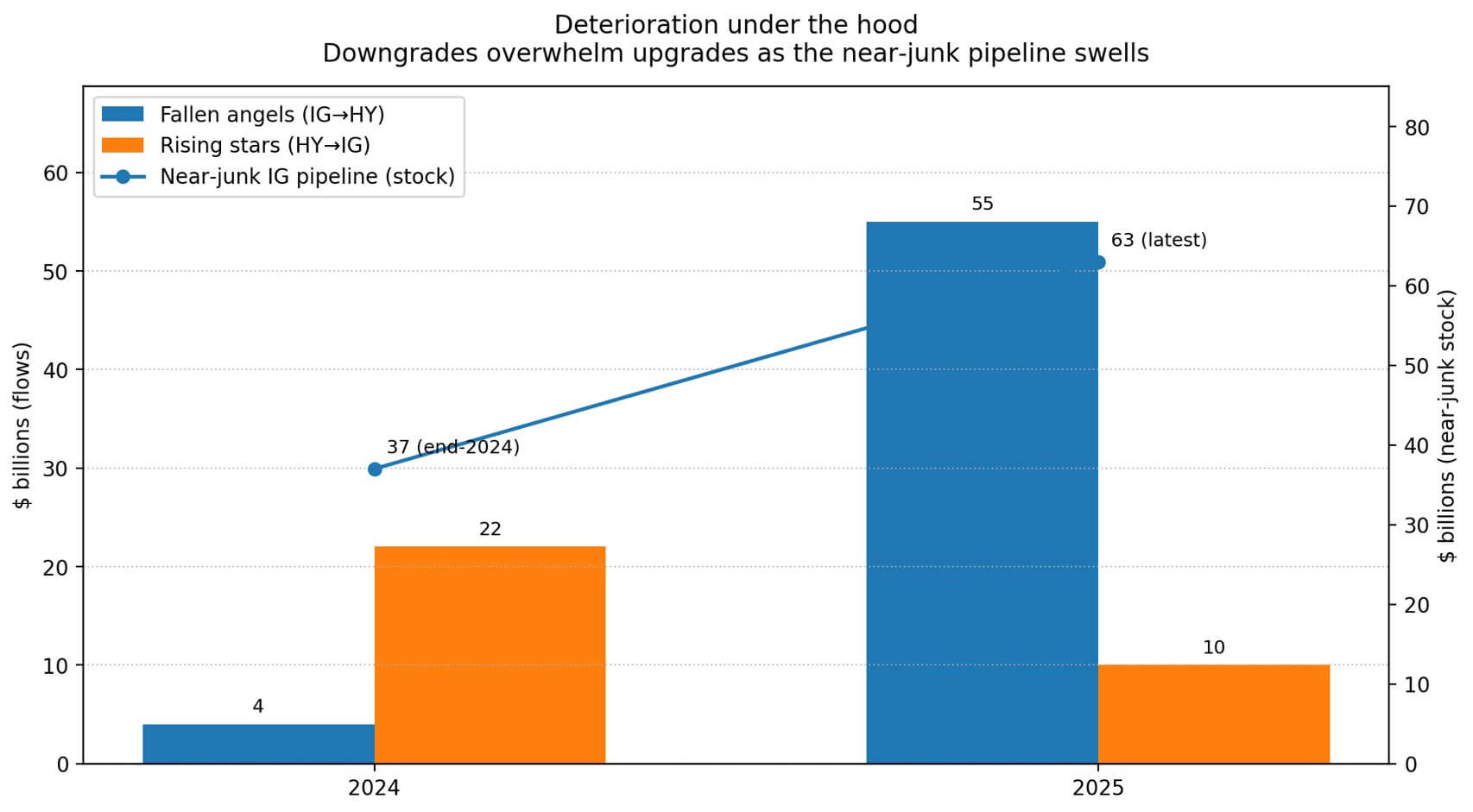

Corporate credit quality is quietly declining beneath a seemingly stable exterior. JPMorgan has identified approximately $55 billion worth of US corporate bonds that are expected to drop from investment-grade to junk status in 2025, known as the “fallen angels.”

Conversely, only about $10 billion of debt is anticipated to regain investment-grade status as “rising stars.” Additionally, around $63 billion of investment-grade bonds now hover dangerously close to junk territory, up from roughly $37 billion at the end of 2024.

Despite these warning signs, credit spreads remain surprisingly narrow. As of January 15th, data from FRED indicates option-adjusted spreads for investment-grade bonds at 0.76%, BBB-rated bonds at 0.97%, and high-yield bonds at just 2.71%.

This suggests that investors have yet to fully acknowledge this as a looming credit crisis even though the volume of potential downgrades continues to grow.

The gap between worsening fundamentals and market complacency creates an environment where Bitcoin might emerge as a convex macro trade opportunity. Typically, moderate widening in spreads dampens risk assets like Bitcoin.

However, if credit stress intensifies enough to prompt earlier Federal Reserve rate cuts or liquidity interventions, what initially pressures Bitcoin could transform into conditions favorable for its price appreciation based on historical monetary trends.

Credit Stress Operates in Two Phases

The interaction between Bitcoin and corporate credit depends heavily on market conditions.

A study published by Wiley in August 2025 reveals an inverse correlation between cryptocurrency returns and credit spreads — a relationship that becomes more pronounced during periods of financial stress.

This explains why Bitcoin often declines when spreads widen initially but rallies if spread expansion triggers shifts in monetary policy outlooks. The first phase tightens financial conditions and suppresses risk appetite among investors.

The second phase raises expectations for looser monetary policy accompanied by lower real yields and a weaker US dollar — factors that tend to benefit Bitcoin more than crypto-specific developments do.

Bitcoin’s sensitivity extends beyond internal crypto narratives; it responds strongly to broader liquidity dynamics within the economy which underscores why monitoring “fallen angels” matters so much.

Bonds downgraded below investment grade force regulated holders such as insurers or funds restricted to higher grades into selling positions while dealers demand wider compensation for holding these risks temporarily.

The European Central Bank’s research highlights how fallen angels negatively impact both bond prices and issuance capabilities for affected companies — effects which can ripple through equity markets increasing volatility overall.

Bitcoin typically experiences this spillover similarly alongside high-beta stocks: tighter financial conditions reduce leverage availability leading investors toward safer assets temporarily (risk-off sentiment).

The story doesn’t end there though: if deterioration accelerates sharply enough threatening refinancing prospects or causing systemic strain across markets then central banks like the Fed may intervene with emergency measures based on past precedents such as those seen during March 2020 when they launched facilities supporting corporate bond markets directly via Primary Market Corporate Credit Facility (PMCCF) & Secondary Market Corporate Credit Facility (SMCCF).

A Different Perspective: Non-Credit Assets

Deteriorating corporate credits remind us that traditional debt instruments carry inherent risks including defaults or refinancing challenges whereas Bitcoin carries none—it lacks issuer cash flows or ratings altogether along with maturity schedules requiring rollovers periodically unlike conventional fixed income securities do.

In environments where investors seek alternatives amid falling yields & weakening dollars combined with rising default concerns, Bitcoin stands out marginally due its non-credit nature.

This should not be mistaken for labeling bitcoin simply safe haven because its volatility profile contradicts such simplistic categorization. rather, if risk arises specifically related to credit exposure, risk capital may rotate toward assets without direct counterparty default risk—even if they carry other types of risks themselves.

The relationship between bitcoin prices versus USD fluctuates over time making any direct causal assumption—like weaker dollar automatically boosting bitcoin—unreliable except under specific macro scenarios involving simultaneous lower real interest rates plus dovish policy pivots triggered by worsening credit stress situations historically most supportive backdrop imaginable.& / P >

Breach Of Complacency And Its Consequences

Currently we observe compressed IG spreads near historic lows juxtaposed against one largest downgrade pipelines since early pandemic times creating three plausible trajectories each bearing distinct implications towards BTC pricing:

SLOW BLEED: a gradual rise within ranges e.g., HY +50-100bps/BBB +20-40bps tightening borrowing costs incrementally raising refinancing anxiety without triggering major policy changes leading BTC acting akin typical risky asset facing headwinds due reduced liquidity without offsetting stimulus likely bearish-neutral outcome overall.

CREDIT WOBBLE: a sharper repricing pushing HY ~401bps/IG ~106bps levels altering Fed outlook sufficiently prompting accelerated rate cut expectations resulting initial selloff followed by faster rebound relative equities marking convexity pattern favoring BTC before broad asset classes adjust fully.

CREDIT SHOCK: a sudden spike reaching crisis proportions forcing massive forced sales alongside heightened dysfunction risks driving Fed intervention using balance sheet expansions/liquidity backstops provoking extreme volatility phases culminating rapid recovery similar historical template witnessed post-March ’20 plunge-from ~$10k down-to ~$4k followed-by surge above $60k within twelve months fueled largely through unprecedented liquidity injections.