On Sunday, Bitcoin held steady at $95,101, boasting a robust market capitalization of $1.89 trillion and maintaining a 24-hour trading volume of $19.02 billion. Traders are closely monitoring the narrow intraday price band between $94,869 and $95,543 with keen interest. The atmosphere is tense; the charts are signaling uncertainty as clearly as a loud parade.

Bitcoin Market Analysis

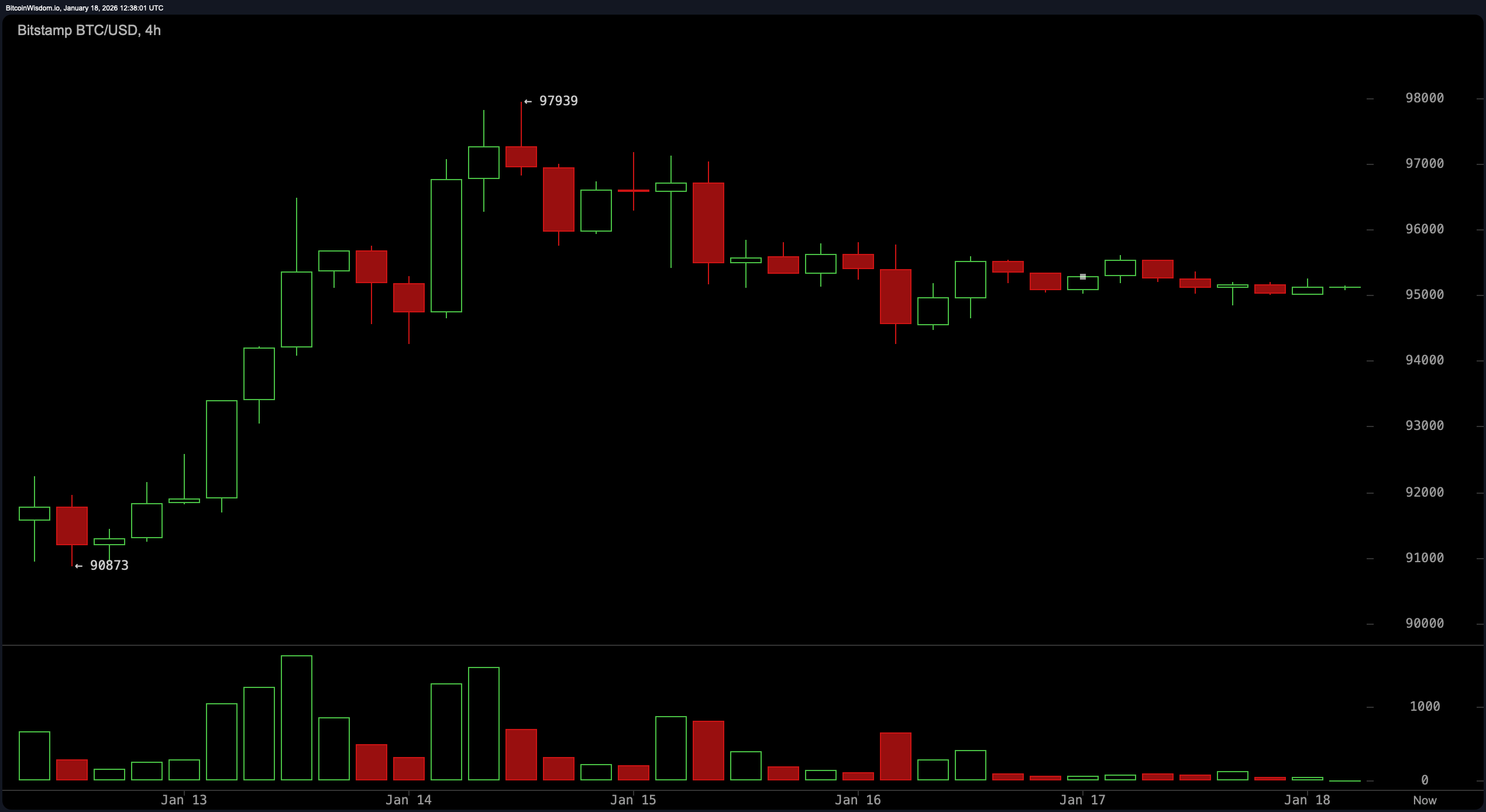

Examining the daily chart reveals that Bitcoin’s momentum had been climbing steadily to reach a peak near $97,939. Since then, it has been hovering just below the $96,000 mark—almost as if waiting patiently for its next move. The overall trend remains bullish with higher highs and higher lows confirming an upward trajectory; however, this pause should not be mistaken for acceleration.

The recent candlesticks have contracted in size while trading volume has diminished—classic indicators of waning bullish energy. Support levels linger between $90,000 and $91,000 whereas resistance stands firm close to the previous high around $97,939. If this price range were likened to a social gathering, it would be akin to guests casually chatting by the snack table in their host’s absence.

The four-hour chart tells another story: consolidation disguised as tactical maneuvering. Bitcoin remains trapped within bounds set by approximately $94,500 on the lower end and about $96,000 on top—forming what looks like a descending triangle pattern hinting at bearish potential ahead.

Volume is evaporating rapidly—as if summer heat dried up puddles—suggesting traders’ commitment is fading fast. Should prices break above roughly $96,‑500, a surge toward nearly $97,‑900 could follow.

Conversely, if prices slip beneath $94,‑ampersand;,500&, investors might find themselves revisiting support zones near $92&;000 or even lower around $91&;000—the crypto equivalent of returning home after an unsuccessful venture into bigger markets.

The hourly chart paints bitcoin in somewhat gloomy colors: successive lower highs coupled with lower lows suggest short-term bearish pressure.

This downtrend is underscored by its failure to reclaim territory above approximately $95, 's key resistance level at $95,-600.

A critical support line exists near $94,-839 but lacks strong buying enthusiasm.

Momentum indicators whisper rather than shout—and without renewed volume strength this weakening pattern may persist.

If prices fall below about $94,-600 traders might quickly exit positions much like participants rushing out during an emergency drill.

Diving into technical indicators offers mixed signals:

The Relative Strength Index (RSI), Stochastic Oscillator,

Commodity Channel Index (CCI), Average Directional Index (ADX),

and Awesome Oscillator all hover neutrally — essentially shrugging off any decisive directional bias.

However,

the Momentum Indicator shows signs of revival at 4,.065

, while Moving Average Convergence Divergence (MACD) flirts positively around 1,.552 — both suggesting emerging bullish tendencies.

Short-term moving averages such as EMA and SMA spanning from 10 up to 50 periods signal sustained strength,

yet longer-term averages including EMA100/SMA100 &

SMA200 remain positioned above current pricing levels indicating skepticism among long-range investors.

This creates classic tension between youthful optimism represented by short-term metrics versus cautious wisdom embodied in long-term data.

This summary suggests that although Bitcoin exhibits underlying bullish cues over extended timeframes,

Bullish Perspective:

If BTC manages a confident rally past $%26thinsp;%2396500 , bolstered by solid volume , expect potential challenges toward previous highs approaching $%26thinsp;%2397900 . Short term moving averages already cheer from sidelines , momentum metrics warming up – bulls just need ignition .

Bearish Outlook:

If instead BTC falters breaking below $%26thinsp;%2394500 without sufficient backing , risk increases for slide toward supports near $%26thinsp;%2392000 or even deeper down close to $%26thinsp;%2391000 . Descending triangle visible on four hour timeframe combined with weakening hourly trends do little inspire confidence – bears lurk ready for missteps turning into falls .

Frequently Asked Questions ❓

What's bitcoin's latest price?

As of January 18th ,2026 BTC trades roughly @ $95, ;101.

Is bitcoin currently trending upwards?

Daily charts confirm ongoing upward trend though momentum appears subdued recently.

Which key price points should traders monitor soon?

Critical support hovers near $94000, resistance clusters around $96500.

Where could bitcoin head next?

Breaking decisively beyond $96500 opens path towards ~$97900. Falling under ~$94500 would likely test lows nearer $92000-91000.