The price of Bitcoin currently stands at a critical juncture following a period of subdued retracement. Since reaching its peak on January 5, BTC has experienced a slight decline but has managed to avoid any significant breakdowns. Compared to last year, Bitcoin is down by roughly 4.5%, reflecting a modestly negative annual performance.

Though seemingly minor, this small negative figure holds considerable significance. Bitcoin is now separated by only a narrow margin from triggering an uncommon historical indicator that was last observed in 2020. Whether the cryptocurrency crosses this threshold or falls short could determine its forthcoming trend.

A 4.5% Shift in Bitcoin’s Price May Mirror an Uncommon Pattern Seen in 2020

Recent historical data analysis has uncovered an unusual pattern: when Bitcoin’s one-year price change dips into negative territory and then reverses back to positive, it often signals major shifts in market trends. This rare event occurred back in July 2020 and was followed by a robust bullish phase.

Bitcoin is exhibiting something extraordinary!

The one-year percentage change turning negative typically aligns with bear markets—except for July 2020 when it briefly dipped below zero before sparking a strong bull run.

Currently, we’re seeing similar conditions… pic.twitter.com/3YdmKj0C7L

— Alphractal (@Alphractal) January 10, 2026

At present, Bitcoin hovers just beneath that pivotal flip point. A gain close to 4.5% would push the yearly change into positive territory once again and replicate this historic scenario.

The chart formations provide further context as to why this matters: BTC is trading within the handle portion of what’s known as a cup and handle pattern—a bullish setup where prices consolidate after rounded recovery before attempting an upward breakout.

If you want more insights like these on tokens, consider subscribing to Editor Harsh Notariya’s Daily Crypto Newsletter.

An intriguing question remains whether the projected breakout distance above the neckline corresponds closely with that same approximate range of four to five percent?

EMA Support Coupled With A Massive Drop In Selling Pressure Reinforces The Bullish Outlook

The short-term trend dynamics bolster optimism for upward movement.

An exponential moving average (EMA), which prioritizes recent prices for gauging short-term trends, shows encouraging signs: Bitcoin recently reclaimed its position above the crucial 20-day EMA and continues holding there comfortably. When BTC last regained this level earlier in January, it surged nearly seven percent within days afterward.

Losing support at the same EMA during mid-December triggered about a six-point-six percent drop — underscoring how sensitive price action can be around this technical line. Maintaining levels above it currently preserves momentum toward gains.

The next resistance lies at the fifty-day EMA; after losing ground here on January twelfth followed by correction shortly thereafter — reclaiming it decisively would signal stronger trend recovery consistent with completing cup-and-handle breakouts well documented historically among traders’ charts patterns analyses alike.

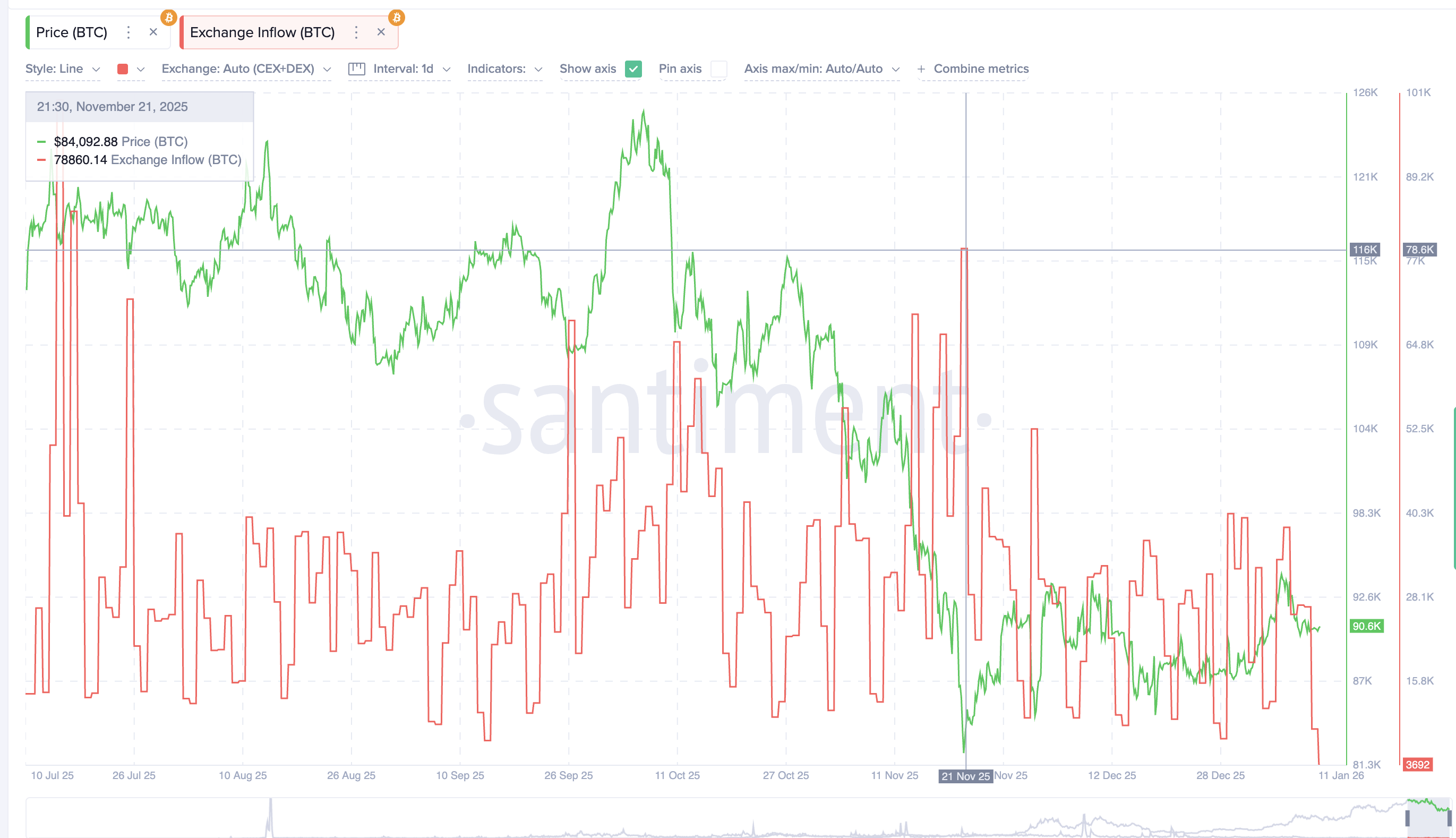

Supporting evidence also comes from blockchain data showing exchange inflows—the volume of coins transferred onto exchanges indicating potential selling pressure—has plummeted dramatically over six months’ time frame.

Daily inflows dropped sharply from approximately seventy-eight thousand six hundred bitcoins around November twenty-first down near three thousand seven hundred presently — marking over ninety-five percent reduction!

This steep decline suggests sellers have largely stepped aside; fewer coins entering exchanges mean less supply available for selling during rallies.

D erivatives Imbalances And Crucial Price Levels Will Shape The Next Move

Leverage positioning introduces another dimension worth considering.

Over coming week s , cumulative liquidation risk sits near $4 .1 billion against shorts while longs stand closer t o $2 .17 billion , meaning shorts outweigh longs b y roughly eighty-nine perc ent .

A crowded short side creates potential fuel ; should bitcoin begin climbing higher , forced covering o f those shorts could trigger automatic buying pressure boosting upwards moves further . Over past year s , btc often defied leverage biases making current imbalance notable yet not necessarily bearish .

All these factors converge around specific key levels:

Closing daily candles beyond $94,880 would confirm completion o f cup & handle breakout aligning perfectly w ith aforementioned yearly flip target.

From there, targets emerge near $99,810 then extend up t o approximately $106,340 based upon Fibonacci extensions plus measured projections derived fro m th e pattern itself.

On downside, $89,230 serves as initial support zone; a breach below risks invalidating bullish structure exposing lower targets such as $86,650.

For now, Bitcoin& #39;s price sits confined within tight boundaries.& #60;/P>

&S e l l i n g p r e s s u r e i s at a s i x -m o n t h l ow ,&n bsp;s hort -t erm t r end support rema ins intact,and rare historic signal lies ju st four point five per cent away.From wh ether Bitcoi n reaches thi s ma rk may d etermine future direction..

&T he post Bitcoi n Bull Market Starts With A Four Point Five Percent Move? History And Charts Finally Align appeared first on BeInCrypto.