Spot Bitcoin exchange-traded funds (ETFs) are currently experiencing a significant surge in capital inflows. Despite widespread expectations of an ongoing “Crypto Winter” affecting the entire market, January 2026 shows promising signs of breaking this bearish trend.

Record Inflows into Bitcoin Spot ETFs Since October 10

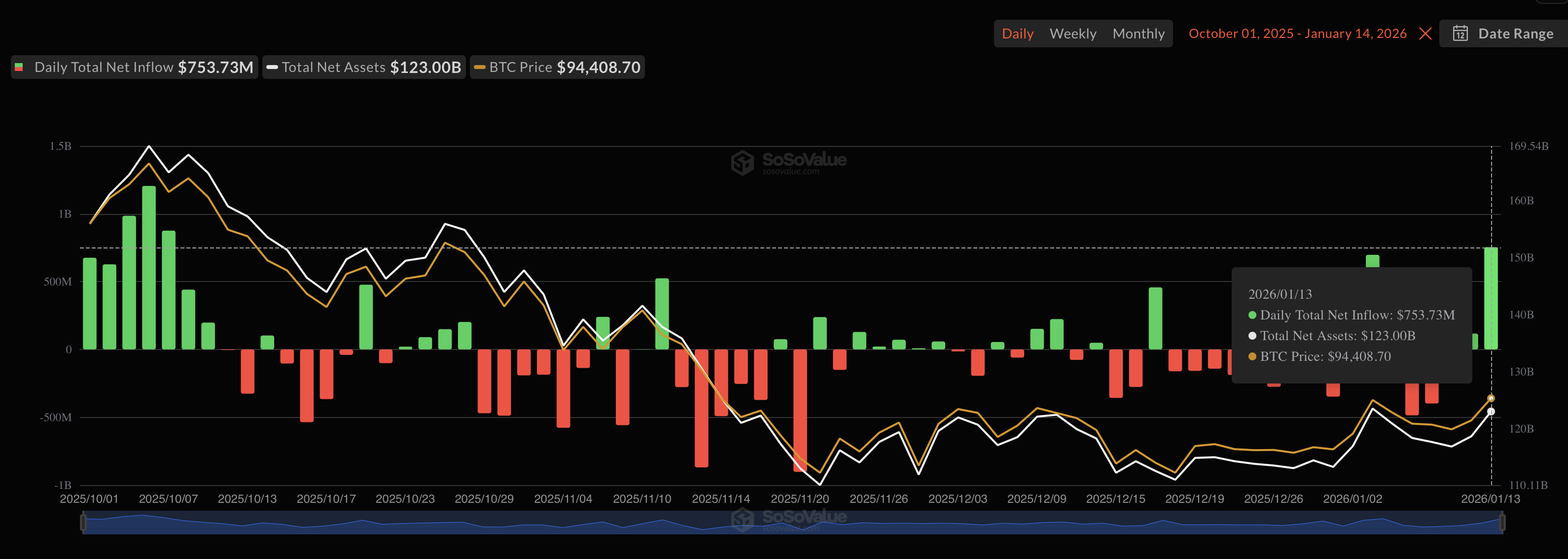

U.S.-based Bitcoin Spot ETFs—investment funds directly holding spot Bitcoin (BTC)—have attracted their largest influx of investments since the market downturn on October 10. Within just one day, investors poured $753 million into these assets.

The trading session on January 13 marked the most successful day for Bitcoin spot ETFs since October 7, 2025. When viewed over a weekly period, this week represents the strongest performance since mid-October.

Overall, year-to-date growth for spot Bitcoin ETFs has reached $660 million in assets under management (AUM).

The leading contributors to these gains over the past 24 hours include Bitwise’s NYSE-listed fund, BlackRock’s IBIT ETF, and notably Fidelity’s FBTC. Collectively, these three funds acquired nearly 7,000 BTC yesterday alone.

This investor enthusiasm towards Bitcoin is largely driven by favorable regulatory developments and positive macroeconomic signals emerging from the United States.

Bitcoin Price Climbs to Near Two-Month Peak

Consequently, today saw Bitcoin’s price rise sharply to $95,700—the highest level observed since mid-November. The flagship cryptocurrency increased by approximately 3.1%, closely mirroring a broader market gain of around 3.2% across other digital assets.

Within the last day alone, liquidations totaling $300 million occurred in BTC positions; remarkably about 99% were short positions being closed out. Ethereum (ETH) also experienced substantial liquidations amounting to $220 million as its price surged roughly five percent to reach $3,283.

The single largest liquidation event reported by CoinGlass involved a long ETHUSDT position worth $12 million on Binance exchange.