Bitcoin briefly dipped below the $90,000 mark as investors rushed to sell off riskier assets amid turmoil in Japan’s government bond market. Meanwhile, U.S. President Donald Trump escalated tariff threats against Europe. This update is part of CoinDesk’s live market coverage and will be refreshed regularly with the latest developments.

Francisco Memoria, CoinDesk reporter (4:12pm UTC):

The ongoing sell-off has also impacted stocks linked to cryptocurrencies. Coinbase (COIN) shares fell by 3.79%, closing at $232.01, while bitcoin mining company CleanSpark (CLSK) saw a decline of 3.07%.

Companies holding Ether treasuries such as SharpLink Gaming (SBET) and Bitmine Immersion Technologies (BMNR) experienced sharper drops, each losing over 7% in value.

Bitcoin treasury heavyweight Strategy (MSTR) was not immune either, tumbling 6.78% to $161.94. Galaxy Digital (GLXY), which offers financial services related to digital assets, dropped by 1.87%. Among the better performers was Bullish (BLSH), CoinDesk’s parent firm, which decreased marginally by just 0.1%.

Krisztian Sandor, CoinDesk markets reporter (4:15 UTC):

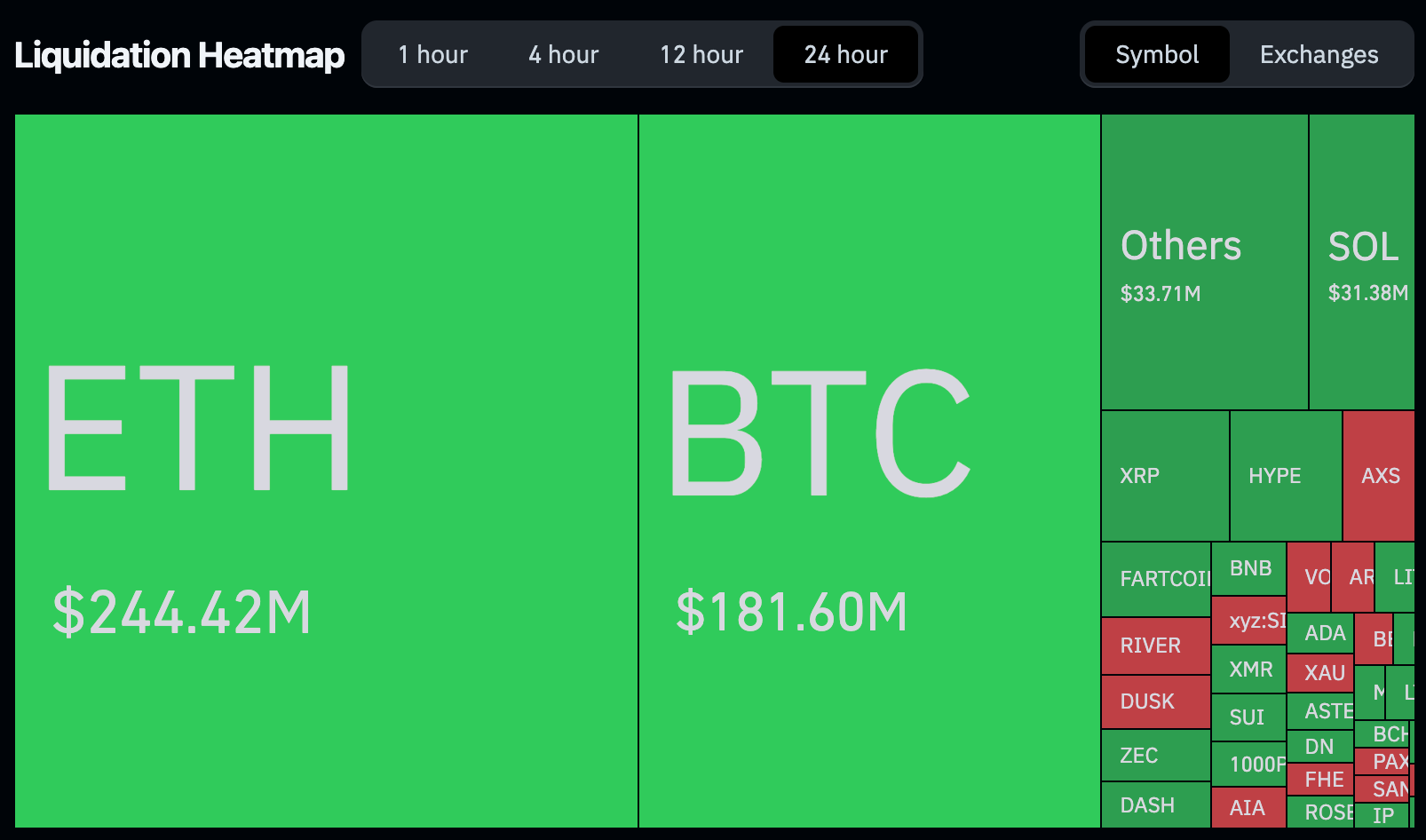

The chaos has led to liquidations totaling approximately $486 million in long positions across all asset classes on Tuesday so far—down from Monday’s figure of $637 million according to Coinglass—marking this as the worst two-day streak for longs this year.

Gold and silver enthusiasts find renewed optimism again (Steve Alpher, Senior Editor at CoinDesk Markets – 4:20 UTC)

Peter Schiff commented on silver’s surge above $95 per ounce—a rise exceeding 7%—stating that what silver is experiencing will soon happen with Bitcoin but inversely: “Silver’s remarkable rally foreshadows Bitcoin’s impending collapse,” he warned emphatically.

A Twitter user named Quoth the Raven recalled a moment nine years ago when CNBC’s Tim Seymour dismissed Bill Fleckenstein for being bullish on gold at around $1,400 per ounce while predicting cracks in Japan’s bond market—which has now indeed faltered alongside gold soaring past $4,700 today.

An observation from ZeroHedge noted correlations emerging between gold prices and Japanese Government Bond yields versus Bitcoin prices tracking JGB valuations closely during these turbulent times.