Bitcoin is currently experiencing a decline as risk-averse sentiment grows, momentum wanes, and multiple bearish technical indicators unsettle the market. Traders are focusing intently on the $90,000 threshold, viewing it as a critical juncture that could determine whether the recent pullback stabilizes or intensifies.

Table of Contents

The risk of further downside is real but not inevitable.

Summary:

– Bitcoin trades near $90,658 and struggles to break through key resistance amid macroeconomic uncertainty and weakening market dynamics.

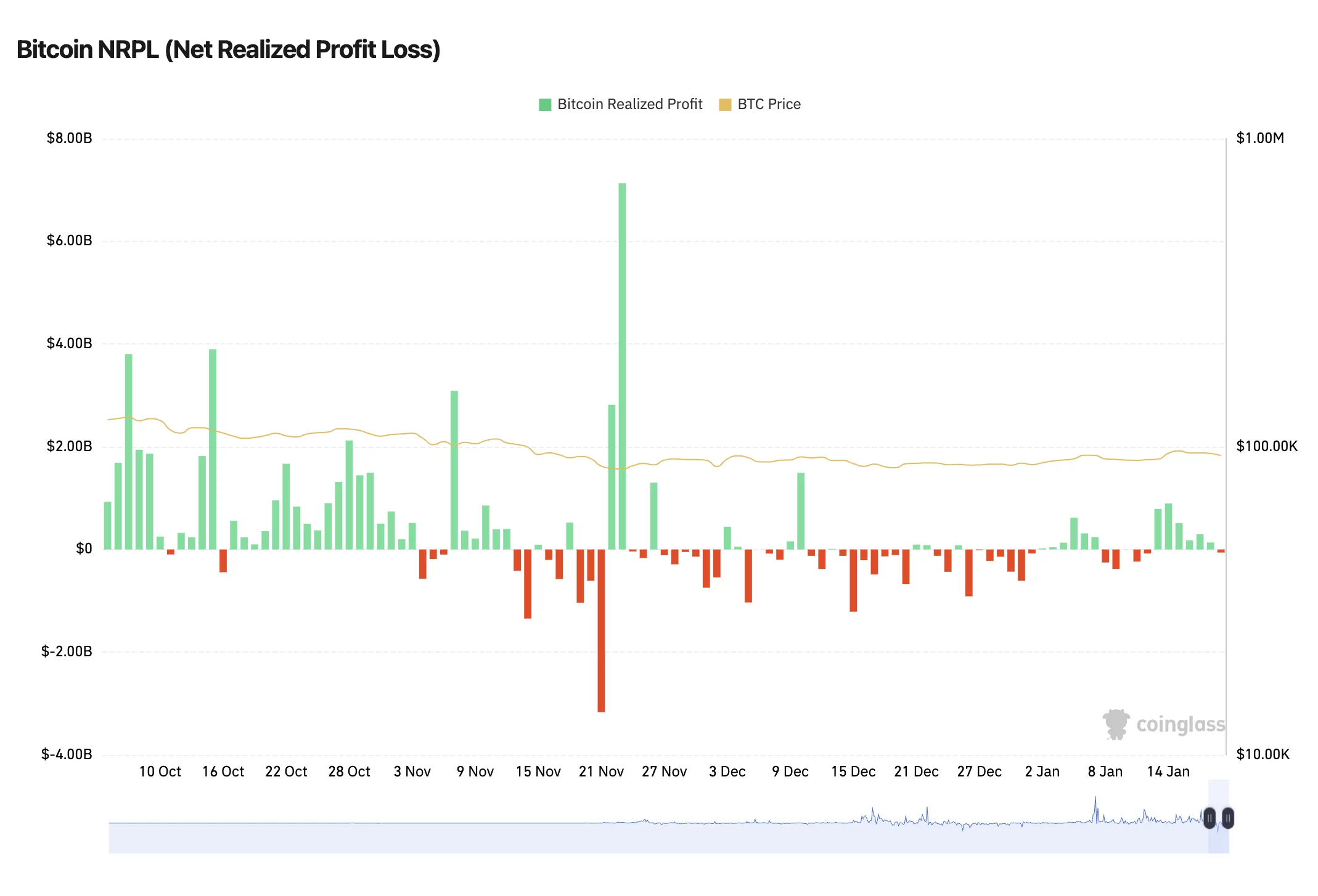

– On-chain data such as CoinGlass’ NRPL metric points to cooling momentum and reduced profit-taking activity, reflecting cautious investor sentiment.

– Surpassing the $97K–$98K range could restore bullish dominance; however, dropping below support at $90K–$91K raises the possibility of a deeper correction. Upcoming price action will heavily influence Bitcoin’s short-to-medium term trajectory.

Overview of Market Conditions

The price of Bitcoin (BTC) has fallen roughly 2%, slipping beneath $92,000 and now hovering just under $91,000. This level has become pivotal for traders who are watching closely — it may either hold firm to stabilize prices or break down further leading BTC lower.

This retreat comes amid an environment dominated by risk aversion triggered by concerns over President Trump’s tariff policies alongside broader market fragility. Key short-term support levels are faltering which signals diminishing buying pressure from bulls.

Additionally, on-chain analytics reveal that profit-taking activities have slowed down considerably contributing further to an atmosphere marked by caution among investors.

Brandt’s Bearish Perspective

Pete Brandt — a trader with more than 850k followers on X — recently intensified discussions around Bitcoin’s future outlook by forecasting a potential drop toward approximately $58,000–$62,000 range.

I believe BTC is headed between 58k – 62k.

If this doesn’t happen I won’t be ashamed so trolls don’t need screenshots later.

I’m wrong about half my calls anyway – no big deal pic.twitter.com/NDOuSrqLwa

— Peter Brandt (@PeterLBrandt) January 19th ,2026

This projection stems from his observation of a rising wedge pattern forming over several months—a classic bearish formation suggesting waning bullish momentum.

BTC now forms what looks like diagonal structure patterns I personally avoid trading these.

These setups usually get interpreted post-move by Elliott Wave analysts claiming perfect foresight.

— Peter Brandt (@PeterLBrandt) January 20th ,2026

While Brandt admits he is only correct about half the time and this scenario remains speculative rather than certain—the warning has heightened nerves especially among short-term traders trying to navigate volatility. Currently Bitcoin continues failing to reclaim significant resistance zones keeping its forecast tilted towards cautioniness.

On-Chain Metrics Indicate Slowing Momentum

Certain blockchain-based indicators hint that upward buying pressure behind BTC might be fading gradually. The NRPL (Net Realized Profit/Loss) metric from CoinGlass—which tracks profitability trends among traders—has recently slipped into slightly negative territory after months showing robust positive figures indicating strong profits realized previously.

This trend often occurs when enthusiasm for purchasing cools off while markets absorb selling pressure steadily—not necessarily signaling imminent collapse but implying increased vulnerability if fresh buyers fail to enter promptly.

Bitcoin Price Outlook : Crucial Levels To Monitor

Should bitcoin rally beyond approximately & amp ; #36 ;97 K -& amp ; #36 ;98 K , bulls would likely regain command potentially reversing current bearish tendencies providing renewed upside impetus .

Conversely , breaching channel support near & amp ; #36 ;90 K -& amp ; #36 ;91 K heightens probability for extended retracement possibly targeting lows around & amp ; #36 ;62 K though this outcome isn ‘ t assured .

Presently bitcoin ‘ s pricing forecast appears uncertain . Technical charts show negative signs combined with slowing on-chain metrics serve as warnings yet btc retains capacity for unexpected moves . Upcoming developments will decisively influence btc ‘ s trajectory over coming weeks or months .