Today, Bitcoin has continued its downward trend, dropping beneath the significant $90,000 mark. This decline coincides with the Supreme Court’s postponement of its decision regarding the Trump tariffs case, adding to the uncertainty surrounding when a ruling will be made.

Bitcoin Dips Below $90,000 as Trump Tariffs Ruling Delayed

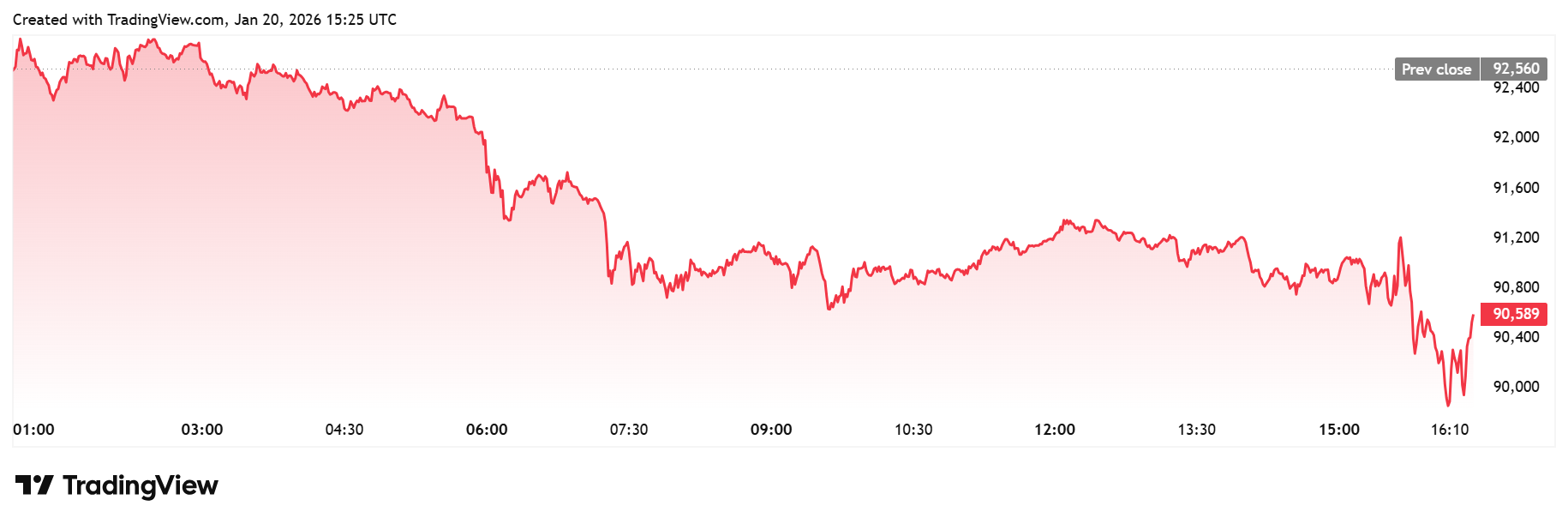

According to TradingView data, Bitcoin has fallen below $90,000 today and reached a low of $89,800. The leading cryptocurrency is down more than 2% for the day after peaking at approximately $93,000 earlier.

Source: Bitcoin Daily Chart

The drop in Bitcoin’s value below $90K occurred following the Supreme Court’s decision not to issue a ruling on Trump’s tariffs today. As reported by CoinGape, there was speculation that an opinion could be released today since it was designated as an opinion day.

However, this expectation did not materialize; while opinions were issued in three other cases by the Supreme Court, none pertained to Trump’s tariffs. The ongoing delay raises further questions about whether these justices will ultimately decide on President Trump’s authority concerning these tariffs.

This situation is compounded by Trump’s tariff threats against several European nations including France and Germany; starting February 1st they are set to face a 10% tariff increase. A favorable ruling for these tariffs would likely have negative implications for both Bitcoin and the wider cryptocurrency market.

Additonally impacting today’s sell-off is growing concern over potential interest rate hikes in Japan. As noted by CoinGape ,the Bank of Japan (BOJ) has suggested that additional rate increases may follow last month’s hike—this development could negatively affect major assets like BTC.

Market apprehension is already evident in Japan due to rising Japanese bond yields following Prime Minister Sanae Takaichi’s announcement regarding an unexpected election aimed at boosting fiscal spending.

The Likelihood of a Favorable Ruling for Trump’s Tariffs Increases

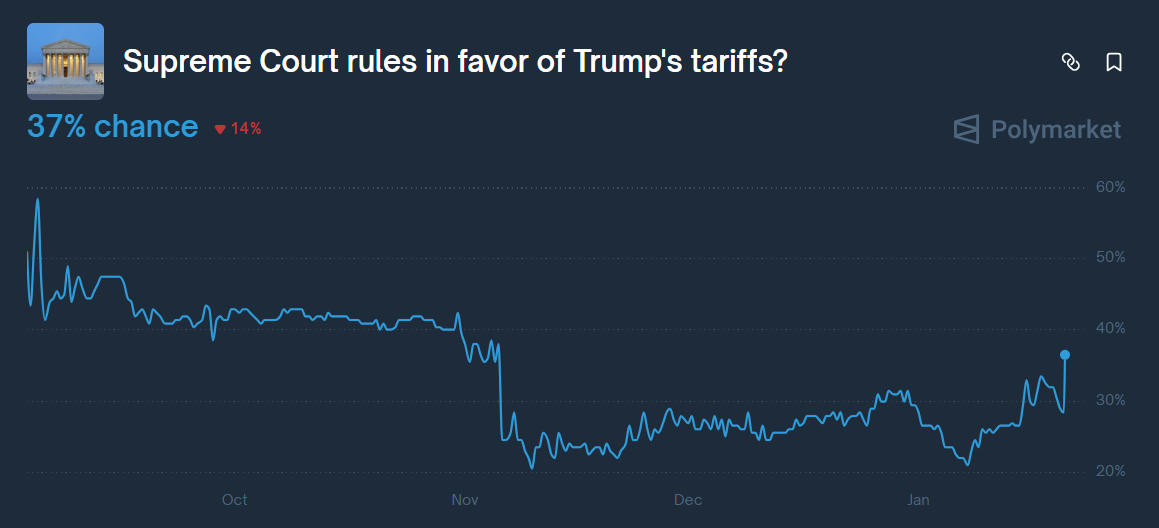

Data from Polymarket indicates there is now a 37% probability that the Supreme Court will rule favorably on Trump’s tariffs—a notable rise from approximately 28% earlier today. These odds have been climbing since delays began affecting rulings related to this case.

Source: Polymarket

The implementation of Trump’s tariffs had previously contributed significantly to declines in both Bitcoin prices and those across broader crypto markets towards late last year—most notably during October when his threat of imposing a staggering 100% tariff on Chinese goods triggered widespread panic selling among investors.

This news comes alongside predictions from analysts like Peter Brandt who foresee further declines in BTC. According to CoinGape ,Brandt anticipates prices might plummet between $58K-$62K soon enough!

As BTC‘s price drops below that crucial threshold,$100k seems increasingly unlikely within this month according data from Polymarket which suggests only about12 % chance remains alive!