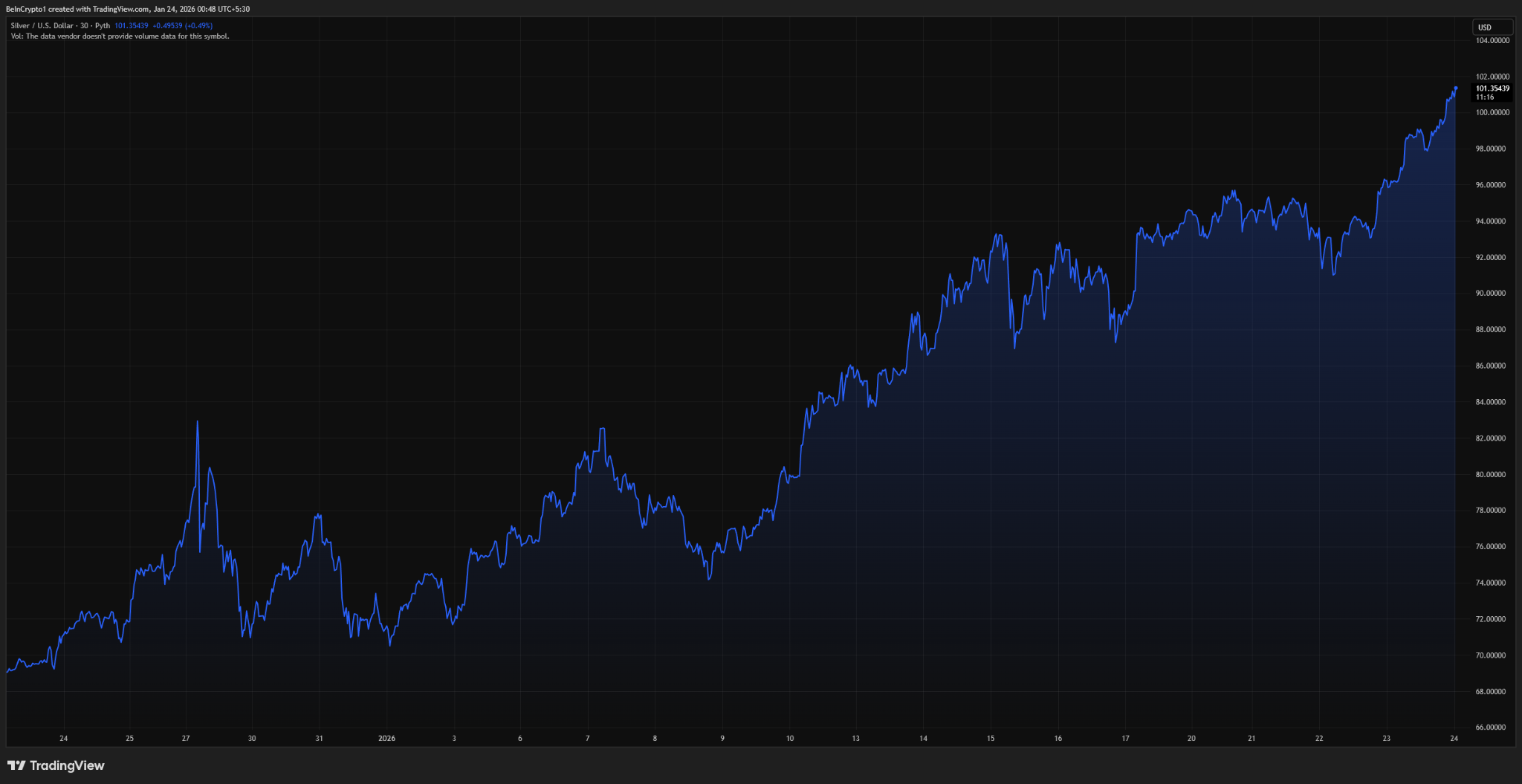

Today, silver reached an unprecedented peak of $101, marking a historic milestone. This upward momentum has been steadily growing over several months and intensified significantly in January 2026. Currently, silver outperforms gold as the top asset amid today’s complex economic landscape.

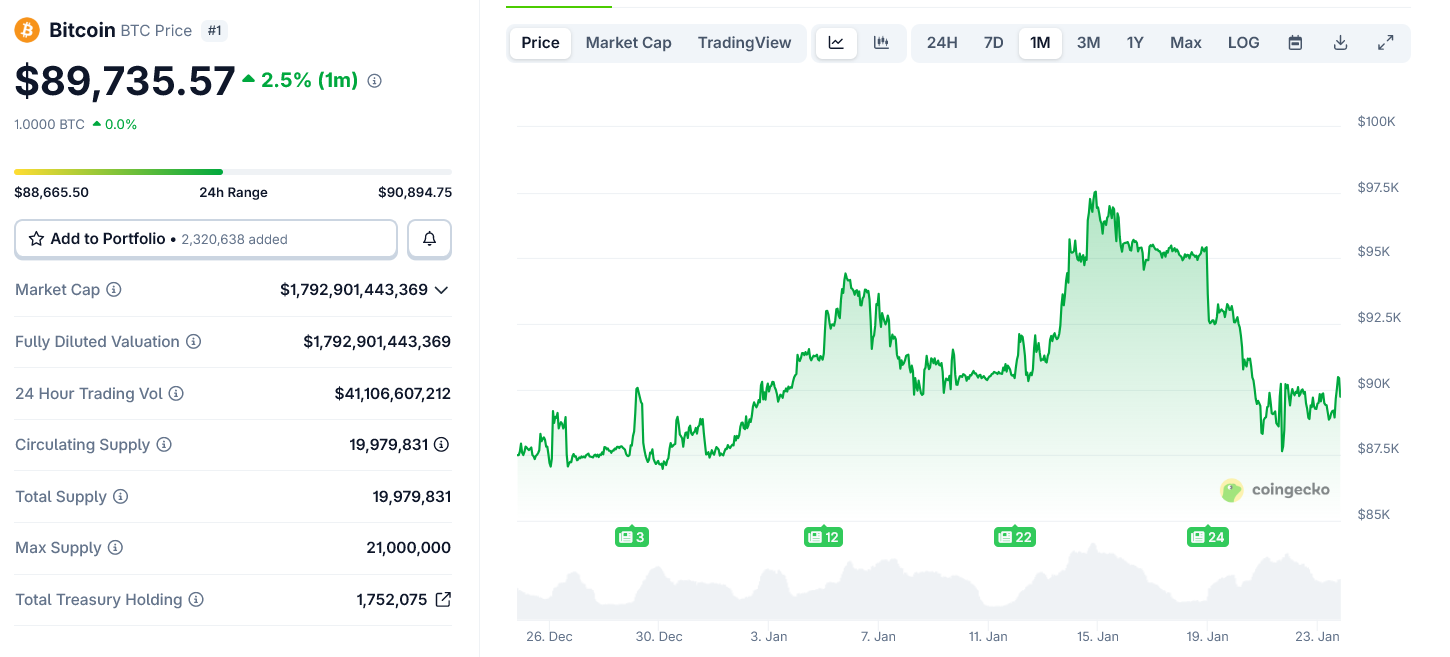

In contrast, Bitcoin has yet to mirror this surge. This divergence prompts an important inquiry for cryptocurrency enthusiasts: what insights does silver’s breakout provide regarding Bitcoin’s potential trajectory?

The Drivers Behind Silver’s Surge

The recent spike in silver prices is not merely speculative; it signifies a broader reallocation of global capital amidst increasing uncertainty.

1. Prevailing Risk-Off Sentiment

Investors have increasingly sought refuge in defensive assets over recent months, especially throughout January.

- Heightened geopolitical conflicts including ongoing trade tensions and unresolved crises in Eastern Europe and the Middle East;

- Concerns about the sustainability of US fiscal policies coupled with rising national debt;

- Anxiety surrounding tariffs and fragmentation within global trade networks.

This environment typically drives capital towards tangible assets deemed reliable stores of value—historically dominated by gold and silver. Silver’s record-breaking price reflects this flight to safety.

2. Declining Real Interest Rates Bolster Precious Metals

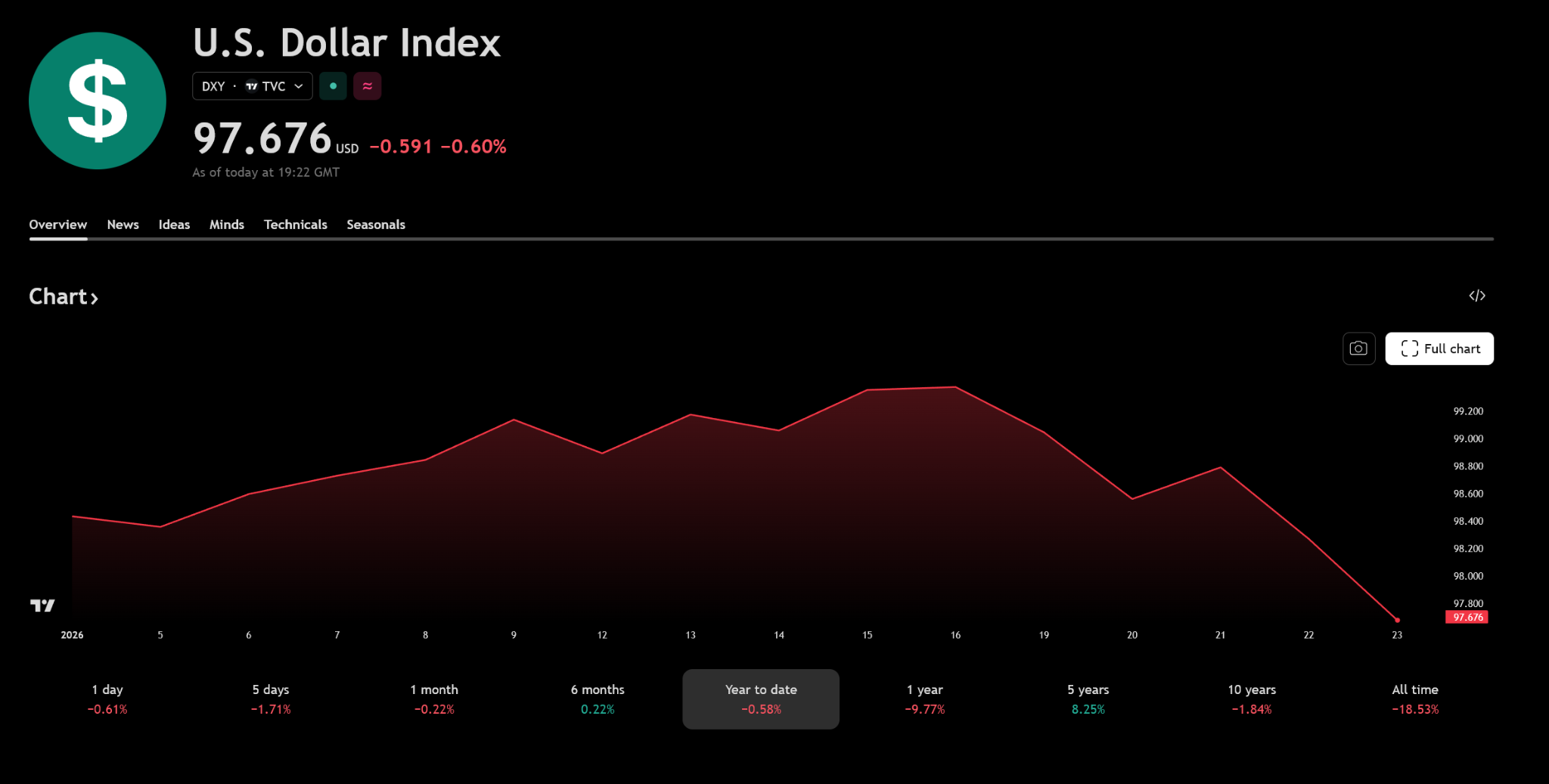

The market anticipates multiple interest rate reductions by the US Federal Reserve later this year, which depresses real yields and weakens the US dollar.

This scenario benefits precious metals substantially since they do not generate yield; lower real rates diminish holding costs for investors. Additionally, a softer dollar makes these metals more affordable internationally—an influential factor behind silver’s strong performance this month.

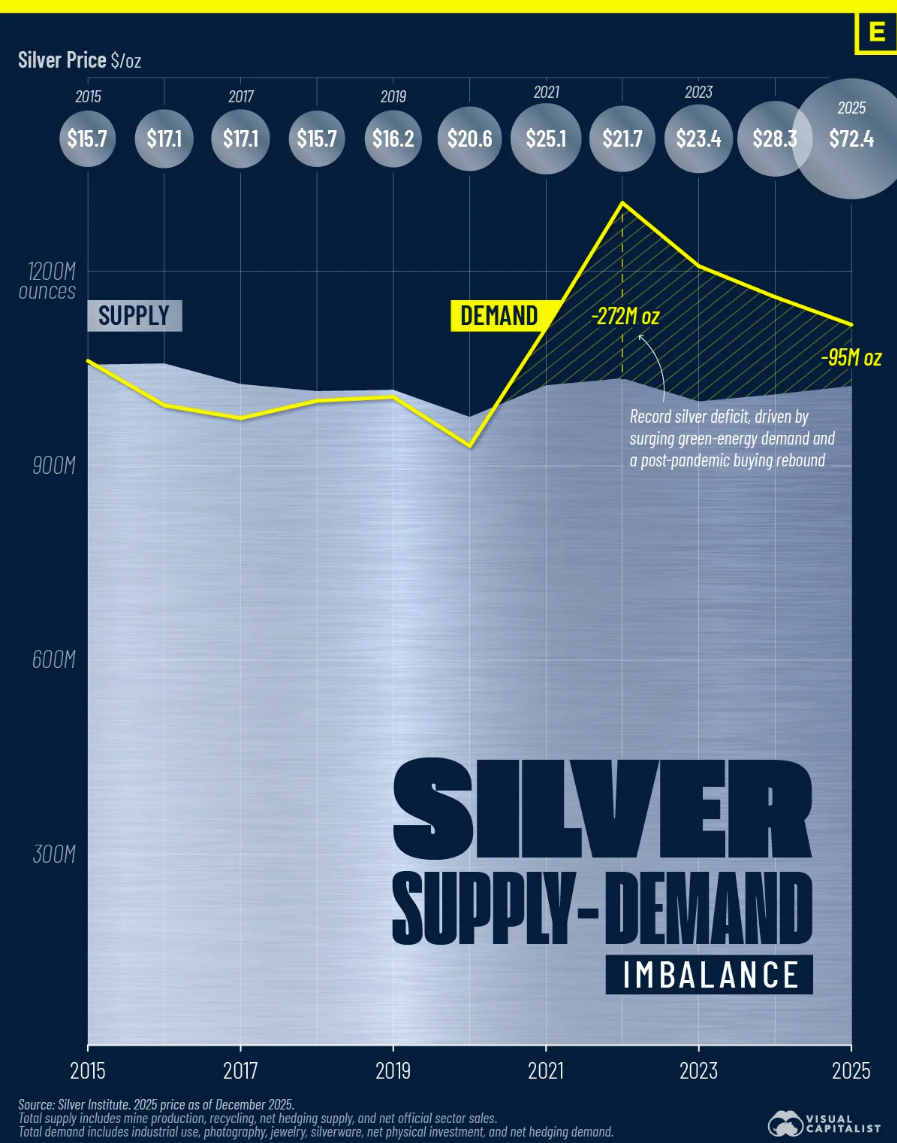

3. Structural Supply Constraints Amplify Price Pressure

Differing from gold, silver faces genuine supply limitations due to its nature as mostly a secondary product derived from mining other metals—restricting production flexibility during rising demand periods.

The United States recently classified silver as a critical mineral leading to strategic stockpile accumulation that tightens available inventories further. As demand escalates without matching supply growth, prices accelerate upward rapidly.

4. Industrial Demand Adds Strategic Importance

The metal plays an essential role in advancing clean energy technologies such as solar panels, electric vehicles batteries systems power grids data centers plus sophisticated electronics components making it both safe haven asset & strategic commodity simultaneously reinforcing its appeal amid global focus on energy security & infrastructure resilience .

Beneath The Surface: Why Bitcoin Hasn’t Matched Silver’s Rally Yet

#Bitcoin’s correl to ‘Silver <span class="ticker" href="https://cryptonews.net/market-cap/bitcoin/" target="_blank"$BTC amp#39;s córrelatío&n t&o $XAG but with a slight lag on the macro.&#46;&#128&lt;br&#60;br&#62Silver have seen a massive price increase as of lately.

<br/>This means that we could see <s pan class="e;ticker"e;} href="e https://cryptonews.net/market-cap/bitcoin/ "e target=&qu ot _blank "e} BTC</s pan> appreciate following this particular move up.&#128293;(NFA) pic.twitter.com/XQQ66BrWSg

— Bitcoinsensus (@Bitcoinsensus) December 26, 2025