Bitcoin (BTC) no longer offers rewards that justify its extreme price fluctuations.

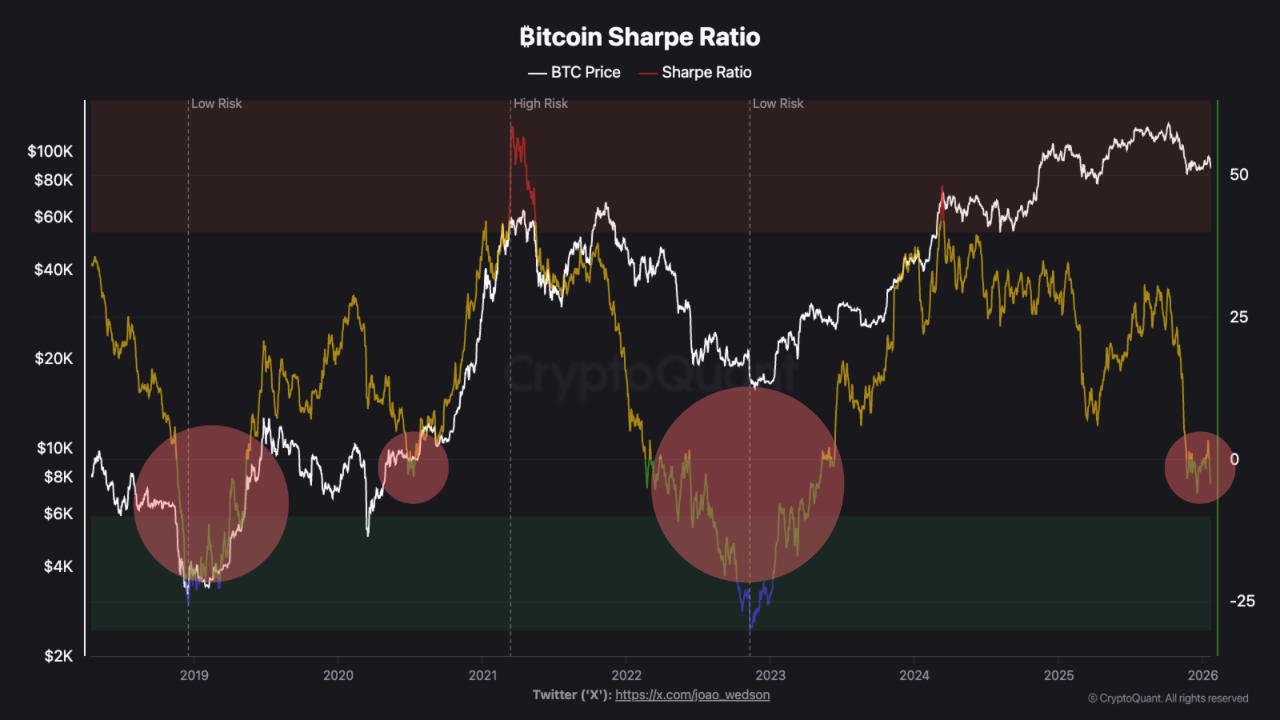

This conclusion is drawn from Bitcoin’s Sharpe Ratio, a metric widely used by fund managers to evaluate whether the additional returns of an investment—beyond safer options like U.S. Treasury bills—adequately compensate for its volatility risk.

According to data from CryptoQuant, Bitcoin’s Sharpe Ratio has dipped into negative territory. This suggests that the gains are insufficient to offset the wild intraday swings and inconsistent recoveries investors have experienced. Although prices have dropped significantly from recent peaks, volatility remains high, squeezing risk-adjusted returns.

This development coincides with Bitcoin retreating back toward $90,000 after reaching record highs above $120,000 in early October.

Similar negative Sharpe Ratio readings were observed during previous bear market lows. Consequently, some social media commentators interpret this latest dip as a potential signal that Bitcoin’s downtrend might be ending and a new bullish phase could be on the horizon.

However, a negative Sharpe Ratio does not guarantee an imminent upward trend. The ratio measures current risk-adjusted performance rather than predicting future price movements.

An analyst at CryptoQuant explained in a blog post: “The Sharpe Ratio doesn’t precisely pinpoint market bottoms but indicates when risk-reward dynamics reset to levels historically preceding major moves. We’re currently oversold—a condition that creates opportunity by lowering long-term positioning risks—not because prices can’t fall further but because the adjusted risk profile favors entry.”

(CryptoQuant)

Back in late 2018, this ratio remained negative for several months while prices stayed depressed. A comparable scenario unfolded throughout 2022 amid an extended bear market caused by leverage failures and forced liquidations.

This means that even after sharp declines subside, unfavorable Sharpe Ratios can persist for quite some time.

Traders often focus on how this metric behaves following prolonged weakness; sustained movement back into positive territory typically signals improving conditions where returns begin outstripping volatility—a pattern historically linked with renewed bull markets.

At present though, there is little evidence of fresh bullish momentum for Bitcoin. The cryptocurrency hovers near $90,000 as it closes out a week marked by erratic swings and underperformance relative to gold bullion, bonds, and global tech stocks alike.

Bitcoin (BTC) no longer offers rewards that justify its extreme price fluctuations.

This conclusion is drawn from Bitcoin’s Sharpe Ratio, a metric widely used by fund managers to evaluate whether the additional returns of an investment—beyond safer options like U.S. Treasury bills—adequately compensate for its volatility risk.

According to data from CryptoQuant, Bitcoin’s Sharpe Ratio has dipped into negative territory. This suggests that the gains are insufficient to offset the wild intraday swings and inconsistent recoveries investors have experienced.

…</html