Bitcoin’s recent price movements have resembled a dramatic saga, plunging sharply from its impressive peak near $97,939 down to a tentative touch around $88,665 before stabilizing close to $89,396. Despite the volatility, the market seems to be settling into a tight trading range as it gathers momentum for what could be its next significant move. Whether this signals an upcoming rally or a pause remains uncertain.

Bitcoin Price Analysis

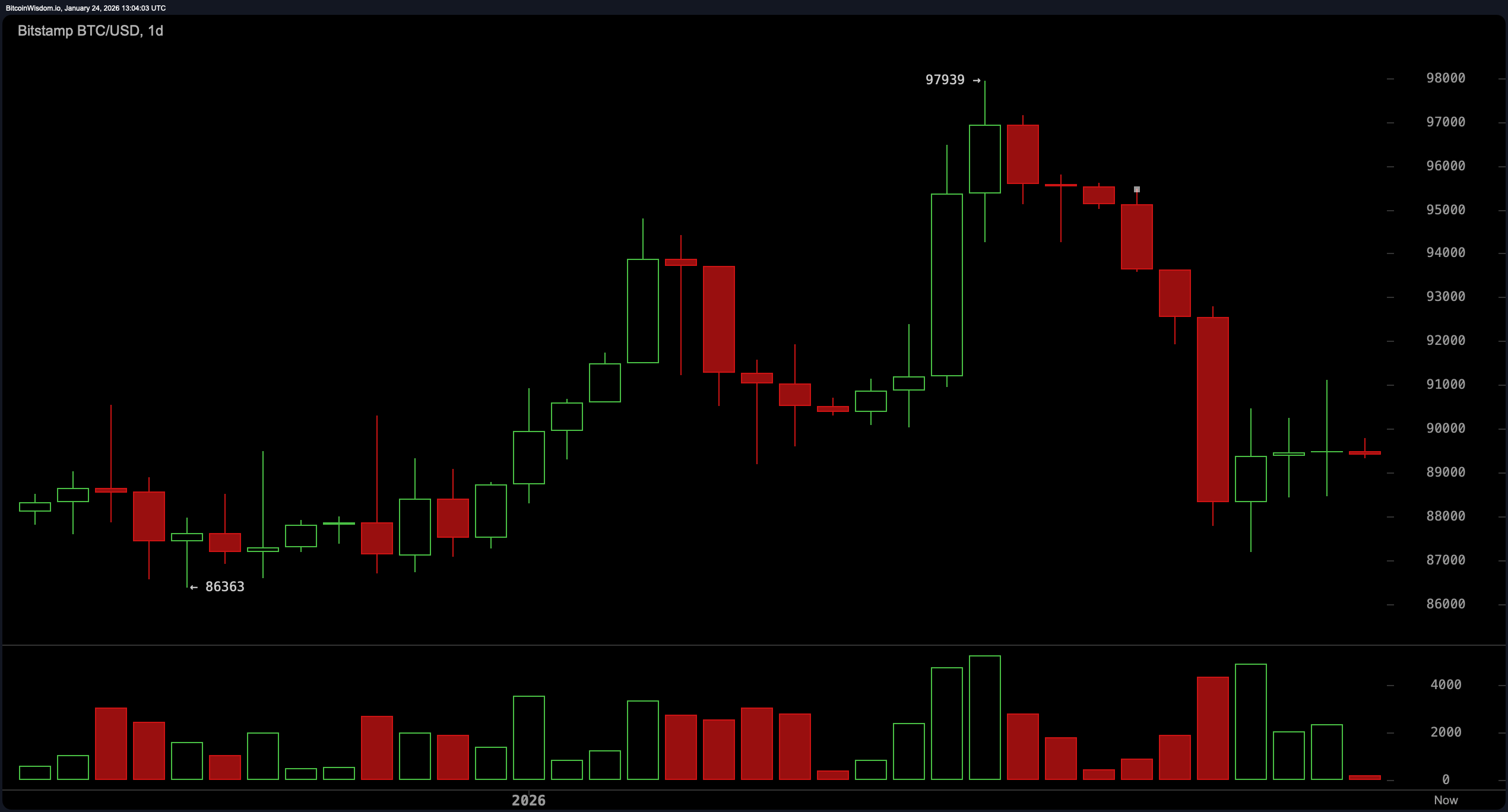

Examining the daily chart reveals Bitcoin recovering after a steep decline from almost $98,000 to roughly $86,000. The volume patterns reflected intense selling pressure akin to panic during an emergency evacuation. Yet there is some optimism as prices have rebounded into the $89,000–$90,000 area and may be forming the foundation for future gains.

The candlestick formations indicate hesitation with narrow price fluctuations—like investors collectively holding their breath. Support levels are identified between $86,000 and $88,000; meanwhile breaking above the short-term resistance at about $91,000 could excite bullish traders. However,the more critical challenge lies in overcoming resistance near the $94,000–$95,000 range.

The 4-hour chart echoes cautious optimism: Bitcoin appears to be consolidating quietly after falling from approximately $95,480 down to around $87,193. Trading has shifted sideways with low volume and tight candle ranges. A slight uptick in activity observed on January 23–24 hints at renewed interest but lacks decisive momentum so far. Watching for a confirmed breakout above roughly $90,500 is key—it might open doors for short-term upward movement if accompanied by increased volume.

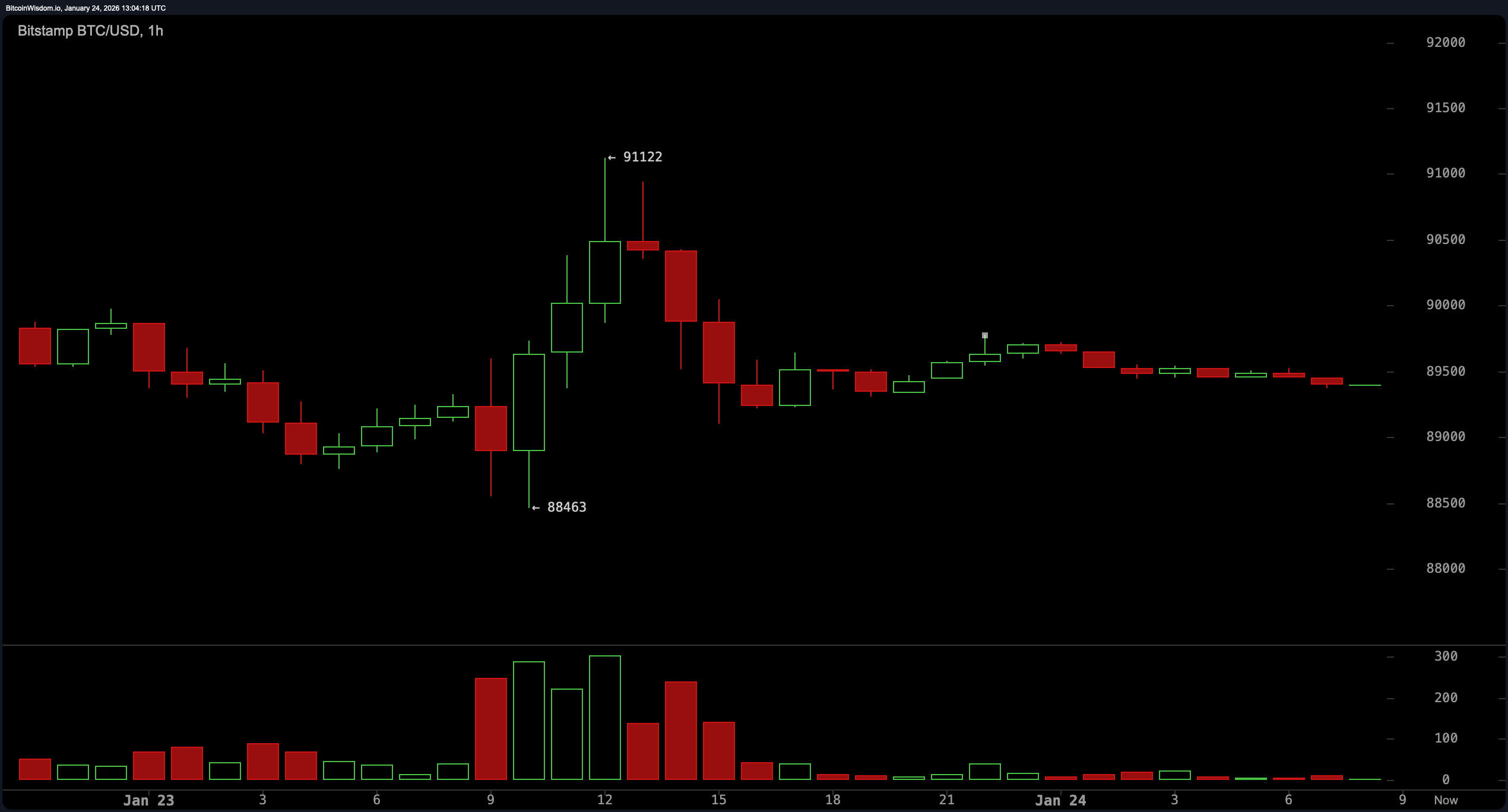

On an hourly scale,the market shows more jitteriness as Bitcoin oscillates between about $88,500 and just over $91,000&period The emergence of higher lows suggests a minor uptrend but rejection near $91,122 dampens enthusiasm&period Volume remains weak indicating limited risk appetite&period A clean break above $&;#x5B;͛�]&�s crucial;a surge supported by solid volume could push prices toward $$91&comma500-$92&comma00 zone&period Until then, short-term traders may watch dips toward support at $$88&comma500 carefully for entry opportunities provided that support holds steady&period

Technical indicators are currently neutral or slightly bearish. The Relative Strength Index (RSI) stands at 43, showing no clear directional bias. The stochastic oscillator rests calmly around 21 while the Commodity Channel Index (CCI) lingers near -84 — all signaling indecision. However, momentum readings paint a gloomier picture: with values like -7546 on one indicator and MACD sitting at -146, there is subtle bearish pressure present. In essence, the indicators suggest caution akin to an animal cautiously inspecting unfamiliar surroundings.

Moving averages reinforce this bearish sentiment—all major exponential moving averages (EMAs) and simple moving averages (SMAs), ranging from short term (10-period) through long term (200-period), lie well above current price levels creating strong overhead resistance. For example, the 10-EMA hovers near 90&comma867 while the longer-term SMA sits much higher around 105&,248 — far beyond today’s trading level.

This cluster of resistances means Bitcoin must overcome significant hurdles before any sustained upward trend can take hold.

Until prices rise convincingly past these averages,

bullish momentum will remain speculative rather than assured.

To summarize: Bitcoin currently rests on important support zones while technical tools signal mixed feelings.

Charts portray markets pausing amid fading momentum yet leaving room open for potential breakouts.

Here patience isn’t just advisable—it’s essential as traders await clearer direction ahead.

Bullish Perspective:

If Bitcoin manages to break decisively over $91&,00 backed by robust trading volumes,

it could spark renewed buying interest pushing prices back toward

(approximately)&$94&,00-&$95&,00 territory within short timeframes.

Though oscillators remain neutral overall,

price action hints that rebounds off established supports are possible

,and bulls might gain confidence should key resistances weaken under pressure.

Bearish Outlook:

With all primary moving averages stacked firmly overhead coupled with negative momentum signals,

downward trends appear favored presently.

Declining volumes alongside unsuccessful breakout attempts underscore hesitancy among buyers .

Unless BTC breaks through these barriers strongly , bears likely maintain control over market direction .

Frequently Asked Questions ❓

What is bitcoin’s current price? –>& nbsp ; As of January 24 ,2026 , BTC trades close nbsp ;to USD89 ,396 .

Where does bitcoin find support ? –& gt ; Critical zones lie between USD86 ,ooo-& nbsp ;USD88 ,ooo .

Which levels act as resistance ? –-& gt ; Key ceilings exist around USD91 oo o plus broader zone spanning USD94 oo o –USD95 oo o .

Is bitcoin trending upwards or downwards now ? –-& gt ; Current charts reveal weak recovery attempts countered by downward pressures signaled via moving average clusters .