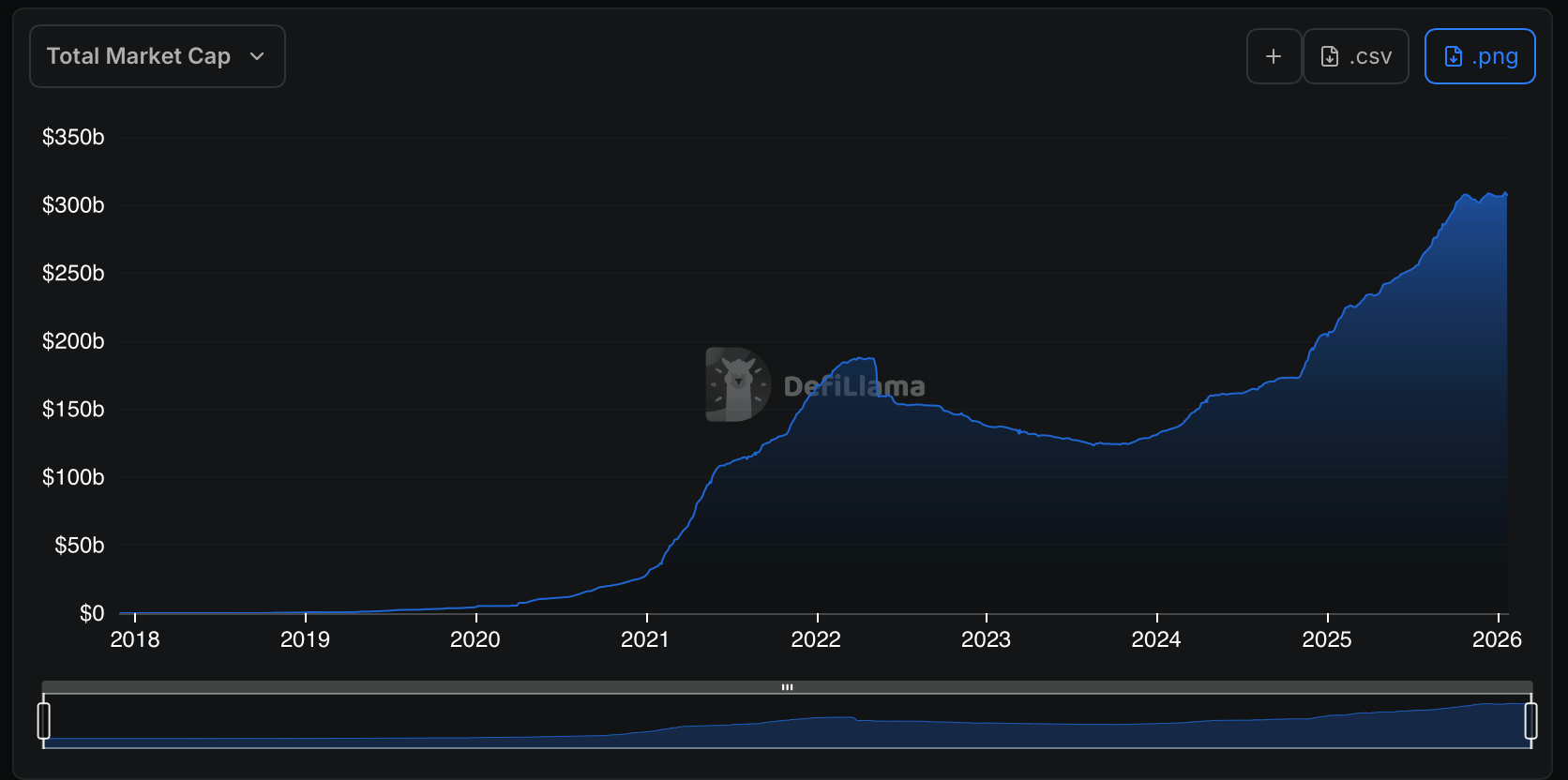

Seven days after the stablecoin sector printed a record $310.426 billion on Jan. 17, the market has given back $3.327 billion—proof that even “stable” capital has a sense of timing.

Post-Peak Pause: Stablecoins Step Back

Starting with the heavyweight contender, tether ( USDT) sits at roughly $186.59 billion in market cap and posted zero activity over the past seven days—in terms of reductions or issuance. USDT currently captures 60.76% of the entire stablecoin economy’s net value this weekend. The stability at the top matters because USDT remains the sector’s liquidity spine, even as the broader category trims size.

Right behind it, defillama.com stats show Circle’s USDC moved the other way, shedding 5.44% on the week to about $72.90 billion. That 5.44% loss equated to a $4.19 billion outflow. USDC’s slide did more of the heavy lifting in the sector’s net contraction than any other single asset, reminding traders that redemption flows still matter.

As of Saturday, the stablecoin sector stands at $307.099 billion after seeing a $3.327 billion reduction between Jan. 17 to Jan. 24, 2026.

Elsewhere, synthetic and yield-linked dollars leaned more upbeat. Ethena’s USDe gained 1.51% to $6.57 billion, Sky’s USDS rose 0.78% to $6.25 billion, while Sky’s dai (DAI) dipped 1.21% to $4.62 billion—a mixed tape rather than a clean trend.

The mid-tier brought the fireworks. World Liberty Financial’s USD1 jumped 22.34% to $4.29 billion outpacing Paypal’s stablecoin contender. Paypal’s PYUSD still managed to add 1.07% to $3.73 billion, and Falcon Finance’s USDf edged 0.26% higher to coast along at $2.06 billion.

Smaller lines also pushed forward. Global dollar, also known as USDG, climbed 2.46% to $1.52 billion, Ripple stablecoin RLUSD rose 0.71% to $1.42 billion, and Blackrock‘s U.S. Treasury-backed stablecoin token BUIDL was essentially unchanged, up 0.02% at $1.27 billion.

Also read: Support Holding, But for How Long? Bitcoin’s Showdown at $89K

The standout gainer out of the top 12 this week was Ondo us dollar yield token (USDY), which popped 46.54% to roughly $1.25 billion, highlighting continued appetite for yield-bearing structures tied to tokenized Treasurys and onchain credit.

Putting the week’s fiat-pegged token numbers together, the data paints a simple picture: after tagging a historic high, stablecoins didn’t unravel—they simply rebalanced. Capital rotated between cash-like safety, yield wrappers, and issuer ecosystems, leaving the total slightly leaner but far from fragile.

FAQ ⏰

Why did stablecoins fall after the Jan. 17 peak?Redemptions in larger coins, especially USDC, outweighed gains elsewhere.

Which stablecoin holds the largest market cap now?Tether ( USDT) leads with about $186.6 billion.

Which stablecoin gained the most this week?Ondo US Dollar Yield rose about 46.5% in seven days.

Is the stablecoin market still growing long term?Yes, despite the weekly dip, supply remains near record levels.