Despite the Federal Reserve maintaining a cautious stance on interest rate reductions, both gold and copper prices have been climbing. This divergence highlights how financial markets often anticipate shifts in liquidity conditions ahead of official policy announcements rather than waiting for central bank confirmations.

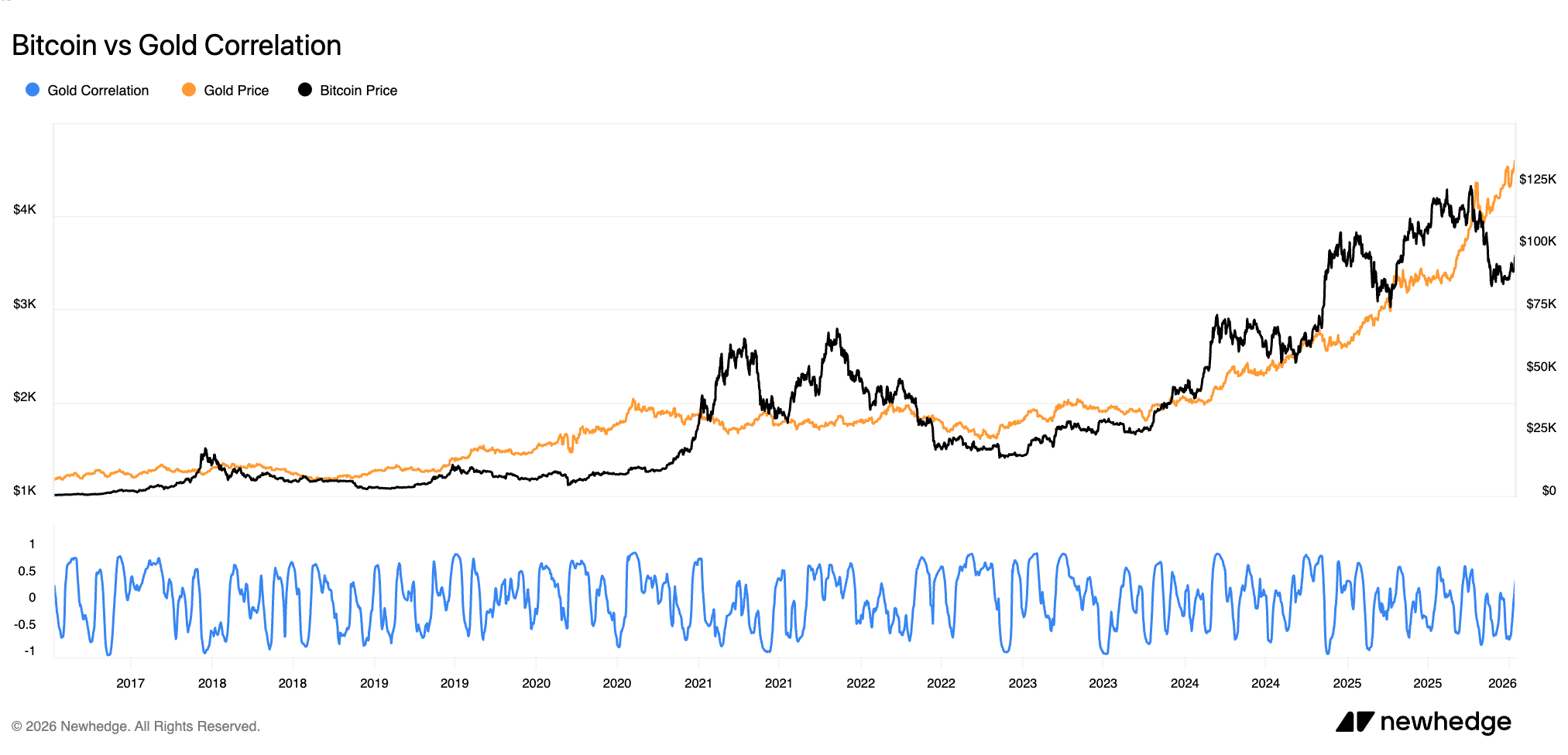

The movements in these metals are influenced by changes in real yields, funding environments, and future expectations—patterns typically observed during the early phases of easing cycles. Historically, Bitcoin has reacted to these factors with a delay; its most significant gains usually occur after metals have already adjusted to anticipated looser monetary policies.

The current market scenario mirrors this familiar pattern. Gold is drawing defensive investments as real returns on cash and government bonds shrink, while copper benefits from optimistic forecasts regarding credit availability and global economic activity. Together, they indicate that markets are adapting to an environment where restrictive monetary policies may be reaching their peak—even if official statements remain conservative.

Bitcoin has yet to reflect this transition fully; however, past trends suggest it tends to respond only once the underlying liquidity signals become unmistakably clear.

Precursors: Metals Lead Before Central Bank Actions

Financial markets generally adjust pricing before policymakers publicly acknowledge a change in direction—especially when marginal capital costs begin shifting.

This phenomenon is evident through gold’s performance across multiple economic cycles. Analysis from LBMA pricing data and insights by the World Gold Council reveal that gold prices often start rising months prior to initial rate cuts as investors react primarily to peaking real yields rather than actual policy changes.

During 2001, 2007, and again in 2019, gold appreciated even while official policies remained restrictive—a reflection of growing anticipation that holding cash would soon yield diminishing real returns.

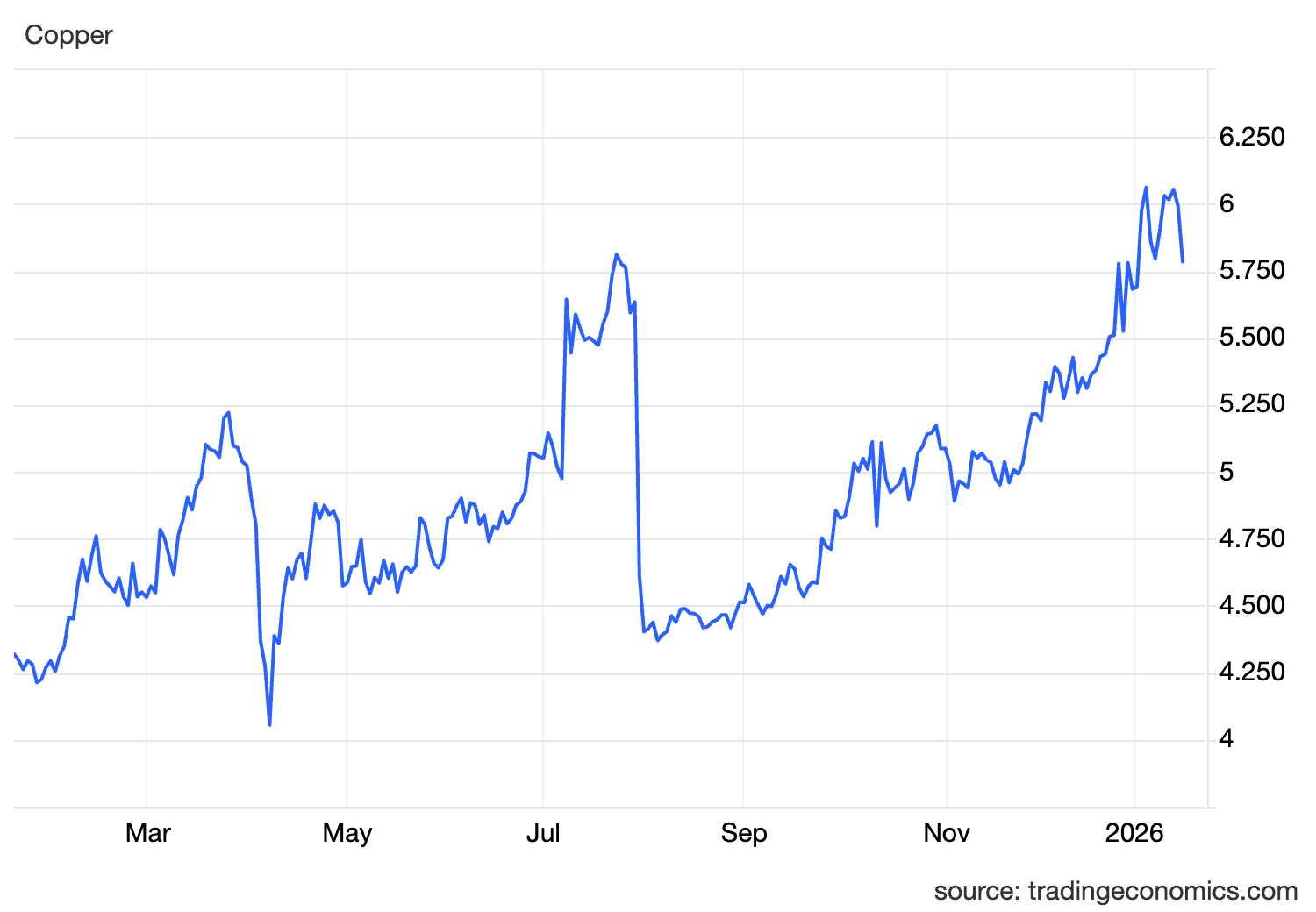

Copper amplifies this signal because its demand ties closely with construction activities, manufacturing output, and investment cycles—making it sensitive not just to defensive positioning but also credit accessibility and funding conditions.

A simultaneous rise in both copper and gold suggests more than mere risk aversion; it points toward market expectations for easier financial conditions capable of supporting tangible economic growth.

Recent increases seen in CME and LME copper futures confirm this dynamic: prices climbed despite mixed growth indicators and cautious central bank communications.

This dual movement carries significant weight because it reduces false positives: while gold alone can surge due to geopolitical tensions or fear-driven demand spikes—and copper alone might react solely due to supply constraints—their concurrent ascent typically signals broader shifts in liquidity expectations priced into markets without explicit policy endorsement.

The Dominant Role of Real Yields Over Policy Announcements

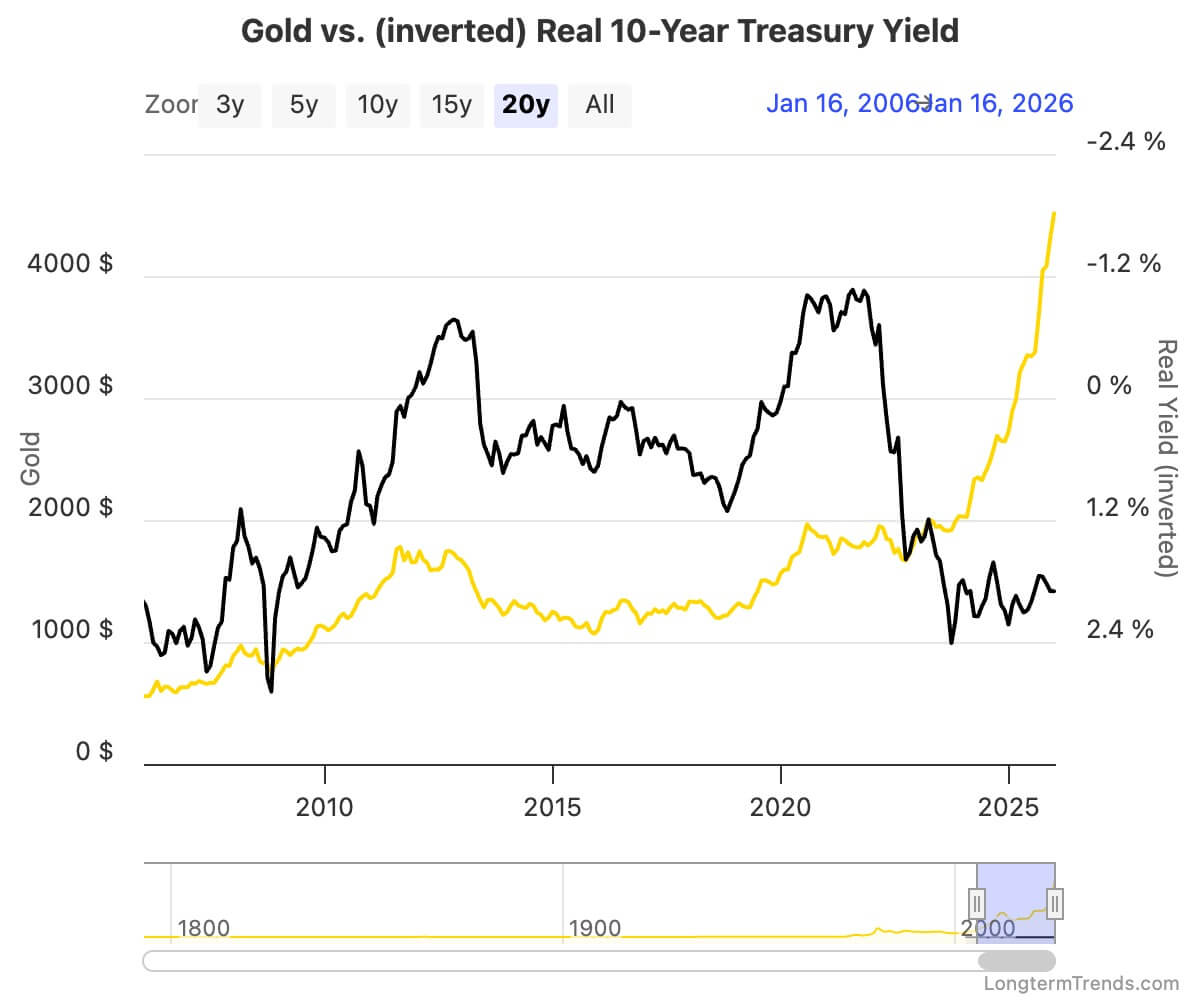

A shared driver behind price actions for gold, copper—and eventually Bitcoin—is the trajectory of real yields on long-term government debt instruments like US 10-year Treasury Inflation-Protected Securities (TIPS). Real yields represent investor returns after accounting for inflation costs—the opportunity cost associated with holding low- or non-yielding assets instead of productive alternatives.

When these yields peak then decline steadily—even if nominal policy rates stay elevated—the relative attractiveness of scarce assets improves markedly.

Historical US Treasury data demonstrates a strong correlation between declining real yields and subsequent rallies in gold prices which tend to commence once those yields turn downward rather than immediately following rate cuts themselves. Attempts at hawkish rhetoric rarely reverse this trend once Treasury real returns begin compressing significantly.

Copper’s connection is less direct but still tied closely since falling real rates generally coincide with looser financial conditions—including weaker dollar valuations—and improved credit access—all factors boosting industrial demand outlooks.

Bitcoin operates within similar parameters but reacts later because its investor base typically waits until liquidity shifts become undeniable before reallocating capital aggressively.

In 2019 especially Bitcoin’s rally trailed sustained declines in real yields gaining momentum only as Fed transitioned from tightening towards easing measures.

The relationship intensified further during 2020 when collapsing real rates flooded systems with liquidity causing Bitcoin’s gains outpace metals’ earlier moves substantially.

The Sequential Flow Of Capital Explains Bitcoin’s Lagging Response

The order assets respond throughout easing phases reflects distinct capital rotation patterns among investors.

Initially participants favor lower-volatility value-preserving instruments such as gold reflecting flight-to-safety behavior.

As prospects brighten around easier lending standards plus stronger growth trajectories,

Copper begins signaling optimism via price appreciation representing industrial sector confidence.

Bitcoin traditionally attracts funds later when market conviction about forthcoming accommodative monetary stances solidifies alongside durable improvements

in overall liquidity facilitating riskier asset adoption.

This progression repeats consistently across multiple historical episodes:

In 2019 metal rallies preceded bitcoin breakouts which surged notably post-rate cut implementations;

While compressed timelines occurred during pandemic-related interventions,

the fundamental sequence persisted whereby bitcoin’s sharpest upward moves lagged initial metal repositionings.

Given bitcoin’s relatively smaller size younger demographic &

heightened sensitivity towards incremental flows,

its price swings tend toward amplified volatility once favorable positioning takes hold.

Currently metals appear ahead repricing expected easing scenarios whereas bitcoin remains confined within established ranges—a divergence typical early cycle phenomena resolving only after persistent compression

of long-term inflation-adjusted bond returns drives widespread portfolio reallocation decisions favoring crypto exposure over time.

Potential Risks That Could Disrupt This Outlook

This analytical framework hinges critically upon continued declines—or at least stabilization—in long-dated government bond inflation-adjusted yield levels;

Should those metrics reverse sharply upwards sustaining higher peaks,

gold’s appeal diminishes undermining rationale behind recent advances whilst weakening supportive case for industrial commodities like copper simultaneously depriving bitcoin

of essential underlying liquidity tailwinds historically linked with bull runs triggered by accommodative regimes.

Additionally accelerated quantitative tightening programs or rapid dollar strength could tighten overall financing availability exerting downward pressure upon all asset classes reliant upon eased borrowing assumptions.

Resurgent inflationary pressures forcing central banks into prolonged restrictive stances would similarly sustain elevated

real interest rates curtailing scope for expansionary monetary impulses critical undercurrent supporting cyclical rebounds across precious metals &

cryptocurrencies alike.

Markets possess ability anticipating policy pivots however cannot indefinitely uphold bullish narratives absent confirming macroeconomic fundamentals aligning cohesively over time.

At present futures contracts continue embedding probabilities favoring eventual loosening paths alongside persistently subdued treasury-derived

real return figures below previous cycle highs reinforcing positive sentiment driving metal valuations higher thus far although digital currencies await clearer directional cues consistent

with historical precedents suggesting delayed but potent response trajectories aligned sequentially following persistent yield decompression stages.

If deflationary forces prevail pushing further compression ongoing trends mirrored presently by commodity behaviors expect eventual pronounced catch-up surges within crypto spaces particularly bitcoin characterized historically by heightened amplitude compared counterparts amid analogous macro-financial transitions.