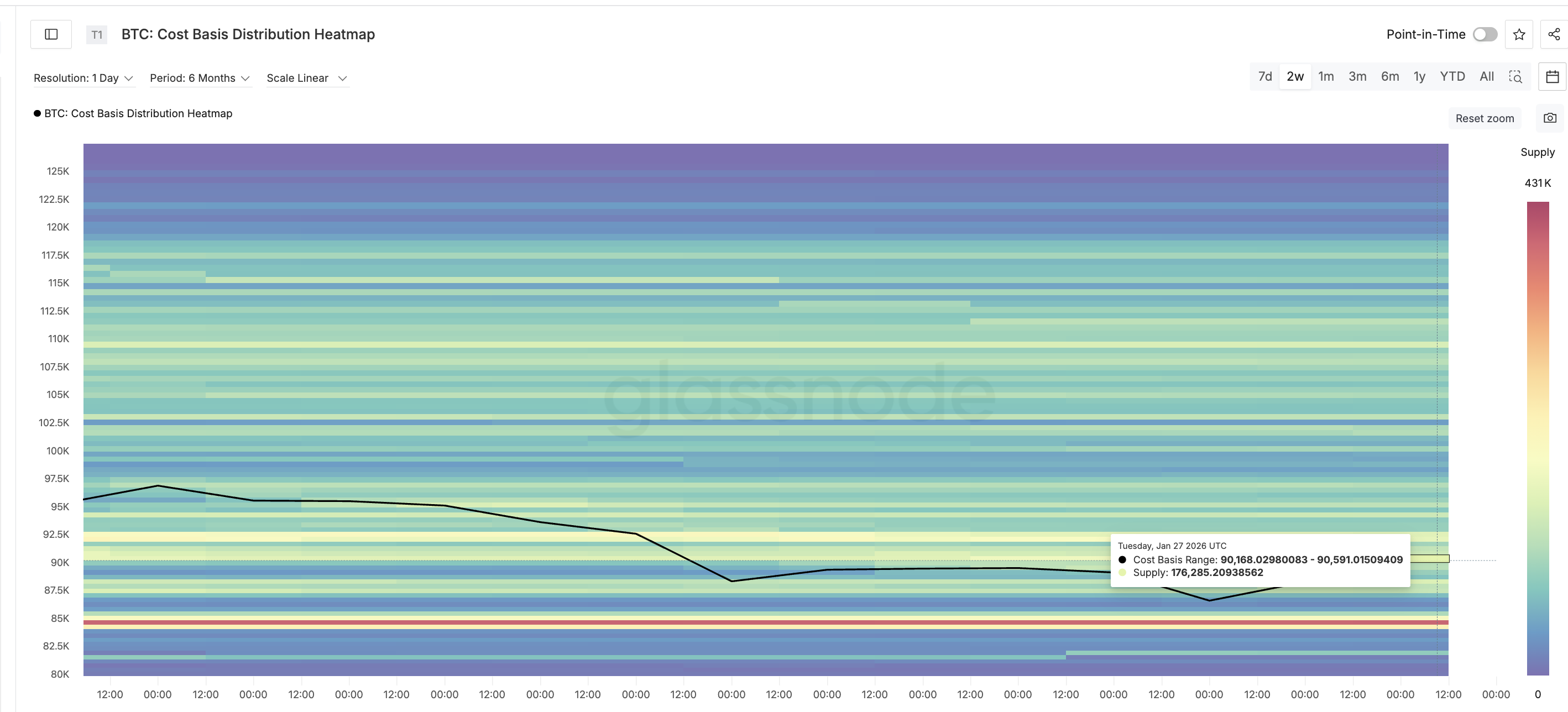

Quiet Accumulation by Large Holders Highlights Key Price Battle Zones Based on Cost Basis Data

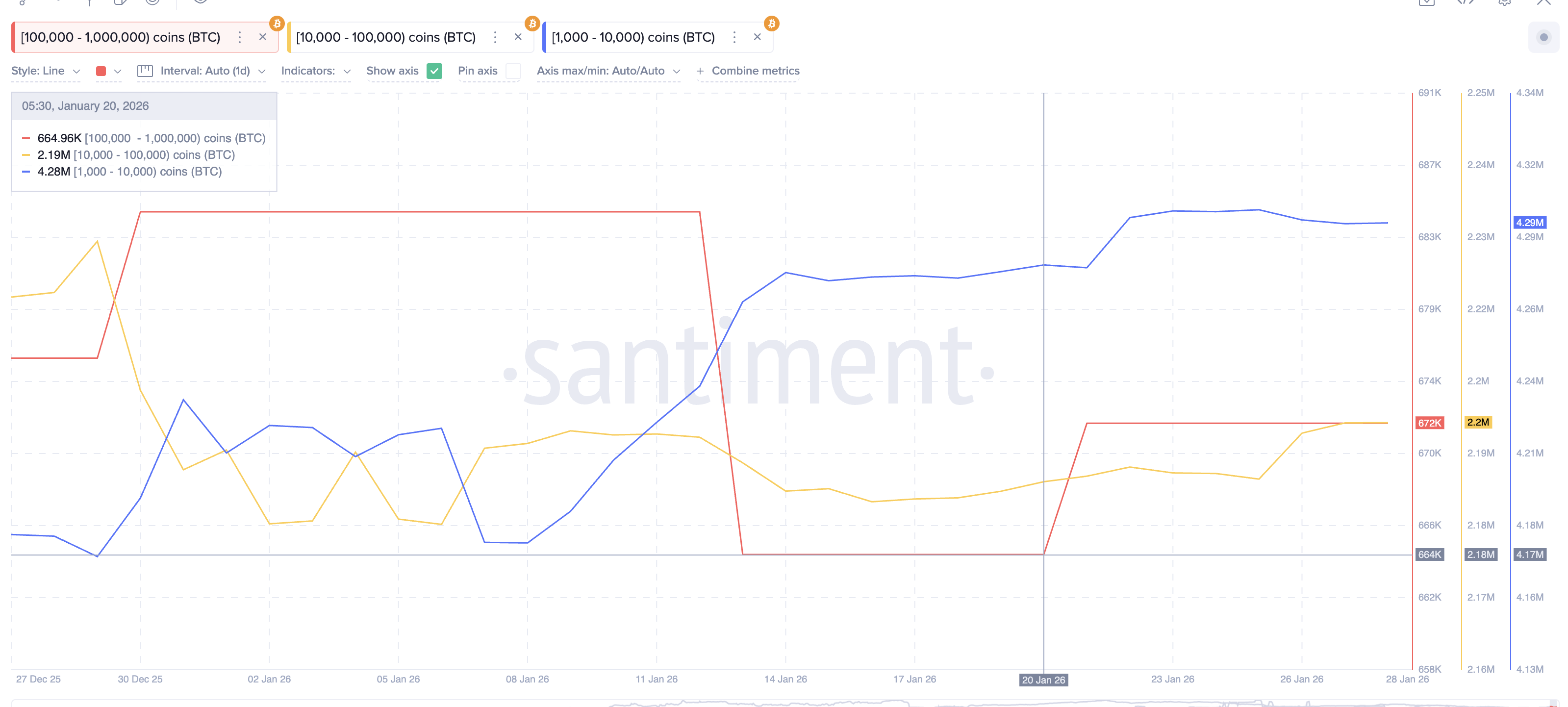

While price action appears lackluster on surface charts, substantial holders are quietly increasing their stakes in Bitcoin.

Wallets holding between 1,000 and 10,000 $BTC, often considered smaller whales, bumped their balances slightly from approximately 4.28 million to 4.29 million coins since January 21.

Larger holders owning between 10k–100k $BTC$ went up from about 2.19 million coins to roughly 2.20 million.

The biggest segment — wallets with holdings ranging from 100k up to one million BTC — saw more aggressive accumulation, rising from around 664k BTC toward approximately 672k BTC — on or before Jan. – a total addition close to ~18K BTC valued near $1..6B$…