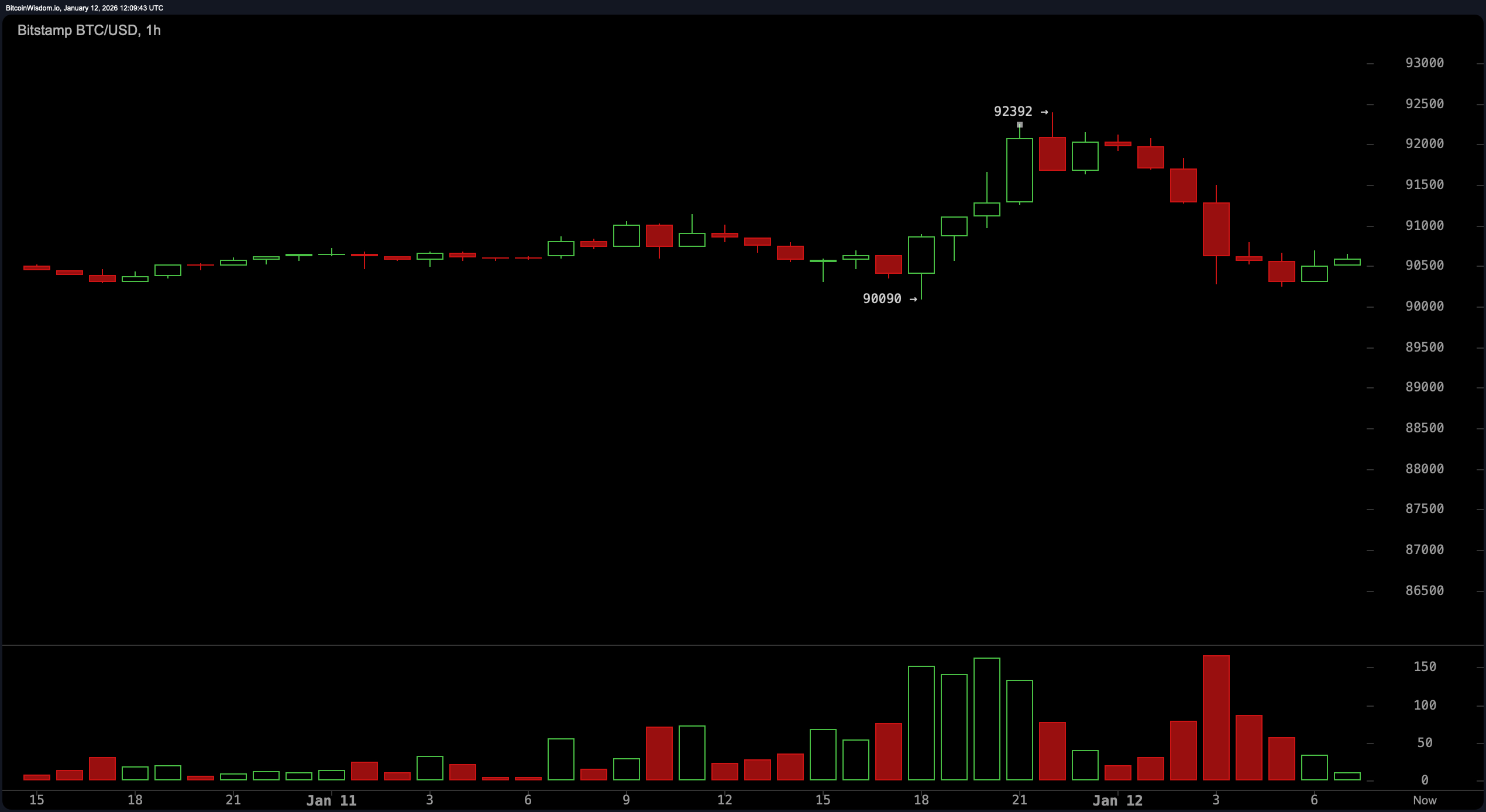

On January 12, 2026, Bitcoin showcased its characteristic volatility, oscillating between $90,090 and $92,392—enough to keep traders on their toes and algorithms active. The charts reveal a captivating story of momentum that ebbs and flows, hinting at potential secretive maneuvers by Bitcoin.

Bitcoin Chart Analysis

The one-hour chart of Bitcoin illustrates a narrative filled with short-term tension. It surged from $90,090 to $92,392 in a rapid burst before retracting back to the vicinity of $90,500. This swift rise followed by pullbacks with low trading volume suggests profit-taking rather than panic selling.

Subsequently, the price fluctuated within a narrow band between $90,000 and $92,000—a classic setup for short-term consolidation. Traders monitoring this timeframe recognize that breaking above the resistance level at $92,400 could spark renewed momentum plays. Conversely, if it falls below the critical support level of $89,800 accompanied by strong volume activity; it would indicate that Bitcoin might abandon its current range altogether.

BTC/USD 1-hour chart via Bitstamp on Jan. 12,2026.

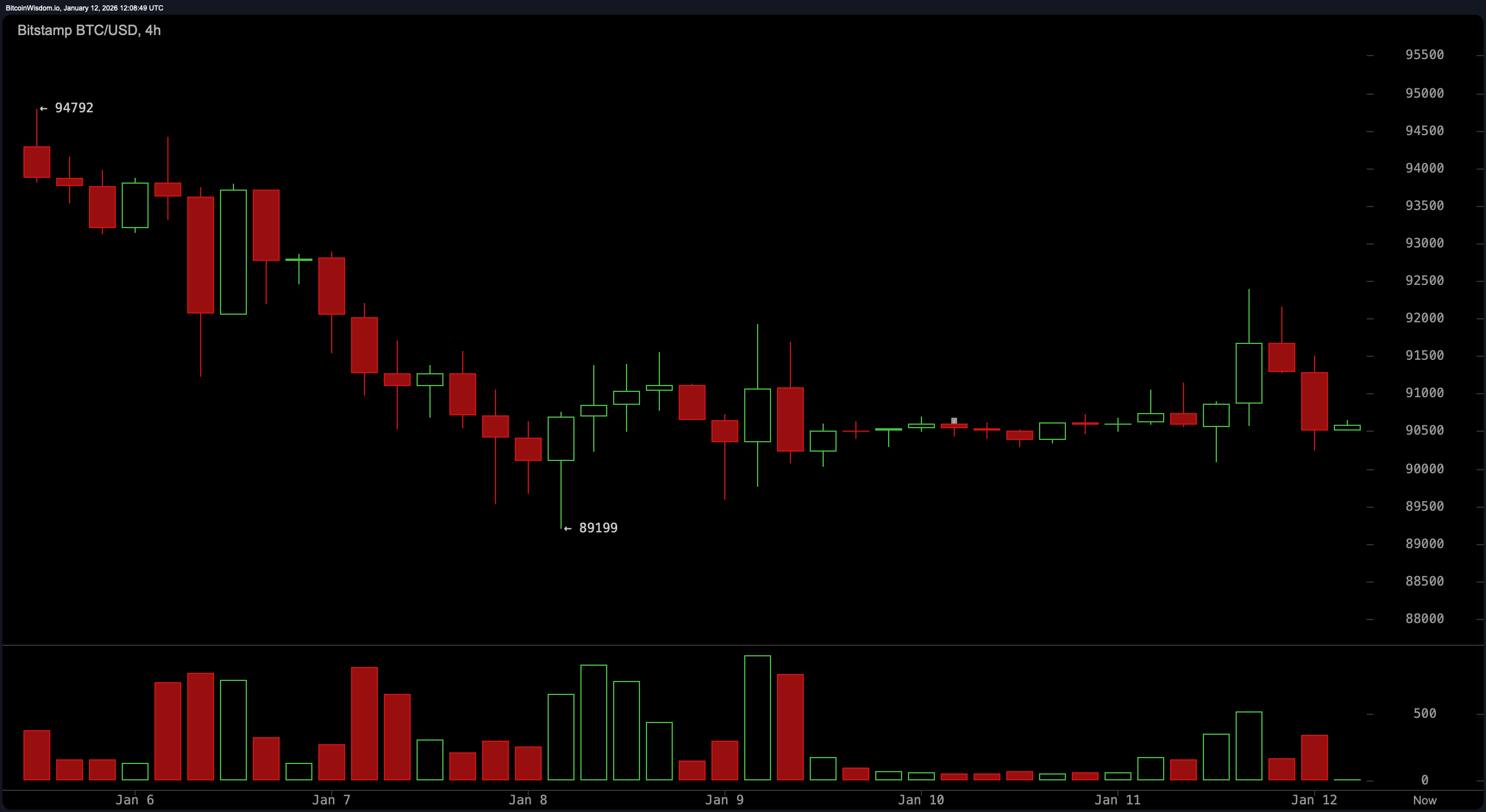

The four-hour chart presents an indication of mid-term uncertainty for Bitcoin’s trajectory. After descending from its peak at around $94,792 down to approximately $89,199,Bitcoin entered into a consolidation phase resembling either a bearish flag or descending triangle—depending on one’s technical analysis preference. Price compression was evident through lower highs while steadfastly holding onto support around the key level of$90,000 like an old companion refusing to let go. Should Bitcoin manage to break above$92,000 with significant volume backing it up; there is potential for revisiting levels in the high$94,000s again soon after this breakout occurs . However ,if support at$89 ,000 crumbles , expect some structural disintegration within this pattern .

BTC/USD 4-hour chart via Bitstamp on Jan。12 ,2026.

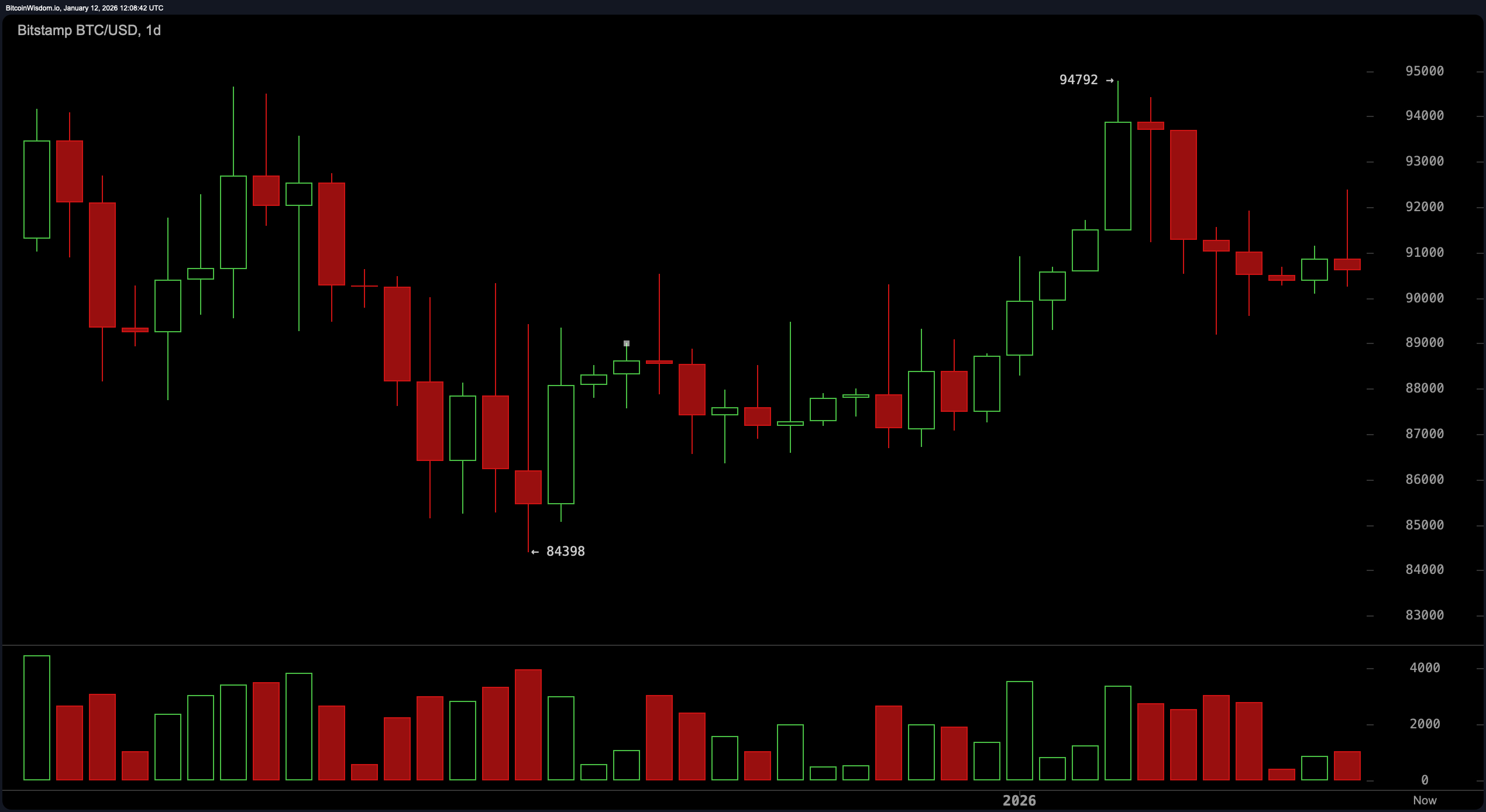

Looking at the daily chart reveals an overarching narrative where Bitcoin attempts recovery from lows near$84 ,398 onlyto experience hesitation near resistance around$94 ,792 . This rally was marked by healthy trading volumes initially but saw enthusiasm wane as prices began forming lower highs instead thereafter . The range between88 ,500and89 ,500 now serves as crucial retest territory favorable for bulls seeking another upward leg forward ; however caution prevails firmly positioned within resistance boundaries spanning from94 ,500to95 ,000 —the latest frontier against which bitcoin must contend effectively moving forward should any sustained upward trend materialize anytime soon thereafter too ! A daily close beneath88 ,000would signal an end toward bullish aspirations temporarily speaking!

BTC/USD 1-day chart via Bitstamp on Jan。12 、2026.

Oscillators convey mixed signals among analysts observing market dynamics closely today! The relative strength index (RSI) sits neutrally reading52 —indicating neither exuberance nor despair currently prevailing across markets right now! Meanwhile stochastic oscillator remains steady sittingat48 echoing similar neutrality overall while commodity channel index (CCI) registers57 suggesting mild strength without firm commitment present still thus far! Average directional index(ADX) measures26 reflecting absence dominant trend directionality overall whereas awesome oscillator confirms limbo status quo value registering1374 presently too ! Momentum dipped cautiously reading678 alongside moving average convergence divergence(MACD) settling446 indicating slight bullish inclination lingering underneath surface here lately!

Moving averages(MAs), ever straightforward truth-tellers reflect equally divided sentiments amongst them currently observed today! Short term signals derivedfrom10-period exponential moving average(EMA)&simplemovingaverage(SMA) warn overhead pressure existing right now situated respectivelyat90730&91438 accordingly however20&30 period averages across both EMA&SMA align supportive side indicating soft cushion intact possibly still remaining underneath surface here lately though further out100&200 period MAs(both EMA&SMA )continue leaning against upside enthusiasm each stubbornly restingabove95000 suggesting bitcoin must exert considerable effort reclaim macro bullish narrative beyond mere rally correction stage ahead going forth!

Bullish Outlook:

IfBitcoin manages maintain position above90000 breaks decisively past92400with conviction &volume backing them up bulls could gain necessary momentum staging run towards94000-95000resistance zone supported mid-range MAs stabilizing market structure indicates recent correction merely pause broader recovery arc unfolding ahead potentially!! But always prudent keeping one eye focused upon volumes whilst monitoring macro sentiment shifts occurring simultaneously during these volatile times experienced consistently throughout crypto space alike!!

Bearish Outlook:

IfBitcoin loses89800-89000support zone backed strong downside volumes path least resistance opens deeper retracement prospects higher-moving averages leaning bearish faltering momentum oscillators provide little comfort whatsoever until buyers reclaim authority surpass92400current structure resembles consolidation downward risk rather than continuation positive trends witnessed previously noted here before today’s events transpired recently!!!

Frequently Asked Questions ❓

What is bitcoin’s current price today January twelve twenty-six? bitcoin trades currently priced ninety thousand five hundred twenty-four dollars ($90524).

What has been bitcoin’s trading range over past twenty-four hours? bitcoin fluctuated between ninety thousand ninety dollars ($90090)&ninety-two thousand three hundred ninety-two dollars($92392 )today alone.

Is there evidence pointing toward bullishness or bearishness regarding bitcoins behavior presently? Currently observing signs suggest consolidation occurring along mixed indicators appearing various timeframes examined thus far noted herein.

Where might we see future movements regarding bitcoins directionality likely heading next? A breakout surpassing92400could trigger upside movement while falling beneath89800adds downside risks associated directly affecting investors confidence surrounding cryptocurrency markets globally too!!