Spot Bitcoin exchange-traded funds (ETFs) experienced a remarkable surge last week, attracting net inflows totaling $1.42 billion. This marks their most robust weekly performance since early October, driven by a resurgence in institutional interest.

Data from SoSoValue reveals that the peak of these inflows occurred midweek, with Wednesday alone seeing an impressive net inflow near $844 million. Tuesday also contributed significantly with approximately $754 million flowing in.

Although there was some retreat towards the end of the week—including a notable outflow of around $395 million on Friday—the strong midweek gains propelled total weekly inflows to their highest level since early October, when ETFs drew in about $2.7 billion.

Ether (ETH) ETFs mirrored this trend by accumulating most of their weekly inflows earlier on as well. Tuesday recorded the largest single-day increase at roughly $290 million, followed by about $215 million on Wednesday. However, Friday saw net outflows close to $180 million, which trimmed Ether’s overall weekly gain to nearly $479 million.

Related: The influx into Bitcoin ETFs surpasses $1.8B: Could BTC rally toward 100K?

The return of investors amid tightening Bitcoin supply

Vincent Liu, Chief Investment Officer at Kronos Research, interprets these patterns as signs that long-only investors are cautiously re-entering the market through regulated avenues.

“The ETF capital flows indicate renewed participation from long-only allocators,” Liu explained to Cointelegraph. “This absorption via ETFs combined with stabilization among large holders suggests a constriction in effective supply and fosters a more risk-on sentiment.”

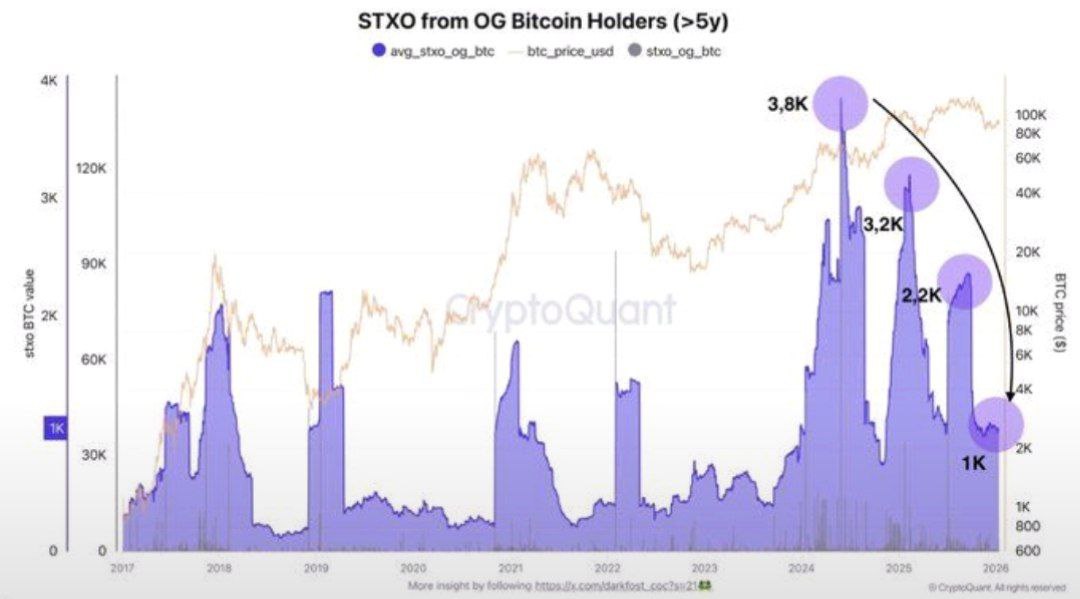

Liu further noted that blockchain data shows whales—large-scale holders—have decreased their net selling compared to late December levels, easing distribution pressures significantly. When paired with consistent ETF purchases, this dynamic points toward reduced available supply despite ongoing price volatility.

Diminishing whale selling pressure according to Liu

Nonetheless, Liu cautions that this shift is still in its infancy rather than being fully established. “We are witnessing an initial phase rather than definitive confirmation,” he said. “Yet increasing ETF demand coupled with declining whale sales and improving market structure indicates a potentially stronger institutional foundation beneath current prices.”

“The probability favors more positive trading days ahead,” he added, “if not always steadily upward.” “ETF investments provide structural support while reduced whale activity means price dips are increasingly absorbed,”Liu concluded.

Related: An overview of various ETF types – Cointelegraph

The limitations of short-term ETF inflows for sustaining Bitcoin rallies

The Bitcoin-focused newsletter Ecoinometrics highlights that recent bursts in spot Bitcoin ETF investments tend only to spark brief price recoveries instead of lasting upward momentum because gains often fade once those capital injections slow down.

Ecoinometrics argues it takes multiple consecutive weeks featuring strong and steady demand for ETFs before any meaningful trend reversal can be expected given cumulative flows remain deeply negative overall.

This suggests isolated spikes may help stabilize prices temporarily but aren’t sufficient alone for supporting prolonged bullish trends without sustained buying pressure over time.

Magazine: A look back at crypto regulations changes during 2025 — and predictions for 2026