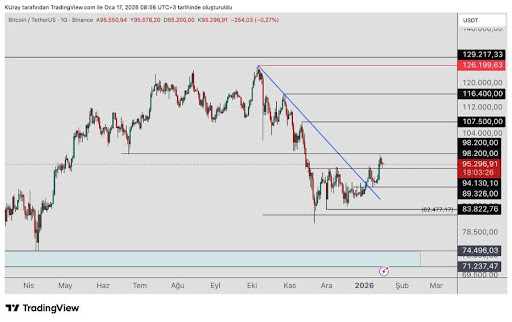

Bitcoin continues to maintain its position above crucial support levels as weekend trading progresses, with significant attention on the $98,200 and $107,500 price points. Traders are closely monitoring whether the upward momentum will persist or if reduced weekend liquidity might lead to a decline testing lower thresholds. The upcoming sessions are expected to be pivotal in determining Bitcoin’s short-term direction.

Critical Support at $94,630 Remains Intact

As highlighted by analyst Kamile Uray, Bitcoin is currently holding firm above the important support level of $89,326. Staying above this mark is essential for sustaining bullish momentum and preserving market structure favorable for further gains. This support acts as a key foundation underpinning potential upward movement.

If Bitcoin successfully surpasses the resistance at $98,200, attention will shift toward the next major target around $107,500. Achieving a daily close beyond this point would represent a new higher high compared to previous downward trends and could signal continuation of the bullish rally.

Conversely, failure to break through resistance coupled with a drop below $89,326 may indicate resumption of bearish pressure. Should Bitcoin find reversal strength within the support zone between approximately $83,822 and $82,477 it might attempt another climb upwards giving bulls an opportunity to regain control.

A decisive close beneath $82,477 could open doors for further declines targeting historical strongholds in the range of roughly $74,496–$71,237. A confirmed bounce from these levels would potentially set up conditions for renewed bullish advances.

Weekend Liquidity Conditions Suggest Sideways Trading

Crypto strategist Lennaert Snyder emphasized that maintaining support near $94,630—also critical on four-hour charts—is vital during current market conditions. On Friday, Bitcoin briefly dipped below this threshold before recovering, underscoring its importance in short-term price dynamics.

Throughout weekend trading hours, , BTC is expected to fluctuate within established ranges until late Sunday or early Monday.

Bullish traders should aim if BTC holds lows and breaks past about $95,820, a move that could open targets near last month’s peak at approximately $97,960.

A partial profit-taking strategy may be employed around monthly highs while allowing 30%–40% exposure for capturing extended upside if momentum endures.

Should BTC lose ground under key supports like $94,630 on H4 timeframes,&nbspthe likelihood increases that prices retreat into prior ranges leading towards lower lows.&;lt;/span&;gt;

In such cases,&;lt;/span&;gt;

short positions can be considered after confirmation via retests providing disciplined risk management opportunities amid potential downturns.&;lt;/span&;gt;

Featured image&32;fromPixaby;, clicht fro&m T&r#a&d;i#n#g&v&i;e&w;.com