After a vigorous rally, Bitcoin’s engines are now cooling down. As of January 20, 2026, the leading cryptocurrency is trading between $90,902 and $91,106 within the last hour. It boasts a market cap of $1.82 trillion and a trading volume of $39.69 billion over the past day. Having fluctuated between $90,599 and $93,301 today, it appears that bullish traders are taking a breather while bearish sentiments linger nearby.

Bitcoin Price Analysis

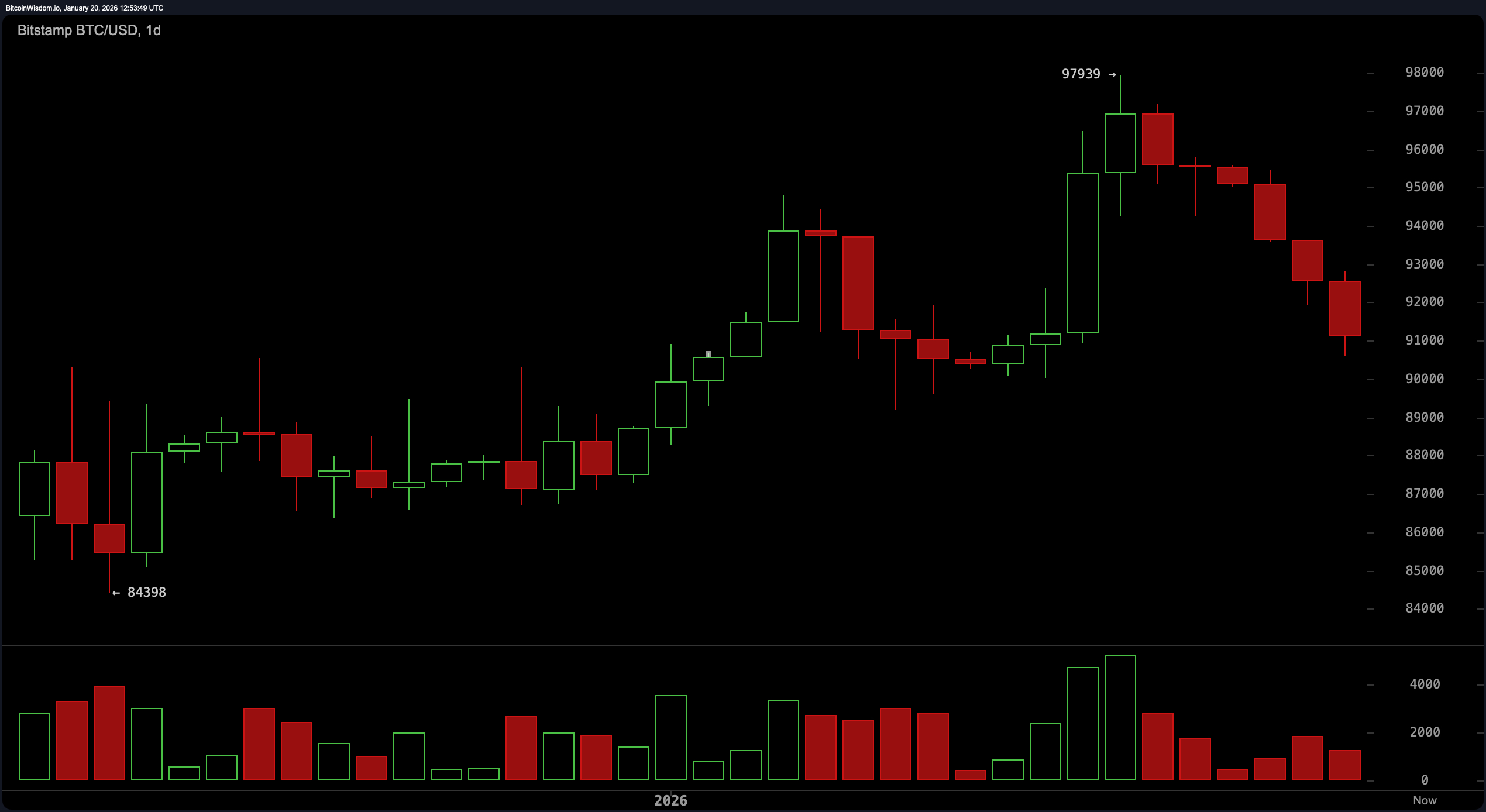

The daily chart presents an unmistakably bearish outlook reminiscent of an off-key karaoke performance. Following its peak around $97,939, Bitcoin has plummeted into the low-$91K range and is currently testing support levels between $90,500 and $91,000.

The series of red candles indicates a clear short-term downtrend that cannot be ignored. The trading volume during both the ascent and descent suggests we may be in a distribution phase rather than witnessing steadfast holders at work. Traders should keep an eye on this support level closely; if it fails to hold up under pressure there could be further declines toward the range of $87K to $88K.

BTC/USD one-day chart via Bitstamp as observed on January 20th.

The four-hour chart does not provide much reassurance either; Bitcoin has tumbled from around the mid-$95K area leaving behind numerous red candles indicative of loss in trader confidence. While there was some minor recovery near the price point of approximately $90,599 recently observed—this rebound lacks structural strength akin to a precarious house built from cards stacked too high without proper foundation support.

For now sideways movement seems to dominate—but unless prices can decisively break through resistance at about$92K with significant volume backing it up—the momentum remains questionable at best.

Scalpers might find allure in targeting around$90 ,600 but exercising patience here isn’t just wise—it’s essential for survival amidst market volatility.

BTC/USD four-hour chart via Bitstamp as seen on January 20th.

On shorter timeframes like one hour things appear almost lethargic—akin to watching paint dry with occasional flare-ups occurring sporadically due mostly towards ongoing consistent downward trends showing little signs for any bullish interruption.

The recent dip hitting lows near$90 ,599 coincided with spikes indicating possible climax selling behavior taking place while current price action drifts sideways lacking enthusiasm comparable only perhaps Monday mornings when everyone’s still waking up!

Until significant breaks occur above ranges sitting roughly between$91 ,500 -$91 ,800 markets remain stuck within indecisive purgatory!

BTC/USD one-hour chart via Bitstamp dated January 20th.

Now let’s dive into technical indicators because who doesn’t enjoy analyzing oscillators? The relative strength index (RSI) stands at neutral territory hovering around47 . Other indicators such as Stochastic Oscillator,C.C.I., A.D.X.,and even our ever-dramatic Awesome Oscillator chime along harmoniously signaling “meh”—essentially meaning neutrality prevails here too! However momentum readings (10) alongside moving average convergence divergence(MACD) both flash cautionary signals suggesting it’s time for some cooling off reinforcing overall corrective phases presently underway!

Moving averages portray less-than-flattering pictures—with EMA10 positioned at93 ,149 while EMA200 rests higher still closer towards99 ,259 nearly all key levels whispering downward trends instead! Only SMA30 &SMA50 cling onto faint hopes remaining somewhat optimistic despite overwhelming overhead resistances suggesting future rallies will require substantial boosts—or miracles—to materialize successfully!

In summary,Bitcoin finds itself entrenched within corrective cycles exhibiting bearish tendencies across major timeframes.Support situated close by($90k-$90000 ) bears heavy weight yet unless volumes increase alongside price reversals happening simultaneously this prevailing downtrend continues holding center stage firmly.Scalpers may catch glimpses opportunities arise occasionally but long-term faith remains elusive indeed.Watch closely that critical level ($91800 )as if owed money staying nimble since crypto never sleeps nor should your strategies either!

Bullish Scenario:

If Bitcoin manages convincingly breach above threshold set forth($91800 ) backed by strong volumes then possibilities open wide creating potential short-lived rallies ahead especially given confirmed bounces originating current supports paired together likely resulting bullish reversal patterns appearing daily charts implying worst corrections have passed us allowing paths reopening toward retesting levels approaching94 k possibly revisiting resistance zones nearing97 .900 provided buyers show commitment enough back them up accordingly!!

Bearish Scenario:

If however,Bitcoin fails uphold vital supports surrounding critical mark($90500 ),slipping beneath those thresholds leads next logical stops arriving nearer87k.Momentum MACD indicators already hinting southward movements meanwhile most moving averages looming overhead serve more resistant barriers rather supportive ones henceforth dominant narratives lean heavily upon continued downward pressures prevailing throughout without fundamental shifts altering sentiments or volumes drastically changing tides anytime soon…

Frequently Asked Questions 🛝

What is bitcoin’s current price? As per data recorded over last hour BTC trades somewhere ranging from$90902-$91106 noted early morning hours Jan twenty(th), two thousand twenty-six eastern standard timings…

Is bitcoin experiencing upward or downward trend?

Technical metrics indicate predominantly short-lived negative trends persisting throughout multiple timelines…

Where lies crucial points supporting bitcoins value?

Key areas offering protection sit primarily nestled amongst boundaries spanning$90500- $91000…

What events could potentially trigger breakout scenarios regarding bitcoins pricing?