The cryptocurrency leader appears to be in a state of pause. As of January 11, 2026, Bitcoin is valued at $90,828, fluctuating within a daily range from $90,291 to $90,850. With a market capitalization reaching $1.81 trillion and daily trading volumes around $14.26 billion, Bitcoin remains firmly seated on its throne while carefully observing the market landscape.

Bitcoin Chart Analysis

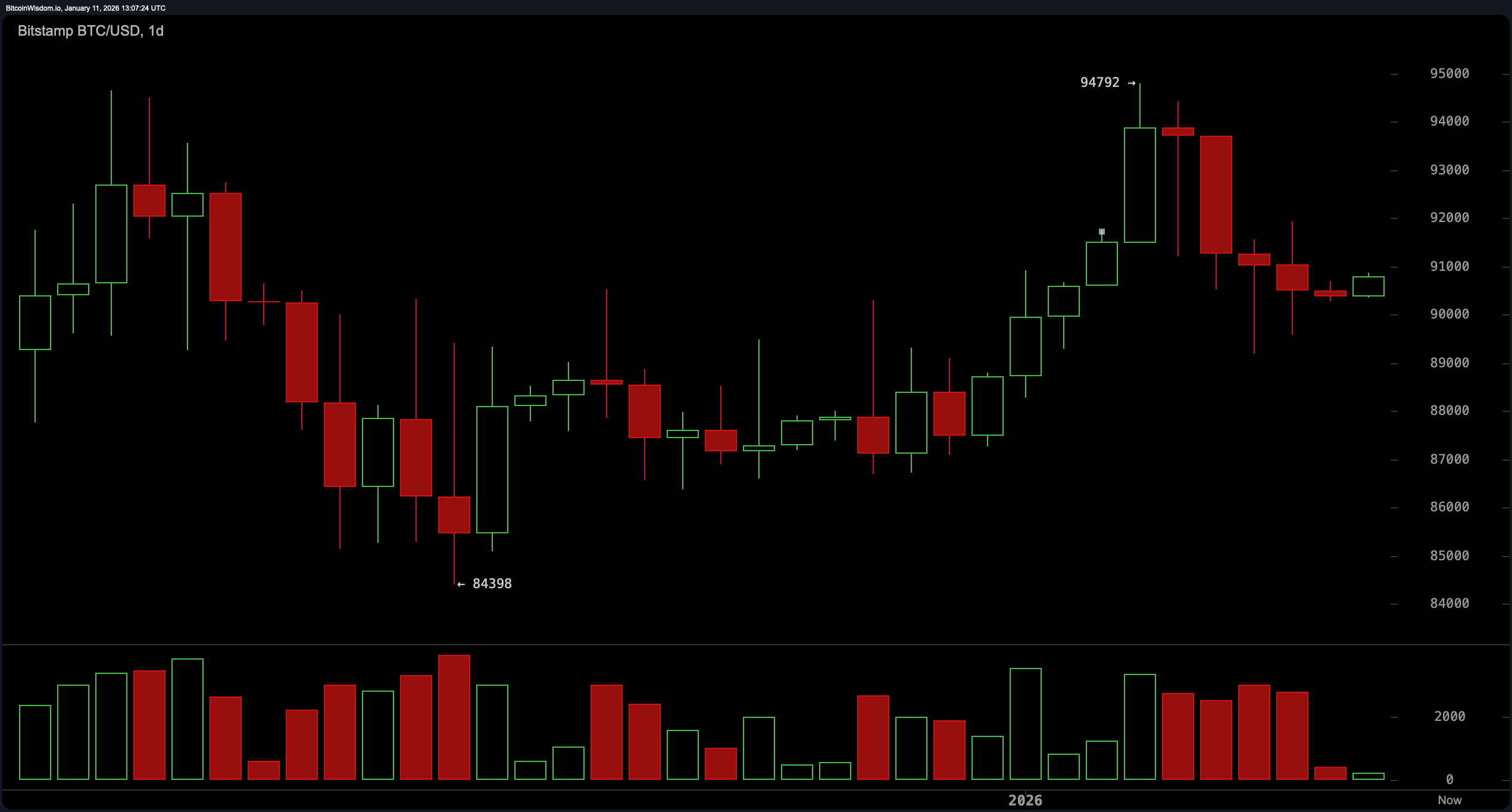

Examining the daily chart reveals that Bitcoin is rebounding from a recent downturn and forming a V-shaped recovery between the low of $84,398 and the peak at $94,792. Currently positioned near $90,500, price movements are characterized by small-bodied candles—suggesting indecision in the market or simply an overall sense of “meh.”

Support levels are robust between $84,500 and $85,000 with resistance noted around the range of $94,500 to $95,000. Traders are keenly observing for any potential resurgence from bullish traders—provided they can shake off any lingering effects from the weekend’s activities. Trading volume has been decreasing which could indicate either preparation for an upcoming move or merely taking a breather after previous volatility.

BTC/USD 1-day chart via Bitstamp on Jan. 11,2026.

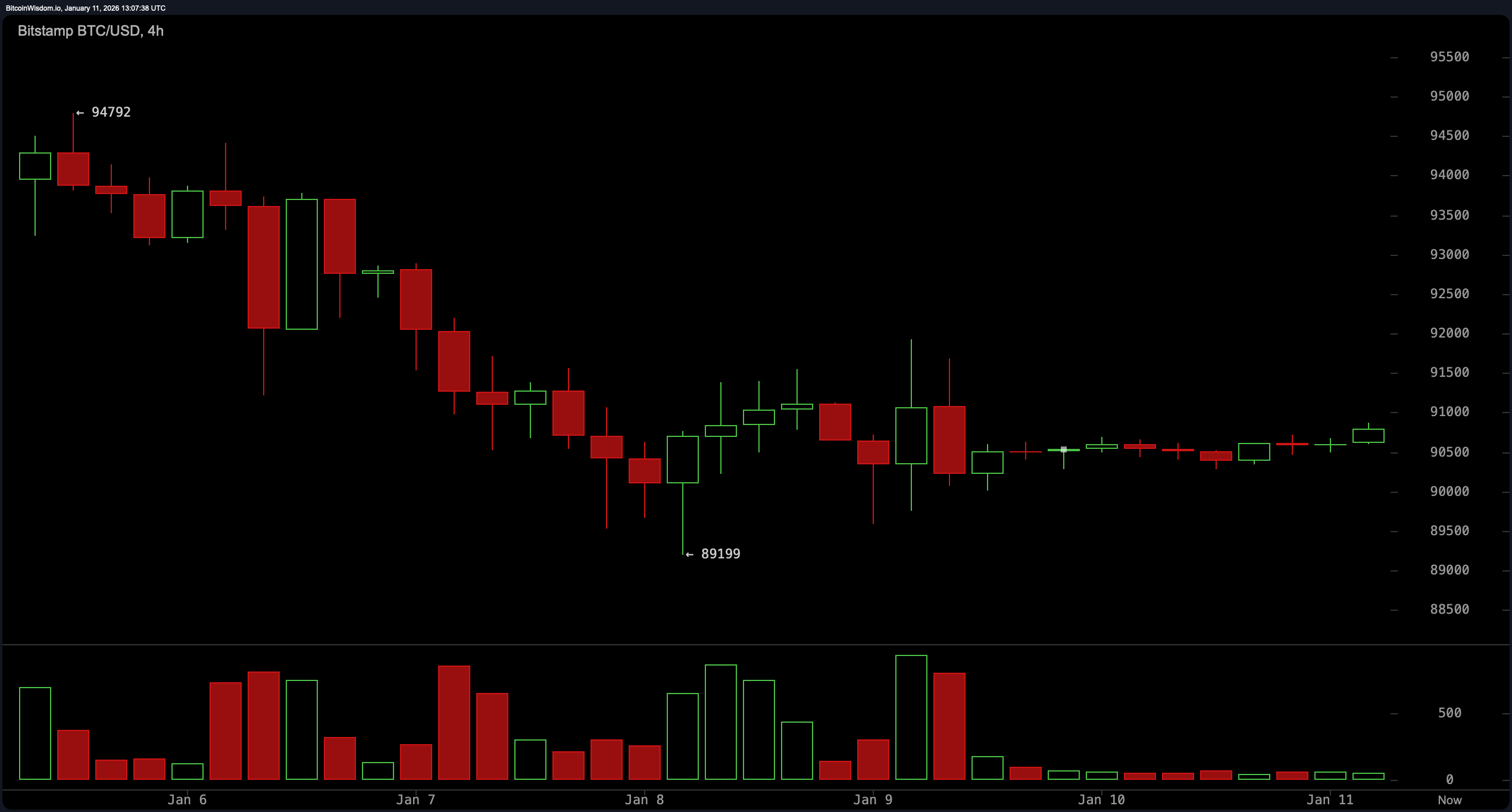

On the four-hour chart analysis shows that Bitcoin’s recent decline found support at approximately $89,199 where buying interest was hinted by bottoming tails on candlesticks. Since then,the price has entered into consolidation within a descending channel that seems to be stabilizing now。Volume trends downward—a typical sign indicating neither buyers nor sellers are eager for confrontation。However,if there’s an upward breakout past$91,000 it may signal renewed confidence among bulls (perhaps fueled by some caffeine).

BTC/USD 4-hour chart via Bitstamp on Jan.11,2026.

Diving deeper into one-hour charts reveals that Bitcoin is currently confined within a narrow range of about$600。A recent bounce back up towards$90、867 accompanied by increased volume suggests possible short-term reversal opportunities。Nevertheless without breaking above$91、000 with substantial volume backing it up this could just turn out to be another false alarm。一 rounding bottom pattern might indicate accumulation but confirmation remains crucial here.Scalpers will likely look for clear movement above$90、900;however if volume diminishes quickly then any rally may deflate faster than balloons post-party in January。

BTC/USD 1-hour chart via Bitstamp on Jan.11,2026.

The oscillators aren’t exactly providing enthusiastic support either.The relative strength index (RSI) stands neutral at53 while Stochastic oscillator rests similarly neutral at48.Commodity Channel Index (CCI) holds steady around46 whereas Average Directional Index(ADX) reflects low trend strength with value sitting at25.Momentum appears sluggish showing bearish indications; meanwhile Moving Average Convergence Divergence(MACD) level indicates slight bullish optimism hovering around475.In summary oscillators seem non-committal saying “We’ll get back soon.”

A glance over moving averages(MAs) presents mixed signals.The short-term exponential moving average(EMA)(10 periods)supports further upside targeting about90140 whereas simple moving average(SMA)(same period)sits slightly bearish closer towards91363.Within20-50 period zone most MAs suggest bullish tendencies including EMA(20)value being90189and SMA(20)value nearing89527.As we extend further out though things take darker turns—the100-period EMA/SMA values rest near96084&98210 respectively along with200-period EMA/SMA values hitting99744&106258 all leaning toward bearish implications suggesting long-term outlook lacks vigor—for now anyway.

In conclusion,Bitcoin maintains composure exhibiting slight bullish undertones across intraday charts; however traders should remain vigilant regarding key levels like floor set below89000and ceiling close approaching91000.Breakouts occurring in either direction could determine future trajectory until then sideways movements persist amidst cautious curiosity prevailing among participants involved.

Bullish Outlook:

If Bitcoin manages enough momentum pushing through resistance beyond91000with convincing volumes behind it this might signify initiation point toward new upward journey.With majority short-to-mid term MAs aligning positively plus oscillators hinting cautious optimism setups favor continuation seekers—as long as bulls stay energized.Path leading toward94000–95000 isn’t guaranteed but certainly stays within sight!

Bearish Outlook:

If unable hold onto89000–90000zone risks returning downwards possibly revisiting855000support region or worse yet even touching84000handle.Long term indicators flashing caution combined dwindling momentum implies significant drop-offs can pave way downward prospects.Bears haven’t seized full control yet—but they’re circling waiting patiently ready strike when opportunity arises!

Frequently Asked Questions ❓

What’s current pricing status? The latest figure stands firm around ninety thousand eight hundred twenty-eight dollars as recorded January eleventh two thousand twenty-six.

How wide is today’s intraday fluctuation? The last twenty-four hours show variations spanning between ninety thousand two hundred ninety-one dollars up until ninety thousand eight hundred fifty dollars .

Is there observable trend upwards/downwards presently? This moment sees consolidation alongside mild positive bias across shorter timeframes .

Which critical thresholds should traders monitor closely ?Pivotal points include supports resting nearby eighty-nine-thousand mark whilst resistances hover near ninety-one-thousand threshold awaiting next breakout opportunity!