Bitcoin was trading within a narrow range of $94,869 to $95,115 per coin at 9 a.m. EST on January 18, 2026. Meanwhile, derivatives traders remained highly active. The futures and options markets reveal dense positioning, substantial open interest, and an increasing focus on price levels just below the $100,000 mark.

Bitcoin Derivatives Indicate Market Preparedness for Volatility

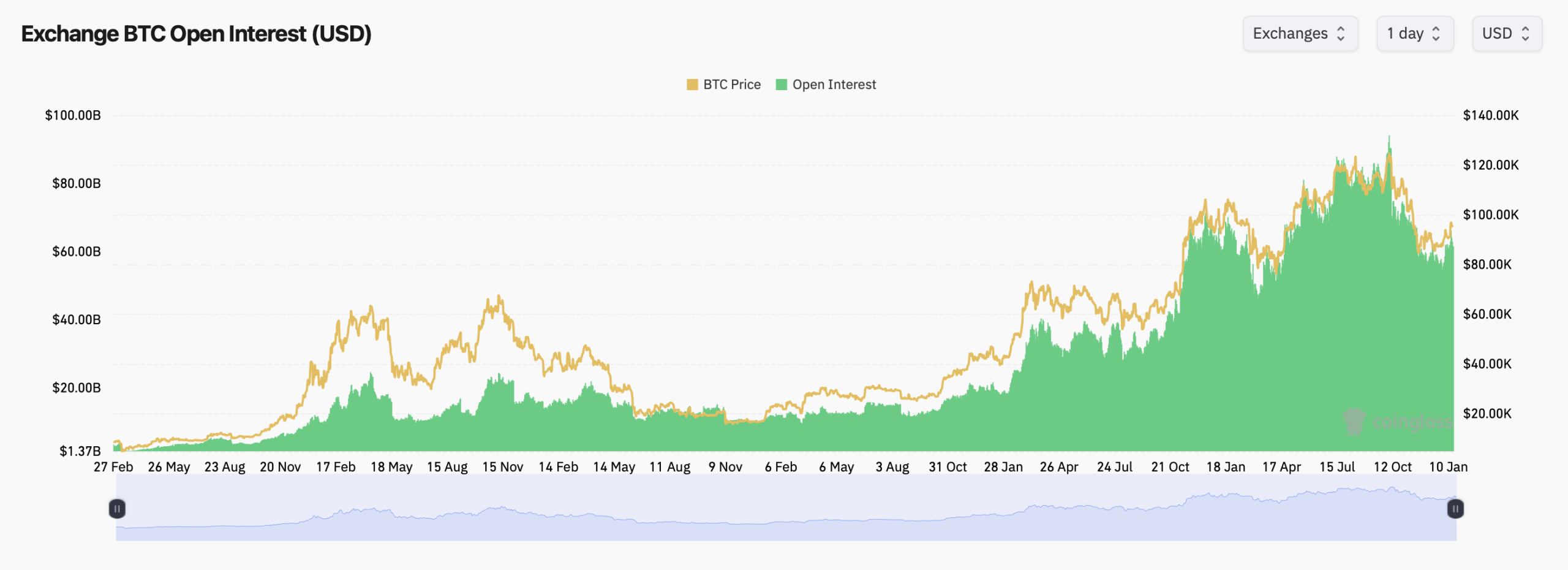

The total open interest in bitcoin futures currently stands at approximately 646,850 BTC — equivalent to around $61.48 billion in nominal value — according to data from coinglass.com. Although there was a slight uptick in open interest over the last hour and four-hour periods, the 24-hour figure declined by nearly 2%, suggesting selective position adjustments rather than widespread deleveraging.

Among exchanges offering futures contracts this weekend, Binance leads with roughly 129,540 BTC in open interest—accounting for just over one-fifth of global figures. Close behind is CME with about 122,640 BTC open interest reinforcing its status as a favored platform for institutional investors. Other notable platforms such as OKX, Bybit, Gate.io and MEXC also hold significant exposure despite mixed short-term shifts.

The market activity across these venues presents contrasting trends: Binance and OKX have experienced modest growth in futures open interest over the past day while CME and Bybit have seen slight declines. This rotation suggests traders are reallocating their exposure instead of fully exiting positions—keeping leverage elevated as prices hover near familiar thresholds.

Options Market Data Reflects Underlying Bullish Sentiment

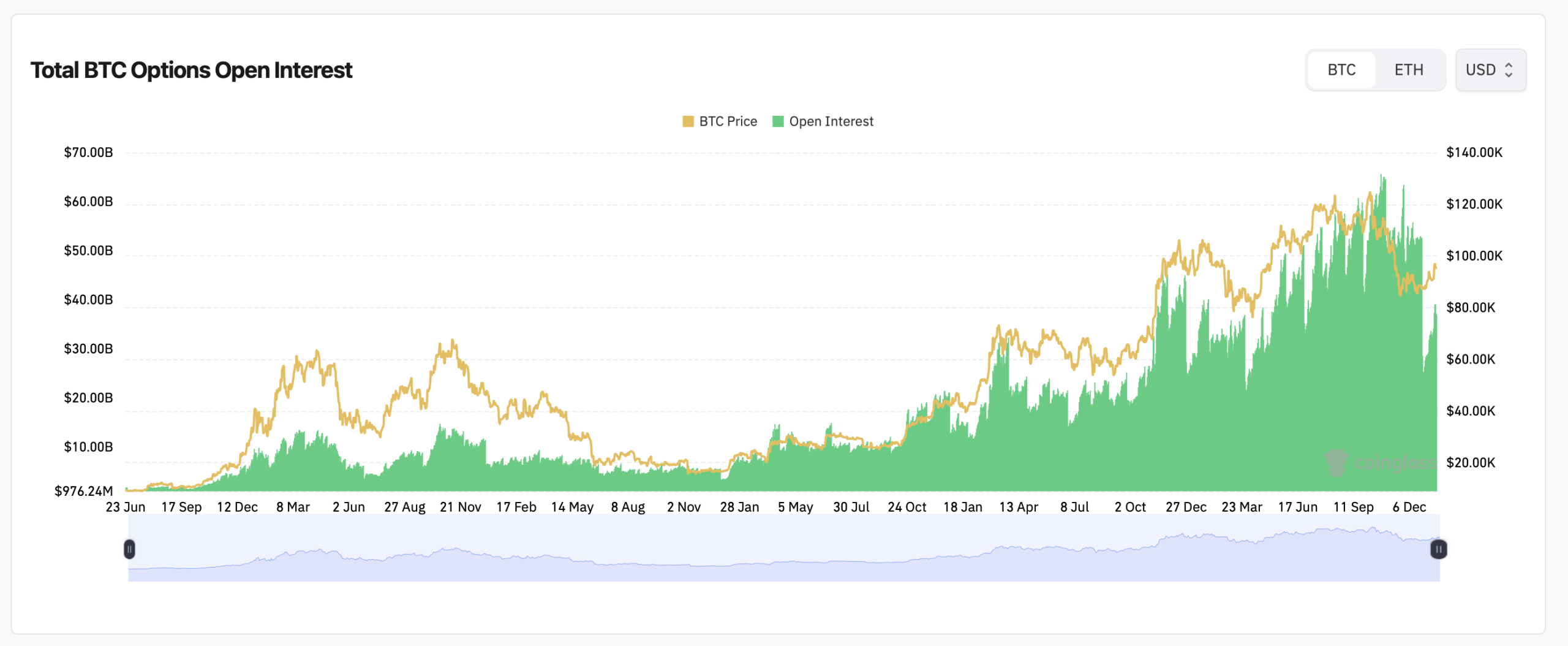

The bitcoin options market continues expanding rapidly with total options open interest nearing $36.88 billion — closely tracking price movements as participants load contracts across various expirations dates. Deribit remains dominant here by hosting both the largest contract volume and most actively traded strike prices.

Call options still outnumber puts significantly within overall options exposure—making up approximately 57% of total contracts or more than 209K BTC equivalents versus puts’ roughly 43% or about157K BTC equivalents respectively—indicating sustained longer-term bullish bias despite some near-term caution among traders.

However,the last twenty-four hours tell another story where put option volumes slightly exceeded calls capturing above55% daily volume hinting tactical hedging strategies designed to mitigate downside risks amid potential volatility around upcoming expiration dates.

An additional insight comes from max pain analysis which identifies strike ranges where option holders stand to lose most value upon expiry thereby exerting gravitational pull on price action near those levels.For late January expiries on Deribit,the highest concentration clusters between$90K-$93K zones alongside secondary pressure points close to$95K.This dynamic often frustrates overly optimistic speculators expecting wider moves away from these anchors prior expiry dates.

“Also read: Battle at $95K: Can bitcoin bulls cold thedeline?

The scenario differs somewhat on Binance’s platform where max pain centers nearer$100k—with significant notional values clustered between strikes ranging from$95k up through$105k suggesting that traders there anticipate broader swings rather than tight consolidation phases.

Around OKX,max pain skews slightly lower trending toward low-$90Ks across multiple expiries combined with rising notional values at selected strikes indicating guarded optimism balanced by prudent hedging tactics.

Taken collectively,the derivatives landscape portrays conviction without complacency:futures players remain engaged while option participants actively manage risk profiles—all occurring as bitcoin’s price navigates zones defined by leverage intensity,mindset,and patience alike.

Frequently Asked Questions ⏱️

- What does high bitcoin futures open interest signify?

It reflects robust trader engagement along with heightened leverage usage throughout derivatives markets. - Why do call options dominate bitcoin’s total options activity?

The prevalence of calls indicates expectations among market participants for higher prices over extended time horizons. - What exactly is max pain regarding bitcoin options?

Max pain refers to the strike price level causing maximum losses when many option contracts expire worthless—a common short-term magnet influencing final settlement prices during expiration periods. - Which exchanges lead bitcoin derivatives trading volumes?

Binance,CME Group (Chicago Mercantile Exchange),OKX ,Bybit,and Deribit together represent majority shares across both futures &&;options segments worldwide markets alike .